- Last week saw a remarkable surge in SHIB’s price, with double-digit gains.

- Despite this, some indicators started showing bearish signals for the memecoin.

The cryptocurrency market experienced a bullish trend recently, allowing various digital assets, including Shiba Inu [SHIB], to achieve significant profits. This surge propelled the world’s second-largest memecoin to break out of a bullish pattern, indicating potential price increases in the near future.

SHIB’s Bullish Breakout

According to CoinMarketCap, SHIB witnessed a more than 13% price surge in the past week. At the time of writing, the memecoin was trading at $0.00001514 with a market capitalization exceeding $8.9 billion, positioning it as the 13th largest cryptocurrency.

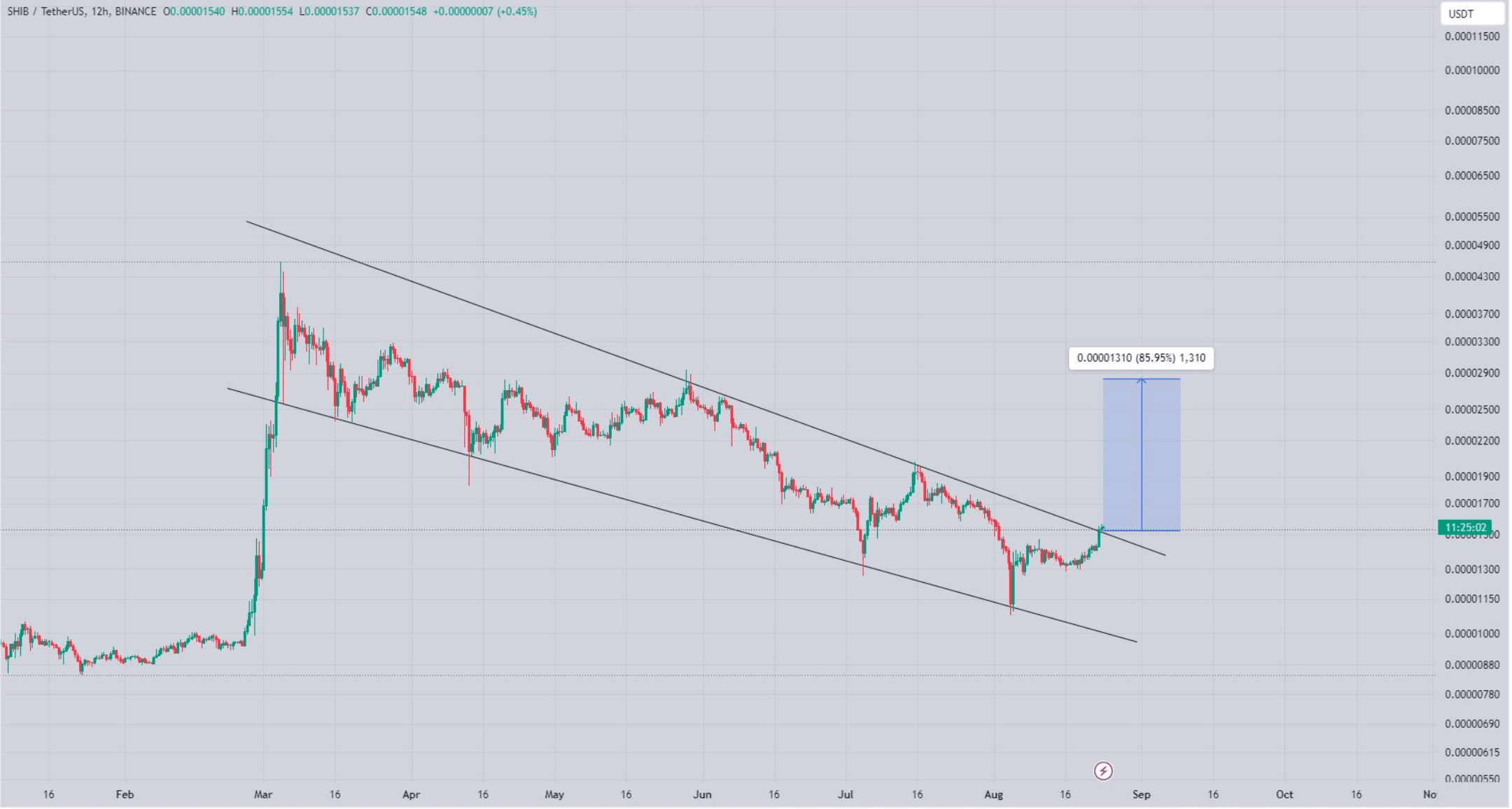

