- SPX has seen a significant 61.5% increase in the past week.

- SPX6900 bulls are dominating the market with hopes of a sustained rally.

Over the last day, SPX6900’s [SPX] has shown a strong upward trend on its price charts.

During this period, the memecoin surged from $0.52 to $0.64, marking a 21.07% daily increase. Additionally, SPX6900 witnessed growth in both trading volume and Open Interest (OI).

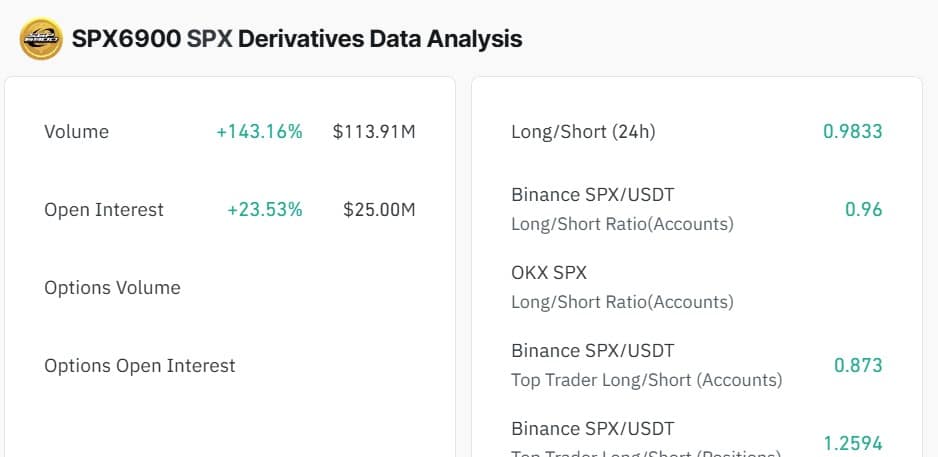

Source: Coinglass

The trading volume of the memecoin surged by 143.16% to $113.91 million, while OI increased by 23.53% to $25 million. On a weekly basis, SPX recorded an impressive gain of 61.50%. The recent price surge, along with rising volume and OI, indicates strong demand for the memecoin.

The main question remains: can SPX sustain these gains and break through higher resistance levels?

Will SPX6900 maintain its gains for a rally?

According to analysis by AMBCrypto, SPX6900 is seeing strong demand as upward momentum strengthens.

Initially, this strong market demand is evident in the increasing Relative Strength Index (RSI).

Source: TradingView

The potential movement is supported by a continuous rise in RVGI over the past five days. A consistent increase in RVGI indicates strong upward momentum in an asset, with gains surpassing losses.

This indicates a strong bullish sentiment among market participants.

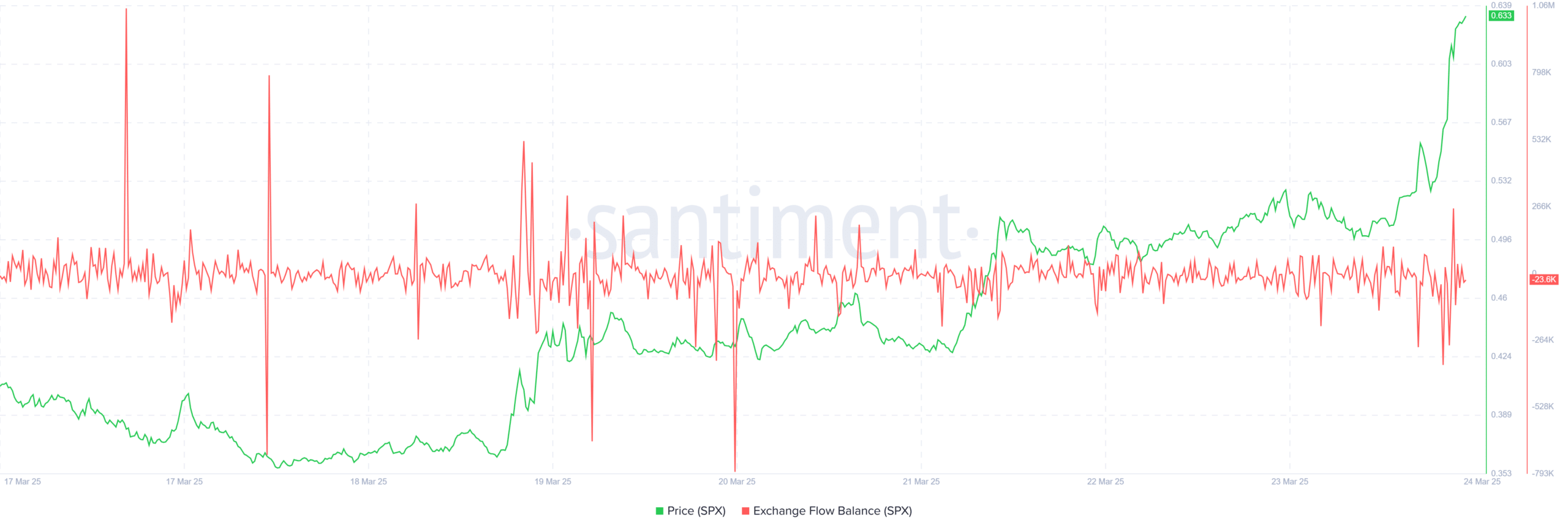

Source: Santiment

Further evidence of SPX6900’s bullishness can be seen in the declining Exchange Flow Balance.

