Polaris saw a significant drop of 6% in premarket trading following the company’s unexpected announcement of a 65% year-over-year decline in adjusted EPS for 2025. This news came as a shock to investors, as it fell well below their expectations. Citi analyst James Hardiman expressed alarm at the downward revision and warned that President Trump’s tariff battle with China could further impact EPS for the full year.

Hardiman noted that while management initially suggested that 2025 EPS would be flat compared to 2024, which was guided at $3.25, they officially initiated a guidance of just $1.10. Despite this, his team maintained a “Neutral” rating on PII shares.

Polaris’ Yearly Forecast (courtesy of Bloomberg):

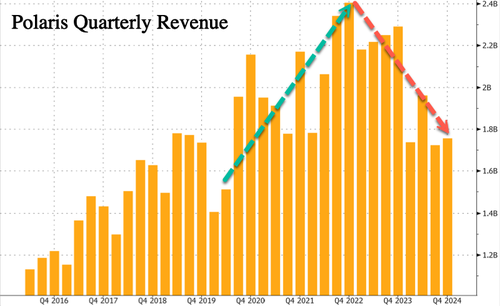

In the fourth quarter, Polaris reported better-than-expected revenue, although sales dropped by 23% year-over-year to $1.76 billion. High interest rates dissuaded consumers from purchasing RZRs, Sportsman ATVs, and other off-road vehicles.

Key Points from the Fourth Quarter:

-

Sales $1.76 billion, -23% y/y, estimate $1.68 billion (Bloomberg Consensus)

-

Off-Road sales $1.44 billion, -25% y/y, estimate $1.36 billion

-

On-Road sales $180.8 million, -21% y/y, estimate $209.8 million

-

Marine sales $137.4 million, -4.1% y/y, estimate $118.3 million

-

Adjusted gross profit margin 21.1% vs. 20.8% y/y, estimate 21.3%

-

Cash and cash equivalents $287.8 million, -22% y/y, estimate $397.8 million

-

Adj. EPS 92c, estimate 90c

The COVID-related boost that Polaris experienced in the past year came to an end in the fourth quarter. The company’s YoY revenue growth is now the worst it has been since the Global Financial Crisis.

Bloomberg’s analysis for 2025 anticipates margin challenges due to negative mix, planned production reductions leading to negative absorption, and the reinstatement of the company’s employee profit-sharing program. The primary reasons for the decline in fourth-quarter sales were lower volume resulting from planned reductions in shipments as well as efforts to manage dealer inventory in a subdued retail environment.

Shares have now fallen back to levels seen during the COVID crash, prompting caution among investors. Bottom-fishing in this scenario is considered a risky endeavor.

Several months ago, Polaris CEO Mike Speetzen had already warned about the challenging consumer confidence and retail demand that the company was facing.

Loading…