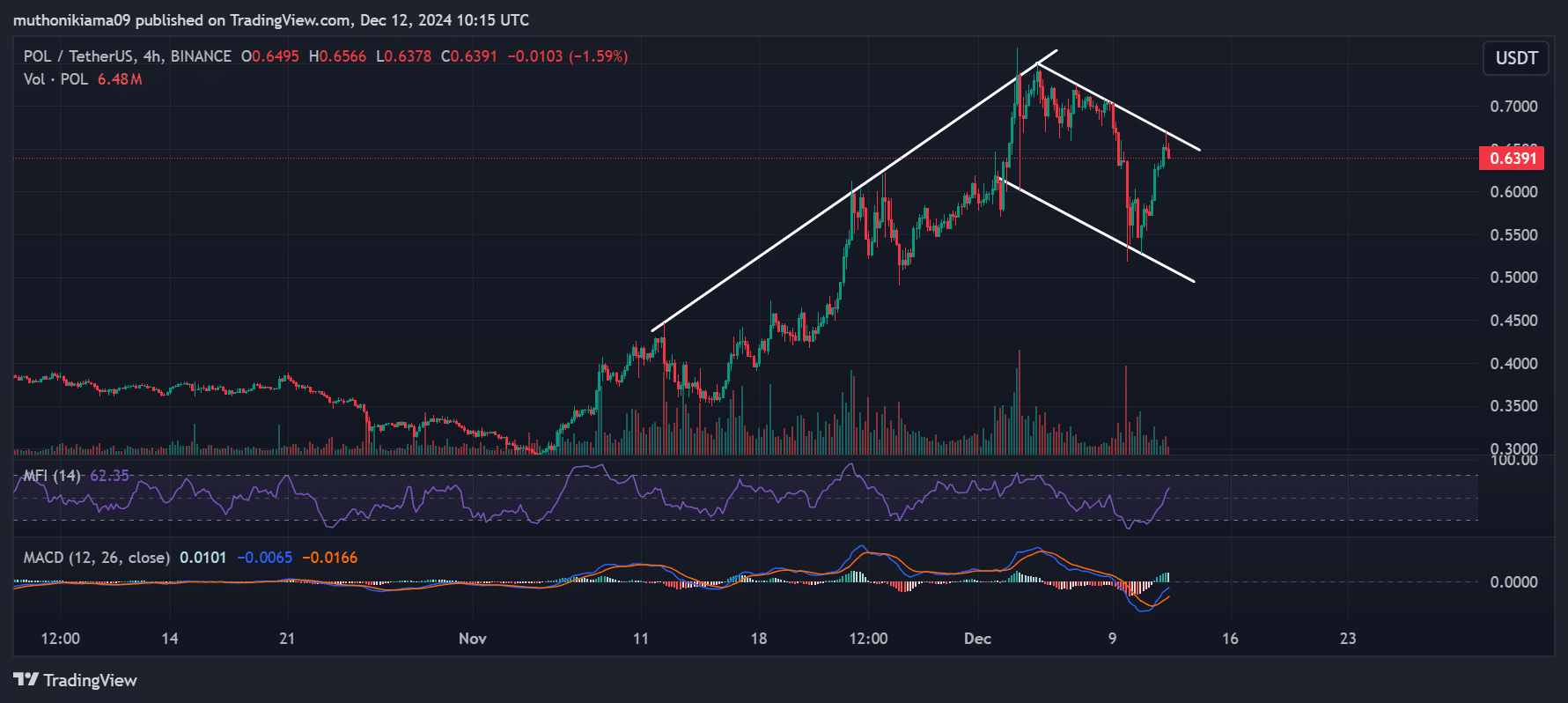

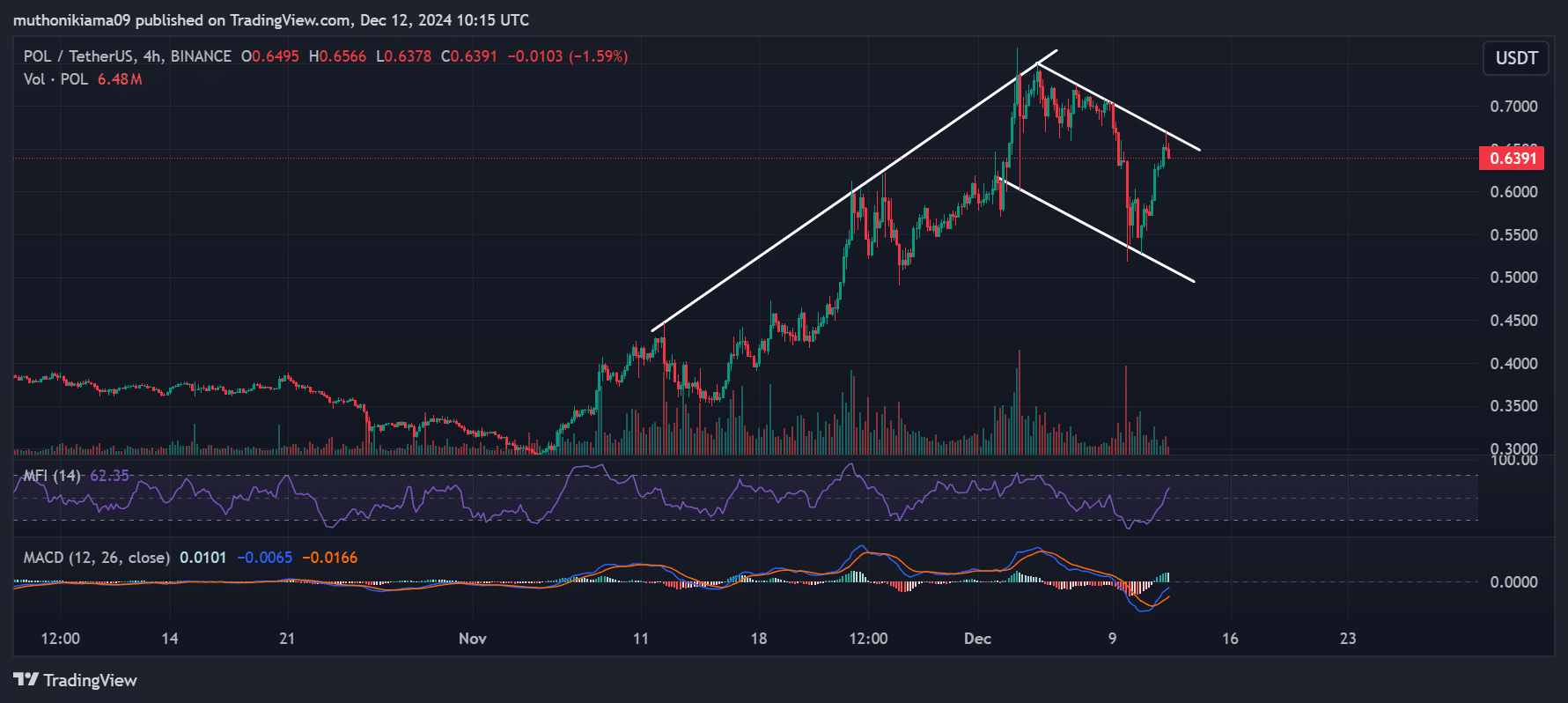

- Analysis indicates that POL may be forming a bull flag on its four-hour chart, signaling a potential uptrend on the horizon.

