Authored by Jim Rickards via Investors Daily,

Gold prices have recently hit a record high, surpassing $3,200 per ounce, and there is potential for further increases in the near future.

As the value of gold rises against the dollar, it becomes more expensive to purchase an ounce of gold. Holding both dollars and gold can prove to be profitable in this scenario.

Central bank gold holdings are on the rise

Central banks have been actively increasing their gold reserves, with holdings jumping from 33,000 metric tonnes to over 36,000 metric tonnes in recent years.

Notably, countries like Russia and China have seen significant growth in their gold reserves, indicating a strong interest in holding onto the precious metal.

This surge in gold reserves by central banks, especially in Russia and China, highlights the importance of gold as a monetary asset.

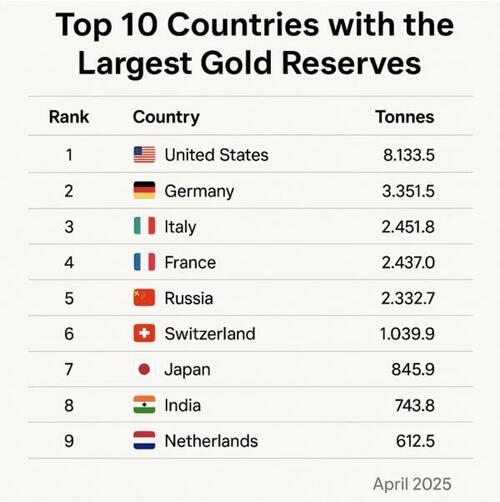

The top ten holders of gold include traditional players like the US, Germany, and France, as well as newer entrants such as Russia, China, and India.

With central banks buying gold equivalent to about 20% of annual mining output, there is a solid foundation supporting the dollar price of gold.

The asymmetric gold trade

This sets the stage for an asymmetric trade where the potential for gains is high, while central banks provide a safety net by buying into dips to boost their gold reserves.

The current dynamics suggest significant upside potential for gold prices, especially if unforeseen events unfold.

Recent tariff announcements by President Trump could further impact global economic conditions, potentially leading to increased demand for gold.

‘BRICS is dead’

President Trump’s stance on imposing tariffs on BRICS members highlights the complexities of global trade and currency dynamics.

The BRICS nations have a significant impact on the global economy, and any disruptions in their trade relationships could have far-reaching consequences.

Trump’s warnings about tariffs and currency rivalries underscore the importance of gold as a common medium of exchange among nations.

The BRICS’ currency solution: gold

While Trump’s tariff threats may be strategic, the reliance on gold as a settlement medium by the BRICS nations showcases the enduring value of the precious metal.

Gold serves as a stable alternative to the US dollar in international trade, providing a secure method for settling trade imbalances without relying on traditional currency exchange mechanisms.

Investing in gold can offer a hedge against economic uncertainties and currency fluctuations, making it a valuable asset in today’s volatile market conditions.

Loading…