- Raydium sees impressive price action driven by strong ecosystem demand.

- Record high volume and TVL for Raydium as it approaches its all-time high.

Raydium [RAY] has been quietly making waves in the market, with significant developments taking place. The Solana-based decentralized exchange has been gaining traction, evident in various performance metrics, particularly its native token, RAY.

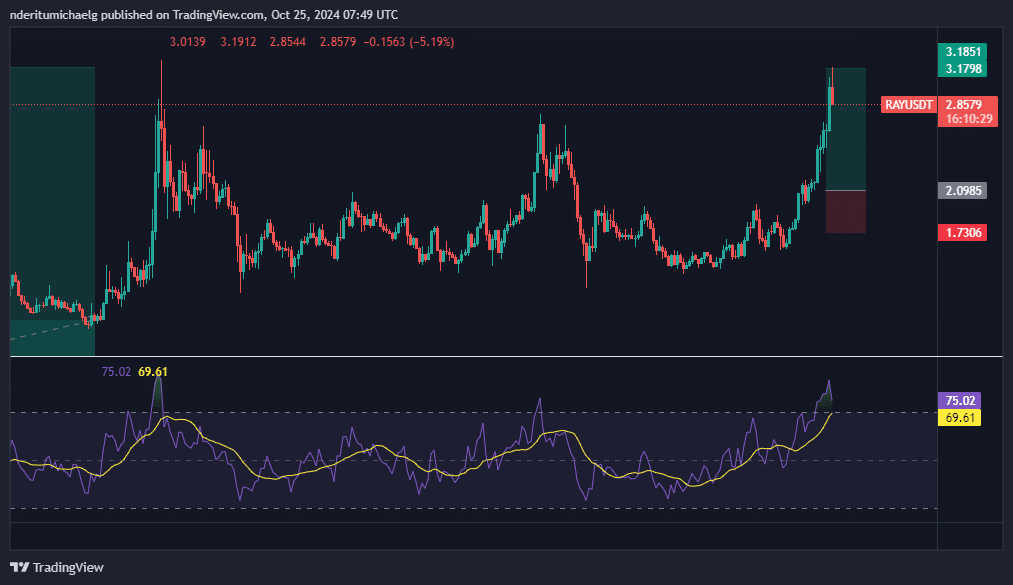

RAY surged to $3.19 in the past 24 hours, showcasing a remarkable bullish run. With a 51% increase in the last week, it has earned a spot among the top weekly gainers in the crypto space.

This surge has led to a staggering 1,637% year-over-year gain for RAY.

Source: TradingView

RAY has retraced to $2.85 at press time, showing signs of profit-taking as it reached near its 2024 high, facing resistance in that zone.

Given its overbought status, a retracement was expected.

Raydium’s Utility Driving Demand for RAY

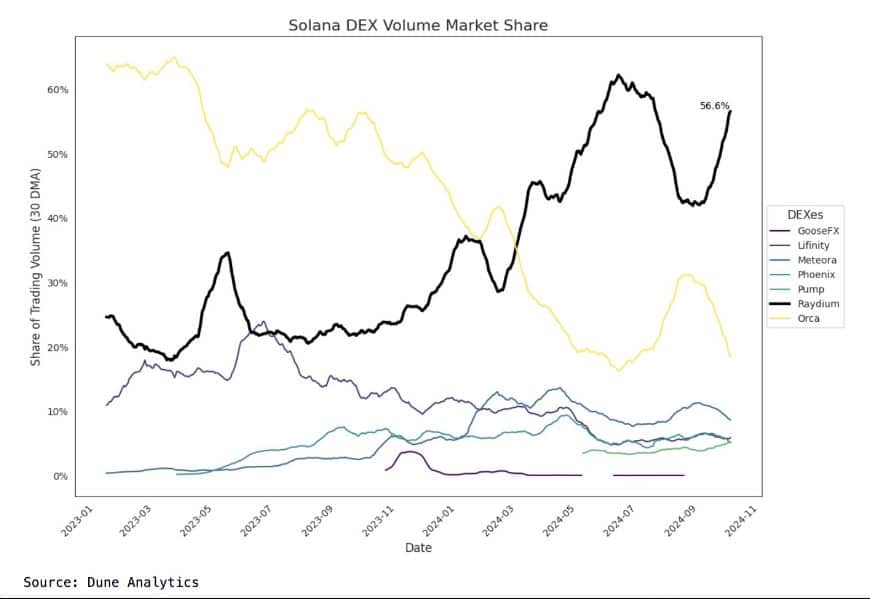

The bullish performance of RAY underscores strong demand, largely fueled by the growth of the Raydium ecosystem. Holding the top spot among DEXs since April, it now commands over 50% of the total DEX volume on Solana.

The surge in Raydium volume and all-time high figures highlight the resurgence of activity within the DEX.

Source: Dune analytics

Raydium’s growing market share on Solana is reflected in the volumes it has handled this year. The market has been heating up, leading to a revival in Solana’s DeFi ecosystem, akin to the first half of 2024.

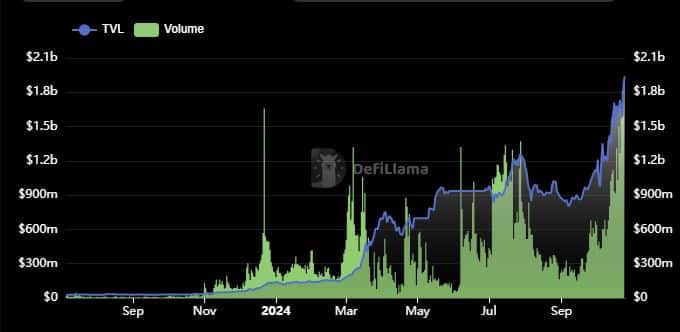

Recent market excitement has resulted in heavy volumes on Raydium, with daily volume reaching a new high of $1.81 billion on October 23, marking a 1,083.66% increase from its 2-month low in mid-September.

Source: DeFiLlama

Raydium also saw its TVL soar to a new 2024 high of $1.93 billion on October 25, coming close to its all-time high of $2.21 billion on November 15.

Realistic or not, here’s RAY’s market cap in BTC terms

Raydium’s dominant position indicates potential for increased demand and utility in the near future as the bull market gains momentum.

With RAY still trading below its historic high, there may be room for further recovery.