Happy 5th Birthday, Solana!

- Solana celebrates five years since its inception as a comprehensive ecosystem.

- Currently, it is experiencing a significant downturn, with DEX volumes dropping and investor confidence waning amid a cooling market sentiment.

Once hailed as a rising star in the post-pandemic crypto world, Solana finds itself at a pivotal moment.

As it marks its fifth anniversary, the high-speed blockchain that once rivaled Ethereum is now grappling with a challenging decline.

DEX volume has plummeted from a peak of $36 billion to just $988 million, the lowest point this year.

With Open Interest also declining, the question arises: is Solana going through a temporary setback, or is it facing a more profound structural issue?

History and Evolution of Solana

Launched in March 2020, Solana entered the scene with promises of unmatched speed and scalability, positioning itself as a next-gen Layer 1 chain designed for widespread adoption.

With strong developer support and growing interest in DeFi, Solana quickly climbed the ranks, becoming a favorite for NFT projects and high-frequency trading platforms.

At its peak, Solana boasted billions in Total Value Locked (TVL) and was dubbed the “Ethereum killer.” However, the landscape has shifted over the past five years.

Despite technical enhancements and ecosystem initiatives, Solana is now facing dwindling volumes and fading market enthusiasm, leading to a deeper examination of its current challenges.

Current State of DEX Activity and Open Interest

Source: Artemis

As Solana reaches its five-year milestone, on-chain data paints a concerning picture. DEX volumes have dropped significantly from a yearly high of $36 billion in January to under $1 billion in mid-March.

This sharp decline reflects reduced trading activity, lower user engagement, and potential liquidity shifts to other platforms.

Source: Coinglass

Futures data adds to the apprehension. Open interest in SOL futures has fallen from over $5 billion to just above $3 billion in March, despite SOL’s price struggling to stay above $150.

This divergence indicates diminishing investor confidence and a waning interest in leveraged positions.

Solana Price Analysis

Source: TradingView

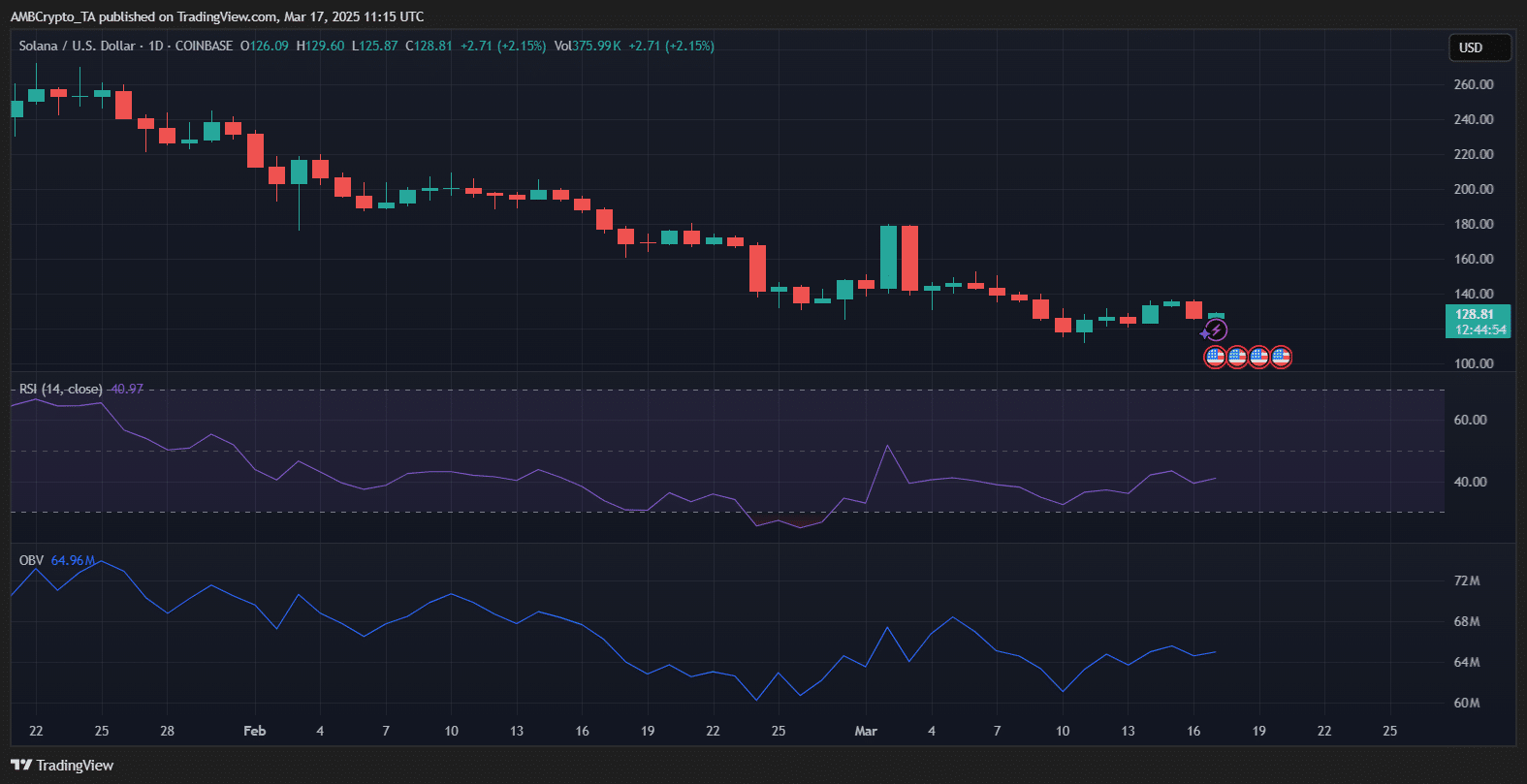

SOL is currently trading at $128.81, with a modest 2.15% daily gain. The Relative Strength Index (RSI) near 41 suggests weak bullish momentum, remaining below the neutral 50 mark.

The On-Balance Volume (OBV) at 64.96 million shows no significant increase in buying pressure, indicating a lack of conviction behind the price rebound.

Price action reflects a clear lower-high, lower-low pattern since late February, reinforcing the bearish trend. Without a convincing reclaim of the $140 level, SOL faces further downside risks.

With dwindling volume and cooling sentiment, the next crucial support level is around $120, and a break below that could lead to a more substantial correction.

sentence: Please rewrite the passage.