- Shiba Inu experienced significant losses this week, ranking as one of the top losers.

- Although the SHIB wedge pattern hints at a breakout potential, on-chain data indicates weak demand.

Shiba Inu [SHIB] ended the week as one of the biggest losers among the top 20 cryptocurrencies. Despite this, its performance reveals interesting insights that could lead to a strong bullish recovery.

Over the last seven days, Shiba Inu saw a decline of over 12%, making it the second most bearish coin among the top cryptocurrencies by market cap according to Coinmarketcap.

This downward trend erased most of the gains it had made earlier in the month, bringing it close to its October opening price.

Notably, Shiba Inu’s performance was significant as the memecoin had been trading within a wedge pattern and had reached a tight squeeze zone. The recent drop nearly touched its ascending support level, indicating a potential for a bullish rebound.

Source: TradingView

SHIB saw a 6.15% rebound to $0.000016 at the time of writing, indicating a resurgence in demand over the past 24 hours, potentially signaling a bullish revival.

Previously, Shiba Inu had shown a strong uptrend at the end of September. However, the wedge pattern had limited any rally attempts since then. The chances of a pattern breakout are now higher.

Assessing the state of Shiba Inu accumulation

The SHIB wedge pattern is expected to trigger activity that could lead to a recovery and breakout, or a different outcome.

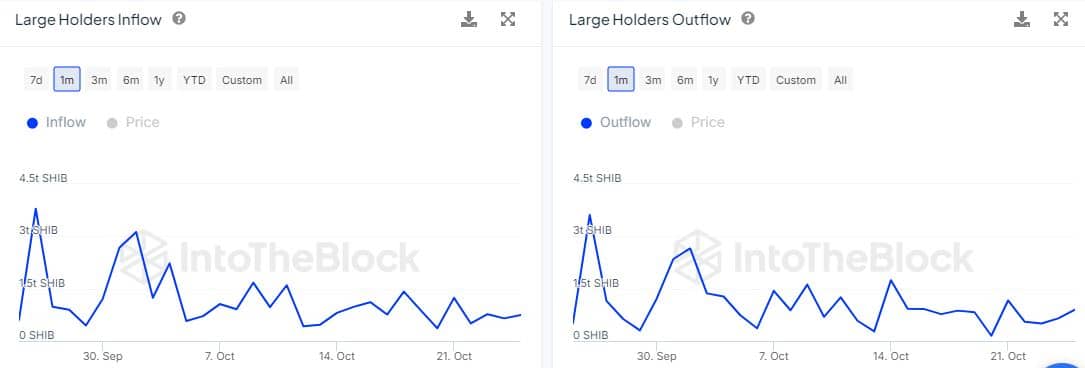

Recent data on large holder flows showed more whales moving Shiba Inu out of their wallets compared to those adding to their holdings.

Source: IntoTheBlock

On October 25, large holder inflows totaled 747.75 billion SHIB with no significant increase in the preceding days. Meanwhile, large holder outflows amounted to 898.96 billion SHIB with a noticeable uptick in outflows over the past 3 days.

Read Shiba Inu [SHIB] Price Prediction 2024-2025

The large holder flows coincided with data on historical concentration, showing a decrease in whale holdings from 60.03% to 59.74% by October 25. This indicates that whales have slightly reduced their balances this month.

Investor holdings increased from 13.24% to 13.31%, while retail trader holdings rose from 26.73% to 26.75%. Despite these marginal increases, the overall demand remained low in the past 3 weeks.