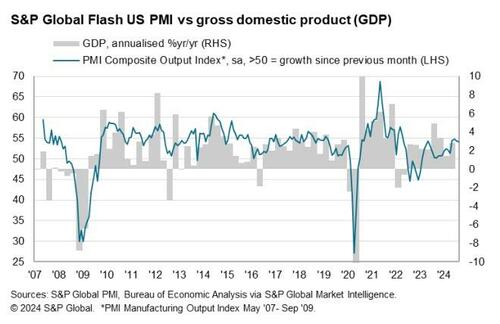

S&P Global’s Flash PMI data for August highlights the ongoing disparity between US manufacturing (declining) and services (holding steady).

-

Flash US Services Business Activity Index at 55.2 (July: 55.0) – reaching a 2-month high.

-

Flash US Manufacturing Output Index at 47.8 (July: 50.5) – hitting a 14-month low.

-

Flash US Manufacturing PMI at 48.0 (July: 49.6) – marking an 8-month low.

These trends are occurring amidst a backdrop of declining ‘hard’ macroeconomic data…

Source: Bloomberg

Providing insight on the data, Chief Business Economist at S&P Global Market Intelligence, Chris Williamson, remarked:

“The positive growth outlook for August suggests a robust GDP expansion of over 2% annualized in Q3, which should alleviate immediate recession concerns. Additionally, the decrease in selling price inflation towards pre-pandemic levels indicates a normalization of inflation, supporting the case for lower interest rates.

“However, a closer examination reveals a less convincing ‘soft-landing’ scenario beneath the surface of the headline figures. Growth is increasingly reliant on the service sector as manufacturing, a typical economic cycle leader, experiences a decline. The manufacturing sector’s orders-to-inventory ratio, a forward-looking indicator, is at one of its lowest levels since the global financial crisis.

“Simultaneously, service sector expansion is hindered by recruitment challenges, leading to rising wage costs and elevated overall input cost inflation compared to historical standards.

“The policy landscape is complex, explaining policymakers’ cautious approach to interest rate cuts. Nevertheless, the key takeaways from the survey indicate a gradual return of inflation to normal levels and a potential economic slowdown due to existing imbalances.”

As illustrated in the chart above, similar divergences in the past have not boded well for the services sector.

Loading…