- Popcat has experienced a bullish trend in the last month.

- The strong momentum and increased buying pressure have given the bulls a good opportunity to reach $1 soon.

Popcat [POPCAT] has surged by 34.15% in the last 24 hours of trading, with a notable increase in volume. This coincided with Bitcoin [BTC] breaking past the $60k resistance level.

The $1 psychological resistance has loomed over the memecoin, causing resistance back in July. What will happen during this current surge?

Popcat Price Targets Based on Extension Levels

Source: POPCAT/USDT on TradingView

Based on Fibonacci levels from the Popcat price drop in late August, the recent surge surpassed the 78.6% retracement level.

The market structure has been bullish since the final week of August.

The 12-hour chart’s RSI indicates bullish momentum over the past ten days, with the OBV steadily rising. This signals upward momentum due to increased buying pressure.

These indicators suggest a solid rally likely to continue, targeting the $1 and $1.18 resistance levels, as well as the local high and Fibonacci extension level.

Spot CVD Contradicts OBV Findings

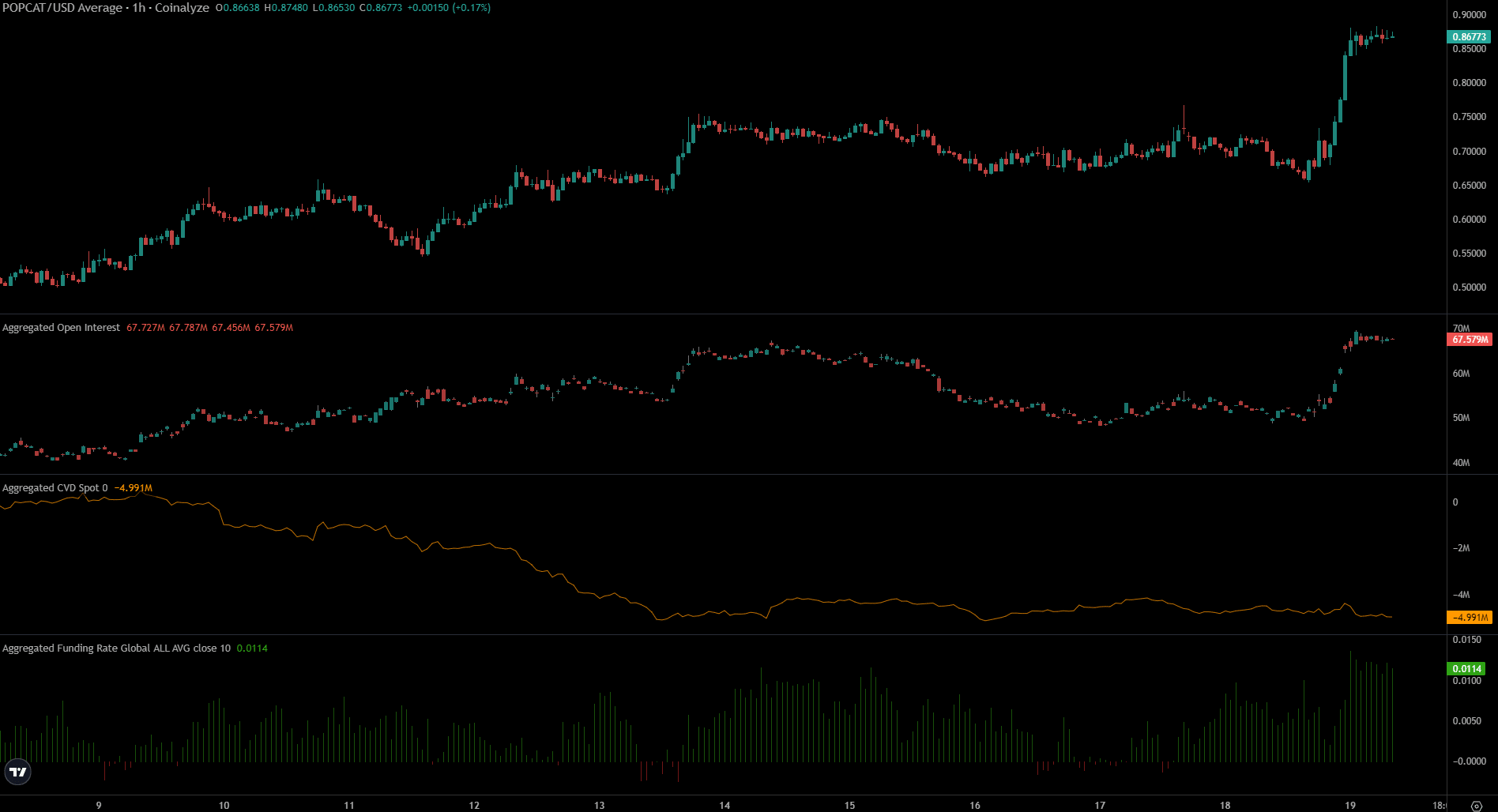

The recent 23% surge led to Open Interest rising from $49.2 million to $69 million, indicating active participation from bulls in the Futures market.

Speculators are keen on going long to capitalize on the Popcat movement.

Is your portfolio in the green? Try out the POPCAT Profit Calculator

The high Funding Rate in the past few days aligns with active participation from buyers. However, the spot CVD has remained flat for a week, indicating a balance between buying and selling in the spot market, contradicting the OBV.

Overall, buyers seem to have the upper hand in the short term.

Disclaimer: The information presented is the writer’s opinion and does not constitute financial, investment, trading, or other advice.