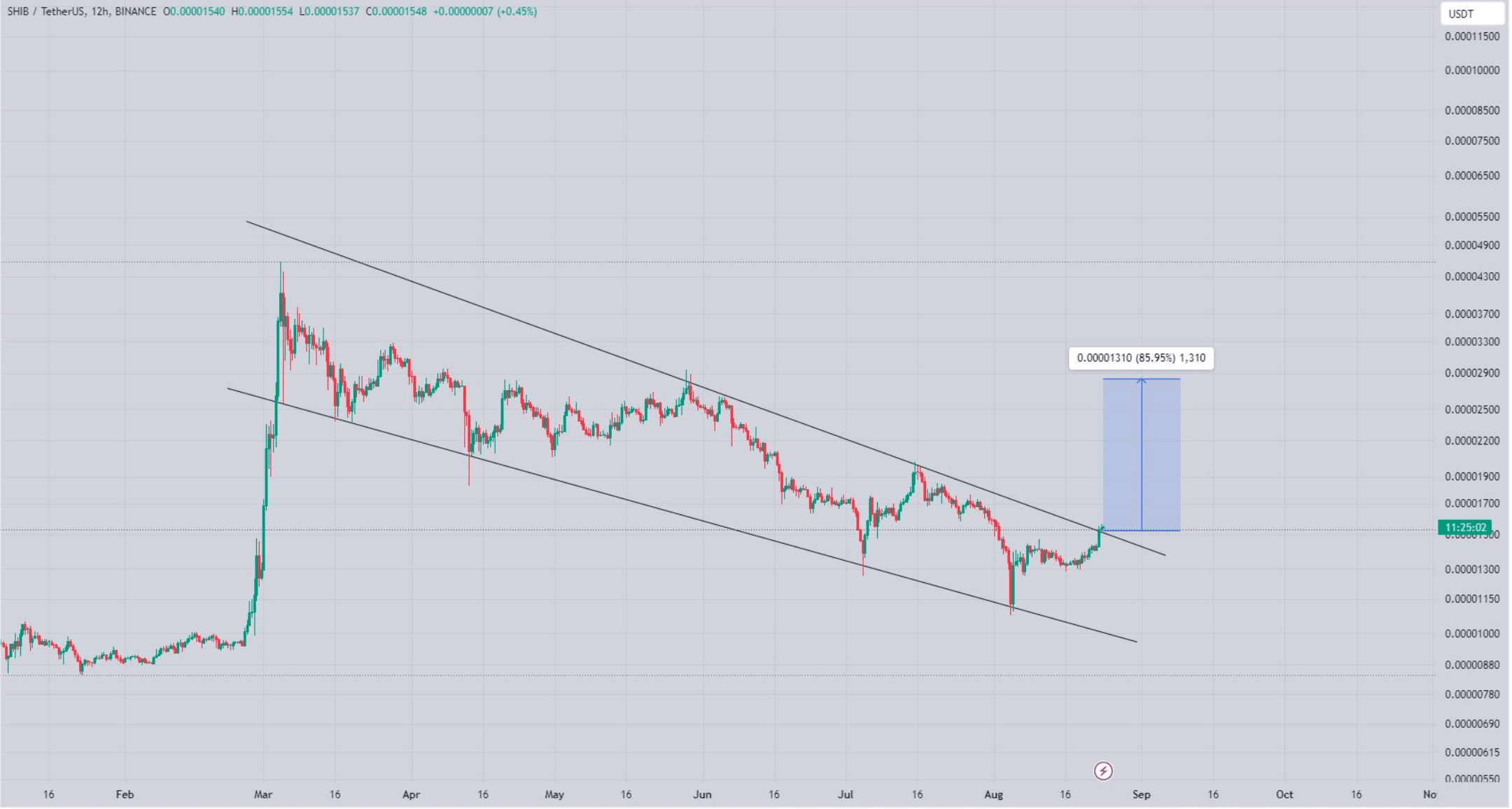

During this period, a popular crypto analyst, World Of Charts, shared a tweet revealing an intriguing development.

The tweet highlighted the emergence of a bullish falling wedge pattern on SHIB’s chart. This pattern initially appeared in March and has been consolidating since then, finally breaking out on August 24th.

The recent breakout above the falling wedge indicated the potential for further price hikes, possibly allowing SHIB to retest its March highs in the coming weeks.

Source: X

However, in the last 24 hours, SHIB’s price action turned bearish, with a 0.3% decrease in value.

Therefore, AMBCrypto aimed to conduct a detailed analysis of the memecoin’s status to determine the likelihood of SHIB regaining bullish momentum.

