- The growth in Synthetix’s development activity reflects the network’s ongoing efforts to attract more users.

- Although SNX’s performance has been bearish due to sell pressure from whales and institutions.

Initially a standout crypto project during the 2021 bull market, Synthetix has faced challenges staying relevant as the DeFi sector becomes more crowded. Similarly, its native token, SNX, has experienced a downward trend recently.

Can Synthetix stage a comeback? The DeFi protocol has been making strides to maintain its position. Case in point – Synthetix has seen significant development activity recently, propelling it to the top spot among DeFi protocols in terms of Developer Activity over the past 30 days.

Is a major move on the horizon for SNX?

This surge could be linked to recent announcements by the project. Synthetix recently unveiled a new integrator protocol called TLX, enabling leveraged trading. In fact, TLX reported over $400 million in traded leveraged tokens just two days ago.

Reports suggest that Synthetix is also developing a new perpetual integrator. These developments hint at potential increased demand for SNX within the Synthetix ecosystem.

SNX has been on a bearish trajectory for nearly 5 months. Its current price of $1.29 represents a 75% drop from its YTD high of $5.28 in March.

Source: TradingView

SNX’s current price appears lower than in previous bearish phases, raising the question of a potential rebound. On-chain data reveals intriguing insights about the SNX token.

Whales, addresses, and more…

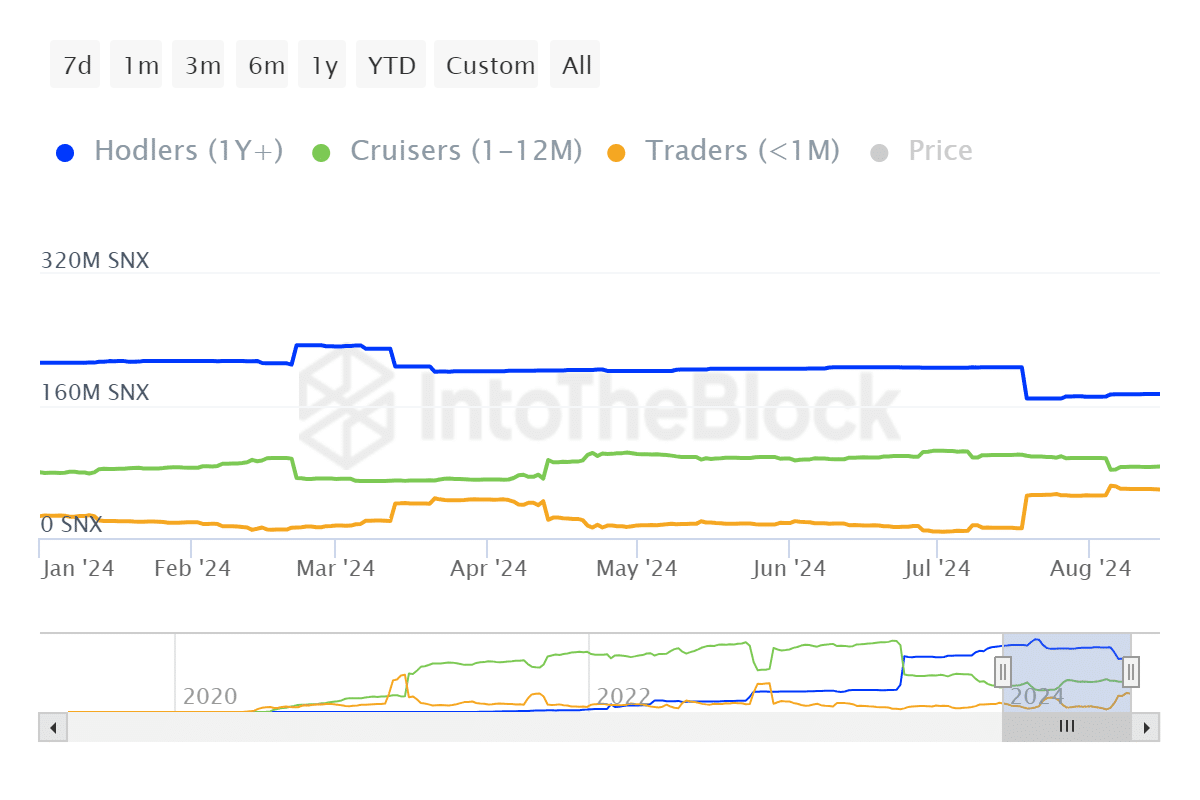

At the time of writing, approximately 98% of all SNX addresses were at a loss, while only 0.76% were profitable. This indicates minimal accumulation at or below the current price level. Additionally, the balance by time held shows a decrease of 37,830,000 SNX among HODLers in the last 8 months.

