- Renowned crypto trader James Wynn has recently taken a substantial long position on PEPE with the goal of maximizing profits.

- Recent analysis over the past 24 hours has shown an increasing number of market participants aligning with this sentiment as acquisitions of PEPE have surged.

PEPE [PEPE] has shown an upward trend in the last 25 hours, marking a 2.15% gain—a continuation of its positive performance over the previous week.

Market analysis suggests that there is a potential for PEPE to sustain this upward trajectory. However, there is also a risk of a reversal of gains, especially with the involvement of a high-profile trader.

Whale Re-enters Market with PEPE after $1B BTC Loss

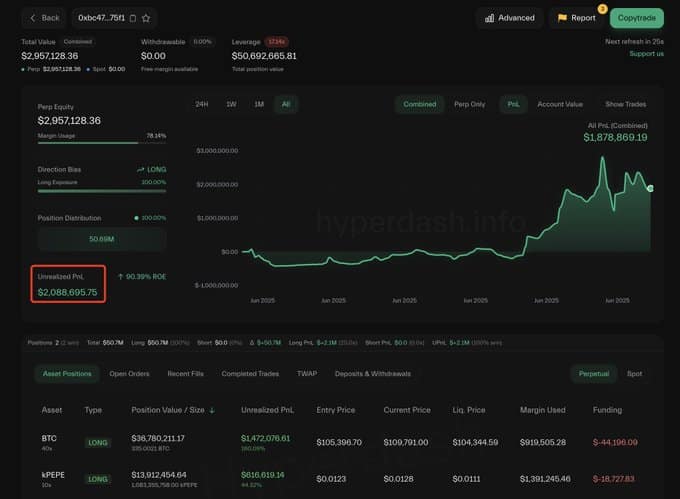

James Wynn, a well-known trader who previously experienced a $1 billion loss on Bitcoin, has now turned his focus to PEPE.

In the past 24 hours, reports indicate that he has set up a new wallet and initiated a long position on PEPE valued at $13.9 million.

As of now, he has an unrealized profit of $616,000 on this position as the price of PEPE continues to rise.

Source: Lookonchain

Wynn had previously held a $10 million position on PEPE through Hyperliquid, which he lost when the market took a turn against him.

Just a few weeks ago, he faced liquidation on a $99 million Bitcoin position when the price dropped below $105,000.

With Wynn’s history of significant losses on PEPE and Bitcoin, the question arises: Will PEPE maintain its bullish momentum, or are we heading towards a bearish reversal?

Spot and Futures Market Outlook

Recent analysis suggests that both the spot market accumulation and rising derivative sentiment could propel PEPE to higher levels.

In the past week, there has been a purchase of $35 million worth of PEPE, continuing the trend observed in previous weeks.

Source: CoinGlass

The emphasis on accumulation this week indicates a strong buying interest, with traders viewing current price levels as attractive entry points.

In the Futures market, sentiment leans towards bullish, as many traders are opening long positions on PEPE.

The Open Interest Weighted Funding Rate currently stands at 0.0104%, indicating a bullish bias as more participants bet on further price increases.

Source: CoinGlass

The majority of open contracts are from long traders paying the funding fee to maintain price balance, suggesting a positive outlook for PEPE.

Memecoin Segment Shows Strong Performance

Analysis indicates that PEPE still has significant potential for a rally as the memecoin market segment makes a recovery.

In the past seven days, this segment has seen a growth of 5.8%, outperforming tokens in the Bitcoin ecosystem and exchange tokens.

Source: Artemis

If the Weighted Average continues to rise, PEPE stands a good chance of maintaining its bullish momentum.

With ongoing accumulation and positive trends in the derivatives market, PEPE is poised for a significant breakout.

following sentence:

The cat chased the mouse through the house.

Rewritten sentence:

Through the house, the mouse was chased by the cat.