Raredex has officially launched on the Arbitrium blockchain, making rare earth metals accessible to a wider range of investors. This move signifies a significant shift in the investment landscape, as rare earth metals have traditionally been reserved for institutional investors.

Raredex, a platform on the Arbitrum network, allows investors to tap into the rare earth metals market. These metals are crucial for various industries, from technology development to renewable energy. Retail investors have historically faced barriers in accessing these assets due to high entry costs, often exceeding $10,000. Raredex addresses this challenge by enabling fractional ownership through blockchain-based tokenization, where each token represents one kilogram of physical metal.

Louis O’Connor, the CEO of Raredex, emphasized the democratization potential of the platform, stating that early adopters can now access an asset class that was previously limited to governments and wealthy individuals. This means that smaller-scale investors can now participate in the market with less capital required.

You might also like: RWA platform Allo secures $100m Bitcoin-backed credit facility

How does Raredex work?

Raredex stores its physical metals in a secure vault operated by Tradium in Germany, ensuring custody and availability. Each token is tagged with detailed source-of-origin data, allowing investors to verify the provenance of their holdings. The use of blockchain technology creates an immutable ownership record, reducing the risk of fraud and enhancing transparency.

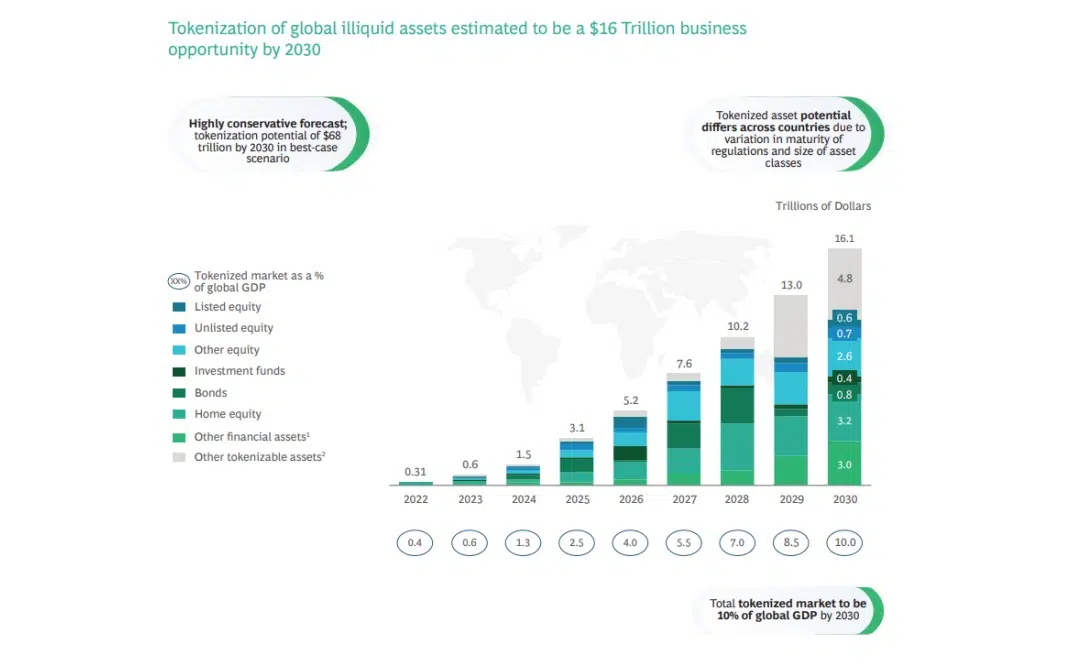

The platform’s launch coincides with a growing interest in RWA tokenization, reflecting a broader trend towards tokenizing real-world assets. In 2023, the RWA market saw a 700% growth, generating $860 million in revenue. Industry experts project that RWAs could become a $16 trillion market by 2030, driven by blockchain’s transparency and trust-enhancing capabilities.

You might also like: Digital asset investment products reach record $44.2b in 2024, CoinShares says

The chart predicts that global illiquid asset tokenization could reach $16.1 trillion by 2030, representing 10% of global GDP. This forecast underscores the growth potential of Raredex operating in the RWA space. Data sourced from ADDX by crypto.news.

Other initiatives in the tokenized asset space include UBS Asset Management’s Ethereum-based investment fund and Archax’s $4.8 billion money market fund on the XRP Ledger.

With increasing demand for rare earth metals driven by technological advancements and clean energy initiatives, Raredex’s platform could pave the way for a broader adoption of commodity trading on the blockchain, reshaping how investors interact with physical assets.

Read more: Fidelity Digital Assets: Tokenization, Nation-state Bitcoin and more in 2025