Anticipated Trends for SHIB

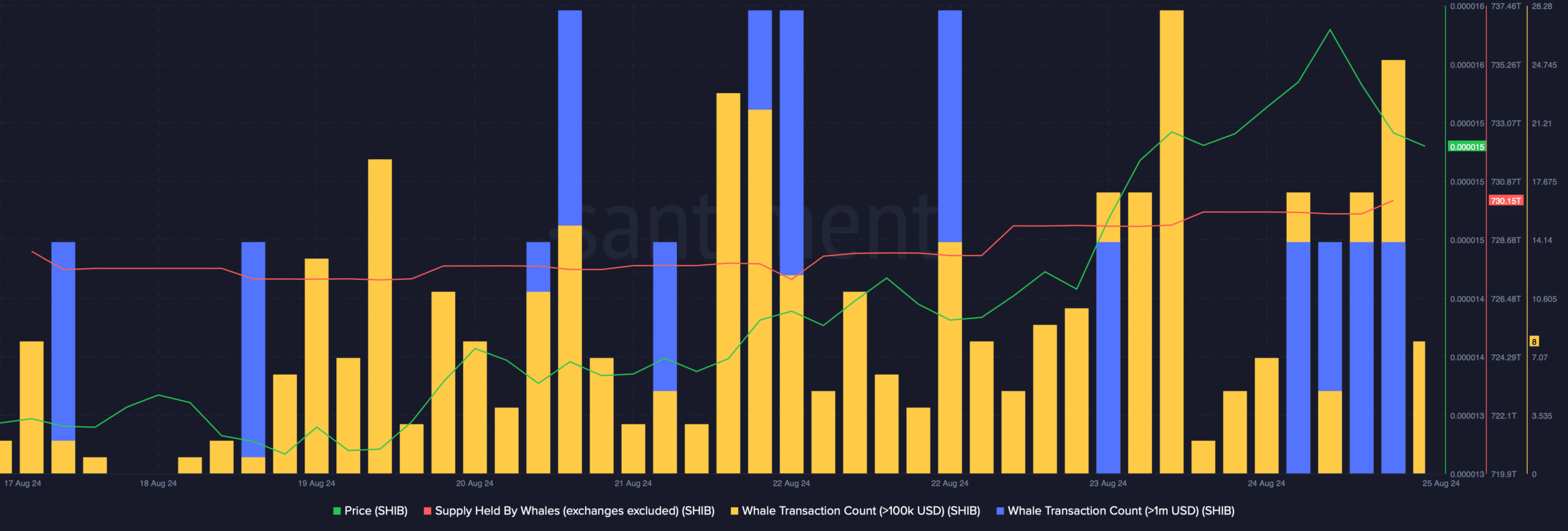

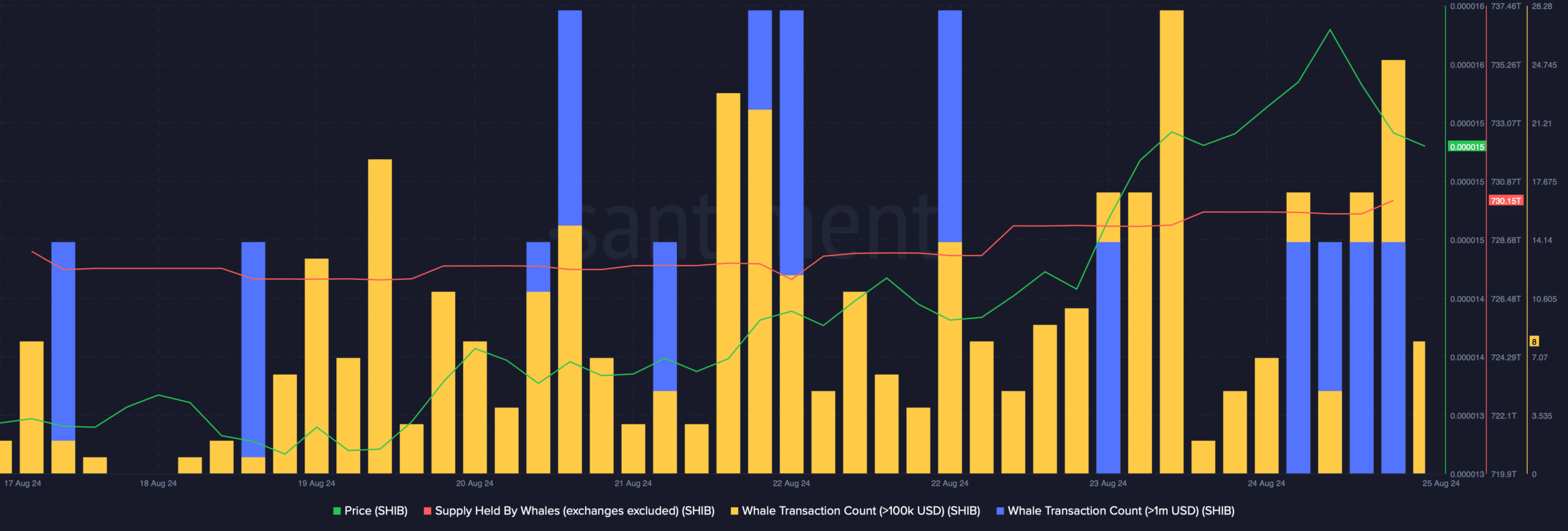

Our examination of Santiment’s data unveiled active trading of Shiba Inu by prominent players in the crypto industry, as evidenced by the increase in whale transaction count.

Source: Santiment

Furthermore, there was a slight increase in the whales’ holdings of the memecoin, indicating their confidence in SHIB and anticipation of a price surge.

