Today marked the calm before the storm as we anticipate a slew of risk catalysts this week, including 41% of SPX earnings and key macro data such as JOLTS, GDP, PCE, and NFP. Despite this, October Dallas Fed manufacturing activity exceeded expectations, adding to the positive momentum in the Citi US Macro Surprise Index…

Source: Bloomberg

The release of ‘good’ data has led to a decrease in rate-cut expectations, with 2024 now evenly split between 1 and 2 25bp cuts, and 2025 pricing in just 3 cuts…

Source: Bloomberg

Goldman Sachs’ trading desk highlighted a 5% decrease in market volumes and shallow top-of-book depth at $8.4mm, with noticeable “squeezy price action” in various stocks:

Bitcoin Equities (+7.5%); China ADRs (+4.6%); Non-Profitable Tech (+3%); and Most Short Rolling (+2.8%) – marking the third consecutive day of significant short squeezes…

Source: Bloomberg

Major stocks experienced marginal gains following a short-squeeze open.

Source: Bloomberg

It’s worth noting that today marks the beginning of the estimated open window period for corporate buybacks, with approximately 50% in open window today. Several companies have already initiated new 10b5-1 plans over the past week.

On the market front, Small Caps were the top performers of the day due to the squeeze, while the Nasdaq struggled to maintain its position. The S&P index lagged behind the Dow…

The VIX experienced a decline today, but the volatility term structure for the S&P 500 suggests anticipation of potential turbulence in the coming weeks…

Source: Bloomberg

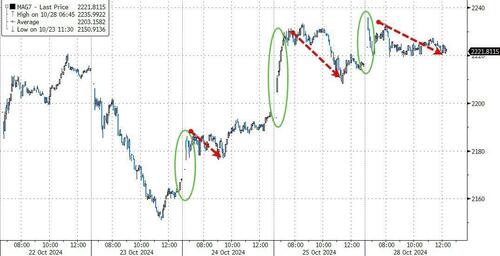

Bond yields saw an increase following the ‘Trump Trade’…

Source: Bloomberg

Yields across the curve rose by 3-4bps, with significant volatility in the bond market observed as TSYs fluctuated between bid and offer prices…

Source: Bloomberg

The dollar ended the day unchanged after a slight increase, following by a decrease, and then a return to parity…

Source: Bloomberg

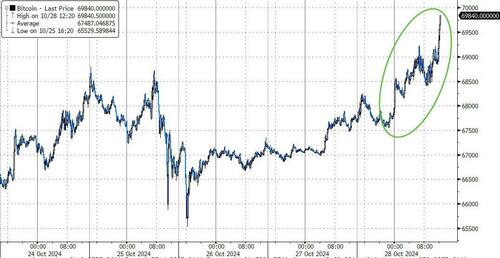

Bitcoin made a strong comeback, reaching close to $70,000…

Source: Bloomberg

Crude oil prices took a hit today as tensions between Iran and Israel eased, leading traders to reconsider geopolitical risk premiums…

Source: Bloomberg

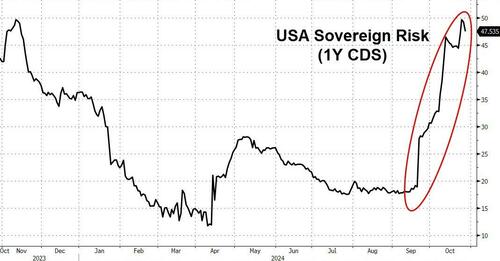

Lastly, USA Sovereign risk is quietly on the rise in the background…

Source: Bloomberg

…as investors hedge their bets against potential election surprises (red or blue sweep)…

Loading…