Source: IntoTheBlock

The number of SNX traders has increased over the last 2 months, suggesting a preference for short-term gains. Consequently, SNX has struggled to maintain a significant uptrend. Furthermore, ownership data indicates that whales have contributed to selling pressure in the past 30 days.

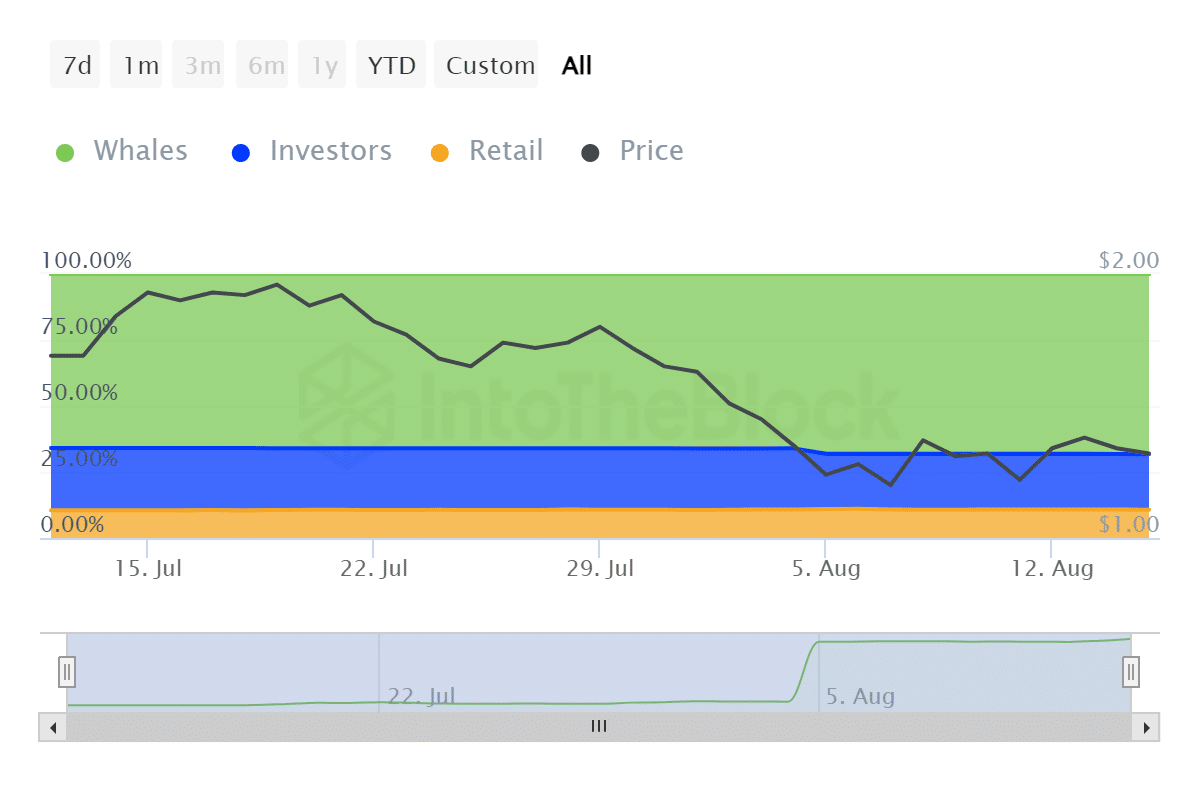

Whale addresses saw a decrease of approximately 7.3 million SNX in the last 4 weeks, while investor addresses dropped by 7.78 million coins during the same period. On the other hand, retail addresses experienced positive growth of around 490,000 SNX.

Source: IntoTheBlock

The uptick in SNX acquisition by retail holders indicates a potential shift in sentiment.

However, the impact of retail buyers on the market may be limited. SNX’s performance may remain subdued unless there is a change in whale and investor holdings favoring accumulation.