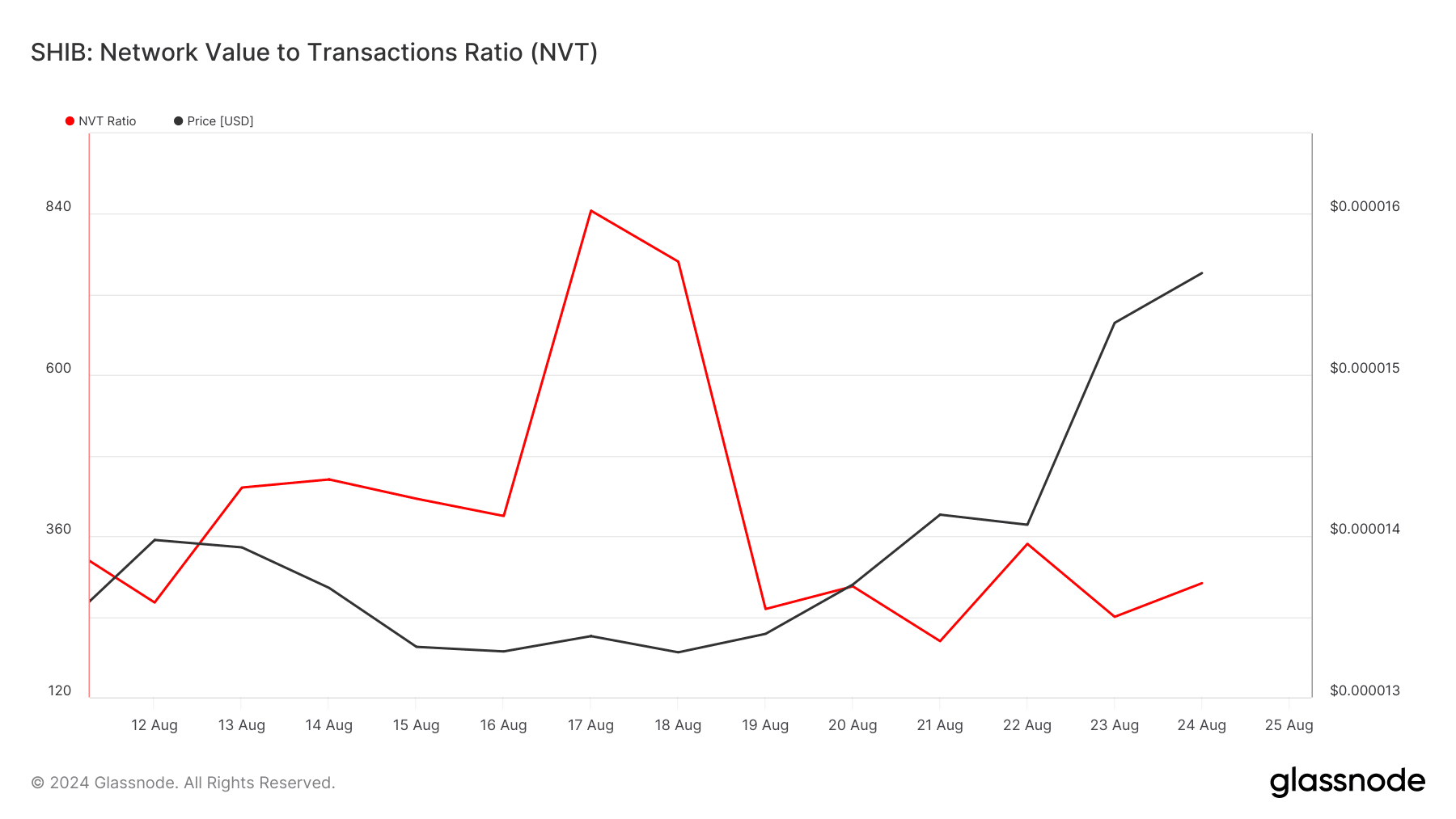

In addition, our analysis of Glassnode’s data highlighted a bullish signal. We observed a decline in SHIB’s NVT ratio, a metric used to assess undervaluation and potential price appreciation. However, the metric showed an upward trend at the time of reporting.