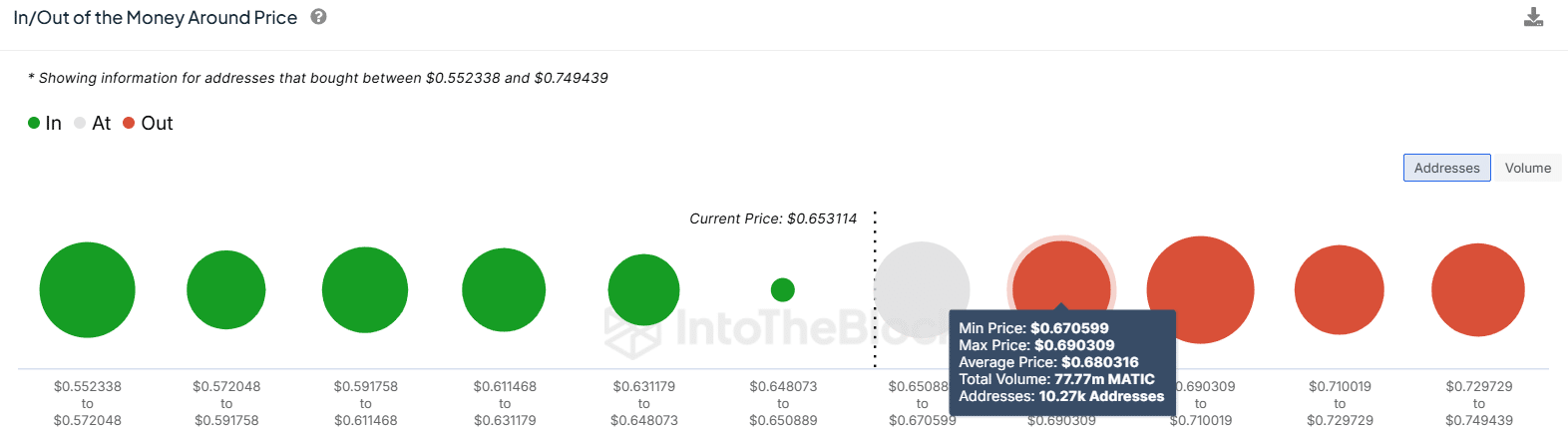

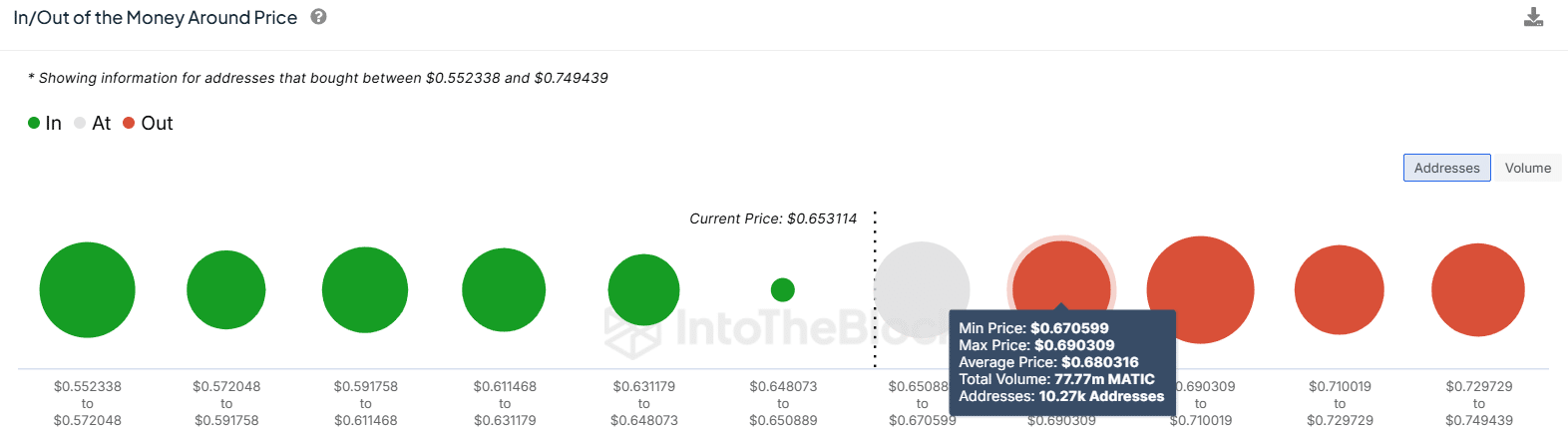

- However, this upward movement could encounter resistance as a significant portion of holders are still in a loss-making position.

Polygon [POL] was trading at $0.655 at the time of writing, showing an 11% increase in the past 24 hours. Despite this recent gain, the price is down by 7% over the last week, indicating a bearish trend overall.

Following a strong uptrend in late November, Polygon experienced a pullback earlier this month, leading to the formation of a bull flag pattern on the four-hour chart.

This pattern suggests the potential for a continuation of the uptrend, although higher buying volumes will be required to support a breakout.

Source: Tradingview

Although the volume histogram shows minimal activity, the Money Flow Index (MFI) indicates a rise in buying pressure, with a value of 62.

Similarly, the Moving Average Convergence Divergence (MACD) suggests that bulls are gaining control as the histogram bars turn green, signaling increased buying interest.

On the shorter time frame, the MACD line is in an uptrend, and a potential crossover above the signal line could confirm a short-term bullish outlook.

Key levels to monitor

Data from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) metric reveals that around 10,000 addresses purchased POL between $0.65 and $0.67, suggesting a potential support zone in that range.

Source: IntoTheBlock

Conversely, over 10,000 addresses acquired more than 31 million POL tokens between $0.67 and $0.69, creating a potential resistance level as these holders may choose to sell once they are in profit.

