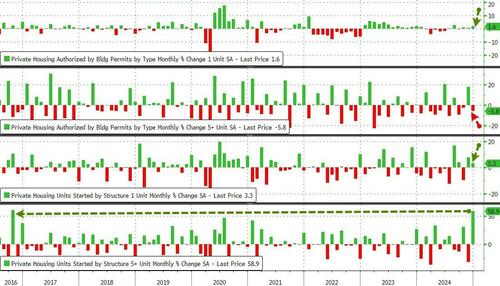

After a downwardly revised 3.7% MoM drop in November, Housing Starts saw a significant 15.8% increase MoM in December, while Building Permits, which are more forward-looking, experienced a smaller than expected 0.7% MoM decline.

Source: Bloomberg

This surge in Starts marks the largest MoM jump since March 2021, pushing the total Starts SAAR to its highest level since February 2024.

Source: Bloomberg

The sharp increase in starts was primarily driven by a staggering 58.9% MoM jump in multi-family units, despite a 5.8% decline in multi-family permits.

Source: Bloomberg

This surge in multi-family starts represents the largest MoM jump since 2016 and the highest SAAR for ‘renter nation’ since December 2023.

Source: Bloomberg

The key question now is whether homebuilders will maintain this rapid pace of construction, especially as sales expectations are declining.

Source: Bloomberg

Despite the strong monthly growth, new home construction for the entirety of 2024 was the slowest since 2019.

With mortgage rates climbing back above 7.00%, it seems that homebuilders are banking on a resurgence of inflation and economic growth to keep home-buying affordability out of reach for many Americans.

Interestingly, the more forward-looking ‘permits’ data actually decreased MoM.

Moreover, as builders adjust to softer demand, the number of homes under construction has been declining over the past year, reaching its lowest point since August 2021.

Additionally, completions have slowed down, reaching the slowest pace since March.

Loading…