Source: Glassnode

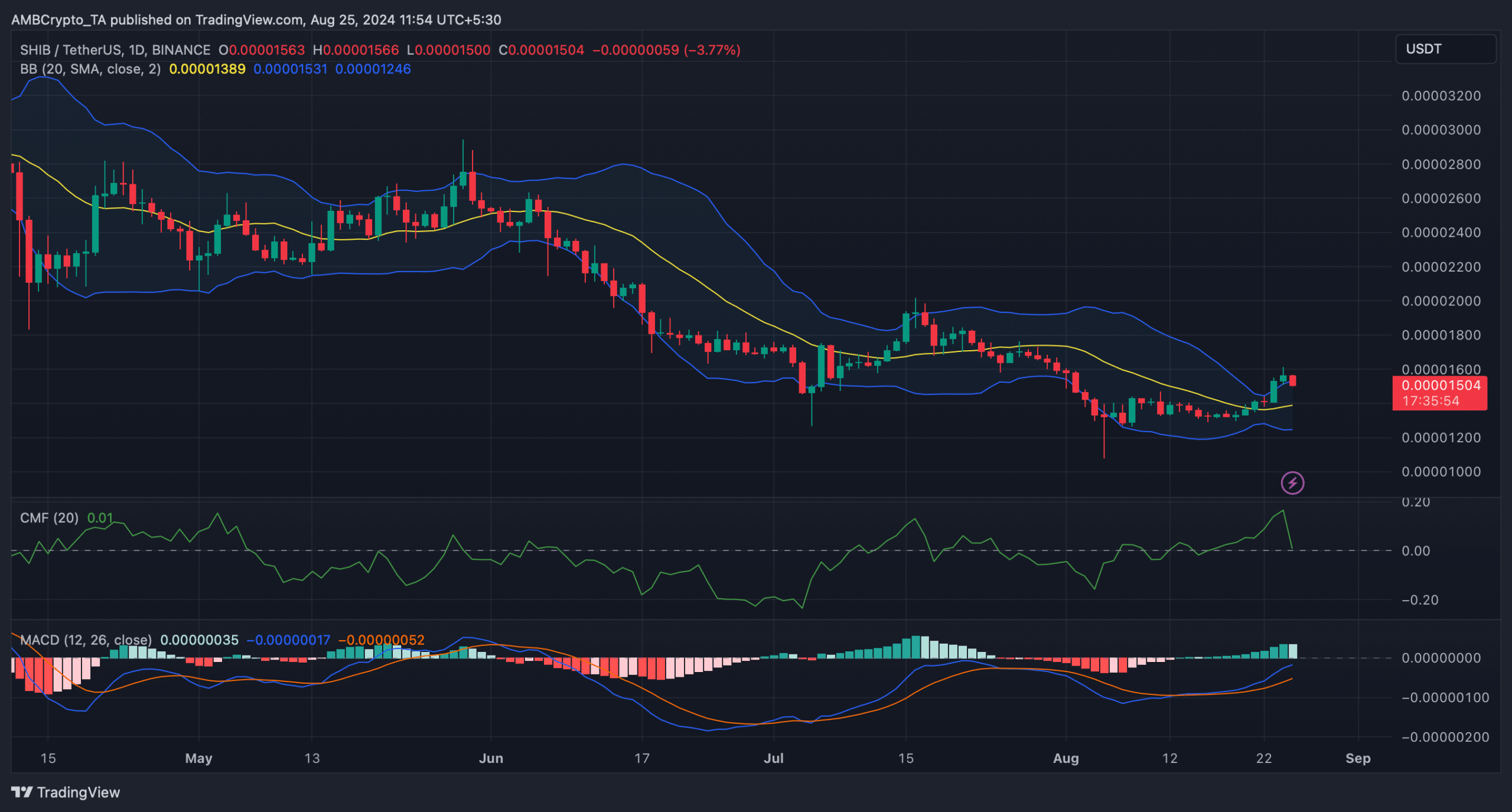

SHIB’s price had recently reached the upper limit of the Bollinger Bands, often resulting in price corrections. Additionally, SHIB’s Chaikin Money Flow (CMF) witnessed a significant decline, indicating a potential price drop.

Nevertheless, the MACD continued to favor buyers, displaying a bullish stance in the market.