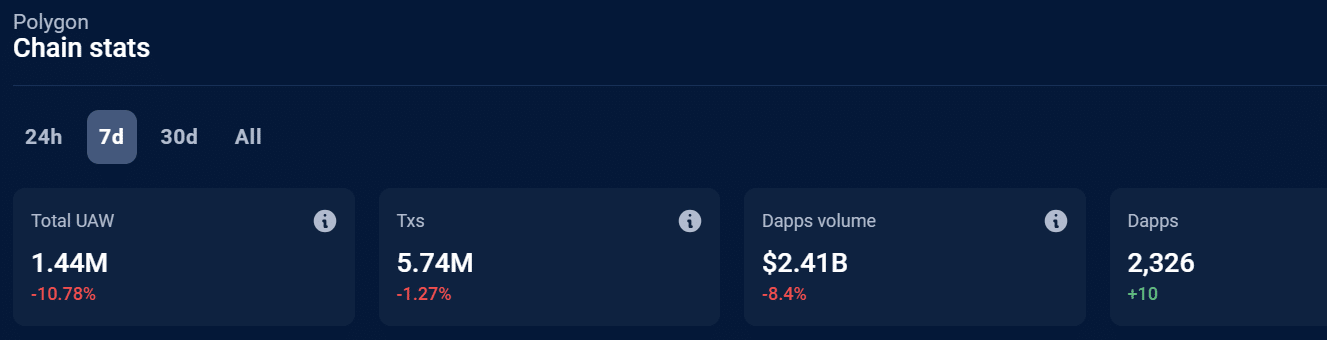

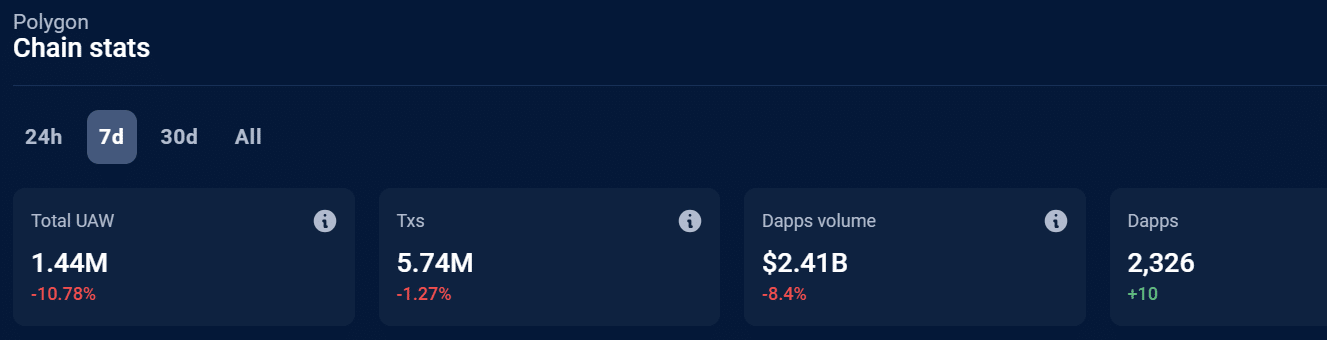

Impact of Polygon’s dApp activity on price

According to DappRadar data, Polygon’s seven-day dApp volumes have declined by over 8%, reaching $2.41 billion at the time of reporting. The number of Unique Active Wallets (UAWs) has also decreased by 10%.

Source: DappRadar

Despite the decline in dApp activity, Polygon’s decentralized finance (DeFi) sector has shown strong growth, with Total Value Locked (TVL) reaching $1.195 billion, as reported by DeFiLlama.

A resilient and expanding Polygon network could have positive implications for POL’s price performance.