According to Santiment data, the flow to exchange balance has dropped to -23.6k. When this value turns negative, it indicates strong accumulation.

As a result, there are more buyers in the market than sellers, with more exchange outflows than inflows.

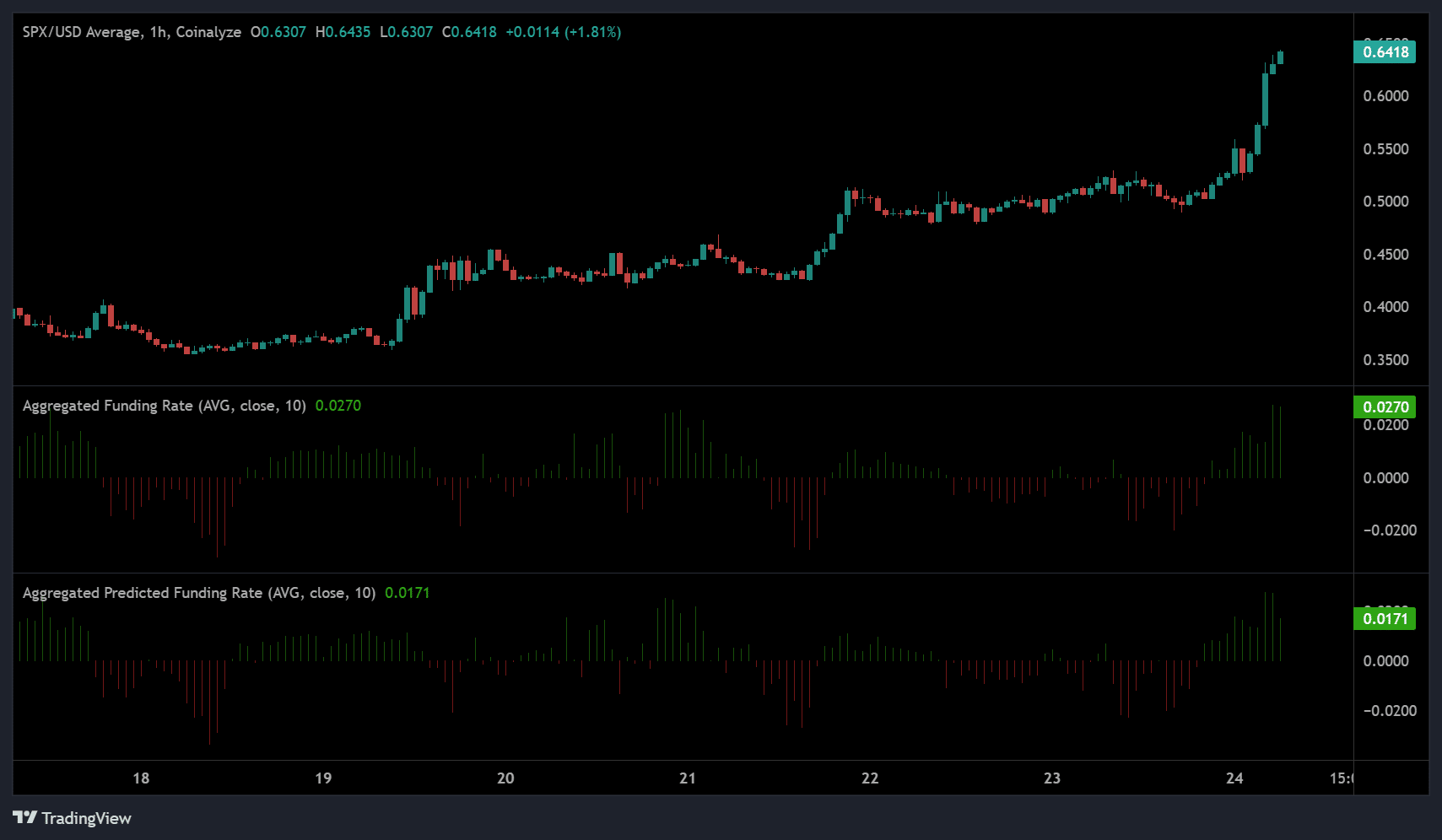

Source: Coinalyze

The positive Aggregated Funding Rate confirms bullish sentiment among investors. A positive rate suggests that most investors are taking long positions and are willing to pay a premium during downturns to maintain their trades.

This reflects strong market confidence as investors anticipate further price increases.

In conclusion, SPX6900 is experiencing strong bullish momentum. Investors anticipate the current trend to continue, driven by high demand and increasing upward momentum.

If these conditions persist, SPX is likely to reach $0.67. However, if buyers are unable to sustain the momentum, a correction could push SPX back to $0.54.

sentence to make it more concise:

“Please make sure to complete the assignment before Friday.”

“Please complete the assignment by Friday.”