- Story [IP] has established a trading range between $3.88 and $5.15.

- A break above $5 could lead to a significant price surge.

Over the past 24 hours, Story [IP] has experienced a 23.5% increase. Despite the downward trend in Bitcoin [BTC] and the overall crypto market, the rising demand for the native L1 token has been a positive sign.

Trading volume has also seen a significant uptick, with a 133% increase compared to the previous day.

However, the $5.1 level has been a strong resistance point for the bulls recently. It is possible that the IP bulls might face rejection once again at this key resistance level.

With the token generation event (TGE) taking place just two weeks ago and 25% of the total 1 billion IP supply already in circulation, the price action data is relatively limited. The gradual unlock schedule over the next year indicates a controlled token release strategy.

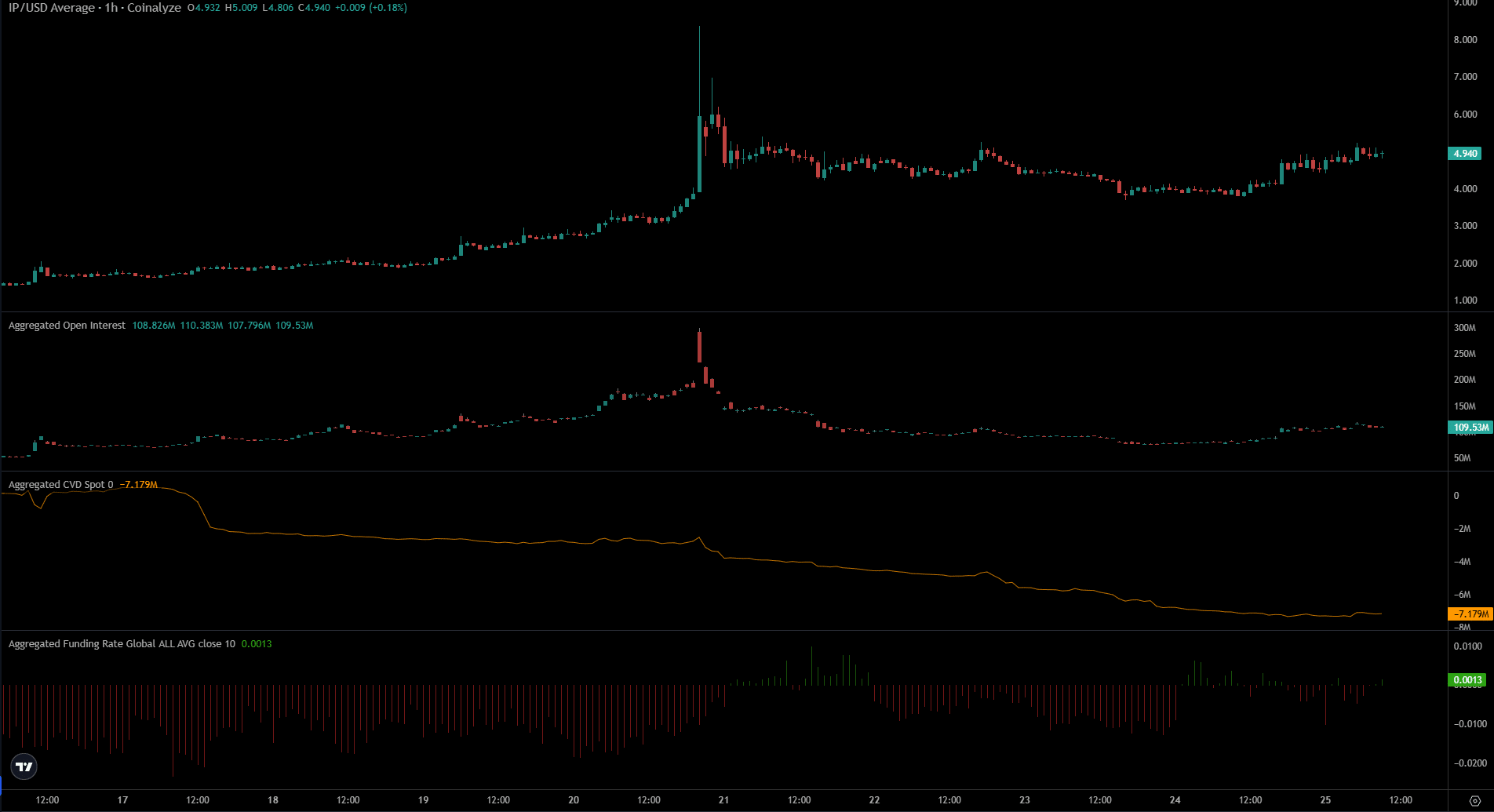

Range Formation for IP

Source: IP/USDT on TradingView

The trading range between $3.88 and $5.15 is highlighted in white on the chart. The $4.5 mid-range level has acted as both support and resistance in recent days.

Currently, the bulls are testing the upper boundaries of the range.

The On-Balance Volume (OBV) has been on an upward trend, but a recent decline suggests a potential reversal. The Relative Strength Index (RSI) on the 2-hour chart remains above 60, indicating strong upward momentum.

A close above $5.26 in a trading session would indicate a shift in market structure. However, a drop to the $4.5 and $3.88 levels remains a possibility.

The weakening spot Cumulative Volume Delta (CVD) suggests low demand, increasing the likelihood of a price drop. The Funding Rate has been hovering around zero and slightly negative at the time of writing.

The flat trend in Open Interest as IP approaches the range highs indicates a lack of bullish sentiment among speculators.

While these factors suggest a potential retracement, further observation is needed to determine the next move for the IP token.

Disclaimer: The views expressed in this article are the author’s own and do not constitute financial advice.

![Story [IP] eyes $5.15 resistance – Failure could send it back to $3.88](https://doorpickers.com/wp-content/uploads/2025/02/IP-Featured-1000x600.webp)