Is your portfolio green? Check out the POL Profit Calculator

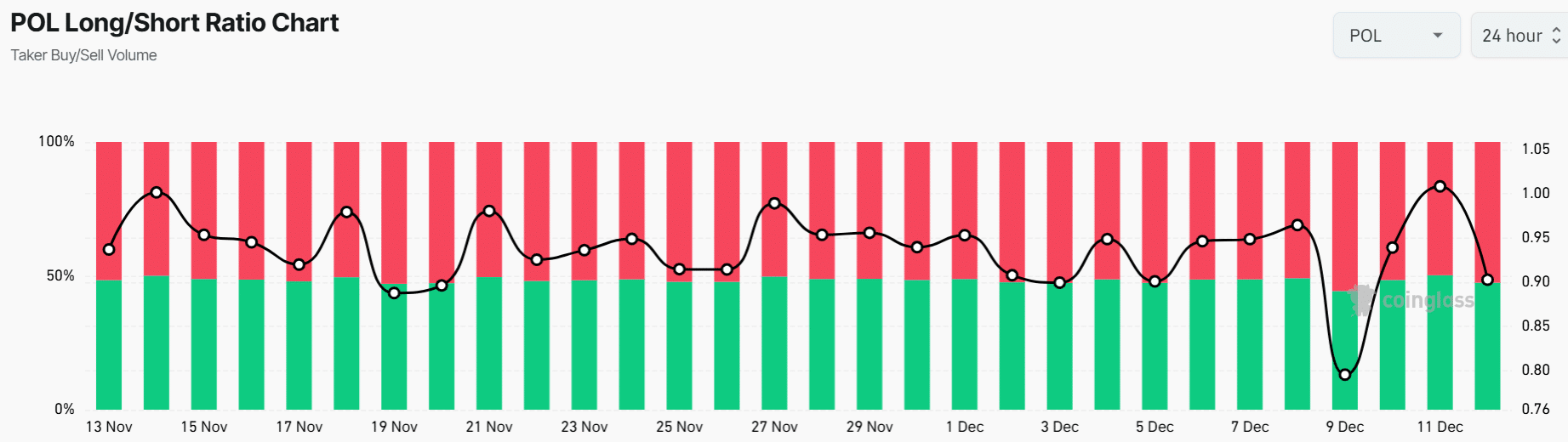

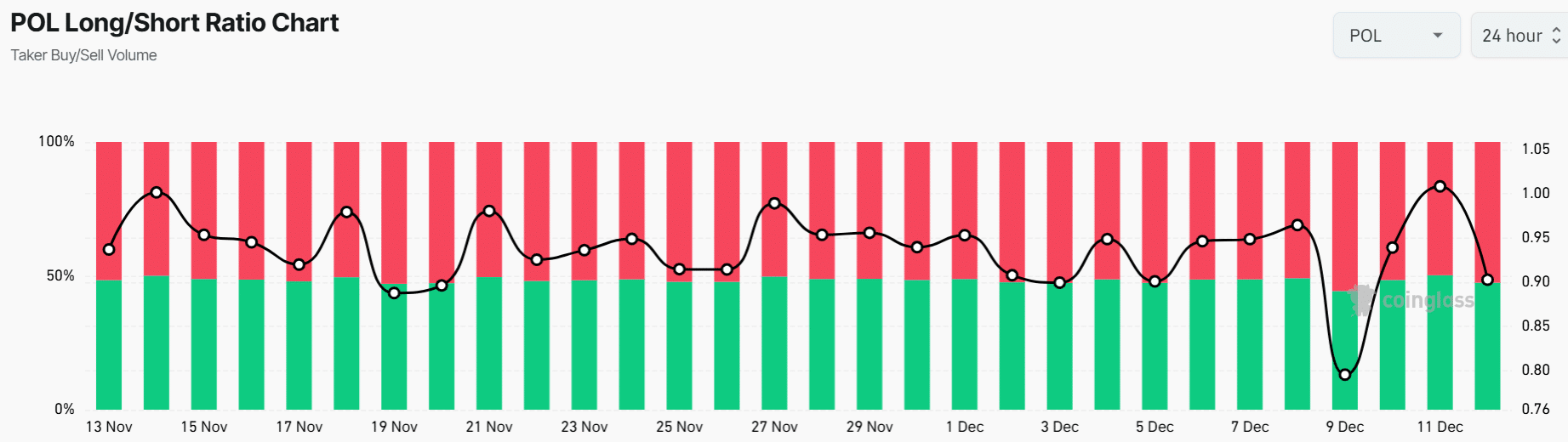

Shift in sentiment reflected in long/short ratio

The long/short ratio for Polygon dropped to a monthly low of 0.79 on December 9th due to increased short-selling, but has since rebounded to 0.90.

Source: Coinglass

Despite the increase, the long/short ratio still indicates bearish sentiment, with 52% of traders being short sellers, suggesting a lack of optimism for a sustained uptrend.

sentence: “The cat sat lazily in the sun, purring contentedly.”

The contented cat sat lazily in the sun, purring softly.