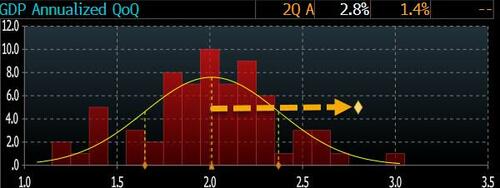

Following yesterday’s alarmist op-ed by the misguided Bill “recession is imminent, so lower rates before Trump is re-elected” Dudley, there were expectations for a Q2 GDP report this morning indicating zero or even negative growth to prompt a rate cut in July. However, Kamala’s Bureau of Economic Analysis surprisingly released a strong report (as we are only 100 days away from establishing Kamalanomics as the next big thing) moments ago, revealing that the initial estimate of Q2 GDP stood at an impressive 2.8%, doubling the final Q1 figure of 1.4% (which was already the lowest since the technical recession in Q2 2022)…

… and even exceeded the consensus estimate of 2.0% by more than 2 standard deviations; in fact, only one analyst predicted a higher rate of 3.0%.

The unexpectedly strong Q1 report puts the H1 GDP growth at around 2.1%, a decrease from the 3.1% pace in 2023.

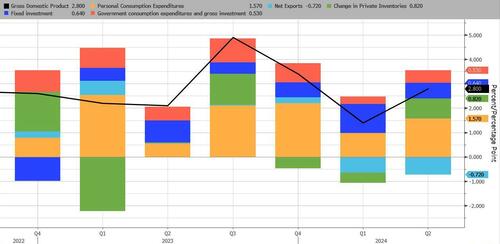

The rise in real GDP was mainly due to an increase in inventory investment, nonresidential fixed investment, and a surge in consumer spending. However, this growth was partially offset by a decline in housing investment.

According to UBS, the details suggest robust growth: investment surged by 8.4% q/q seasonally adjusted annual rate, the highest since Q3 2023. The growth was supported by increased investment in information processing equipment, which rose by 10.2% q/q. Personal consumption increased by 2.5% in Q2, a significant improvement from the 2.3% decline in Q1. Government spending rose by 3.1% q/q, surpassing the 1.8% growth in Q1.

Further insights from the BEA report show that compared to the first quarter,

- The rise in consumer spending was driven by increases in both services and goods, with healthcare, housing, utilities, recreation services, motor vehicles, recreational goods, furnishings, durable household equipment, gasoline, and other energy goods being the key contributors.

- The increase in inventory investment was led by gains in wholesale trade and retail trade industries, offset by a decrease in mining, utilities, and construction sectors.

- The increase in business investment was propelled by higher equipment and intellectual property product investments, partially offset by a decline in structures.

Breaking down the GDP components:

- Personal Consumption contributed 1.57% to the total 2.80% growth, a significant jump from 0.98% in Q1.

- Fixed Investment dropped to 0.64% from 1.19% in Q1

- Private Inventories added 0.82%, a notable increase from the -0.42% destocking in Q1

- Net trade subtracted 0.71% (mainly due to a -0.93% contribution from imports), almost unchanged from the 0.65% in Q1

- Government’s contribution to GDP significantly rose from 0.31% in Q1 to 0.53% in Q2.

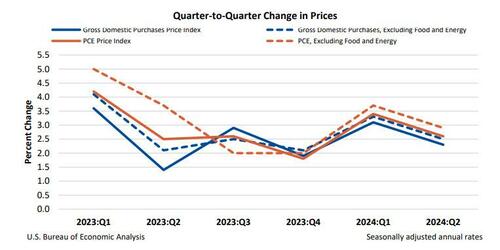

Meanwhile, the core PCE index declined to 2.9% y/y from 3.7%, slightly above the 2.7% consensus. Additionally, the headline gross domestic purchases prices rose by 2.3% in Q2, below the 2.6% estimate after increasing by 3.1% in Q1.

In conclusion: as per UBS’s analysis, “This detailed report reflects very positive growth” and effectively refutes the “doomsday is near” narrative painted by Bill Dudley yesterday, which triggered a significant reversal in the yen carry trade and negatively impacted various other assets.

Loading…