Authored by Josh Stylman via Substack,

One Chart. Three Generations. Total Extraction.

I came across this chart on Twitter this week, and it made me pause. Although the specific data combines information from various sources, the trend is unmistakable: in 1950, over half of 30-year-olds were married homeowners. By 2025, some analysts predict that number could drop as low as 13%.

This isn’t just a societal shift. It’s not a random economic occurrence. It’s the visible result of a hidden strategy—one that extracted everything it could from three generations, leaving only illusions behind.

Some might argue that people nowadays simply make different choices—that the decline in marriage rates is due to shifting values. However, people can’t choose what they can’t afford. When the economic basis for starting a family disappears, cultural shifts inevitably follow. That chart doesn’t reflect changing values or new priorities. It reflects a systemic breakdown, cleverly disguised as freedom.

It illustrates the gradual erosion of the social contract. For one generation, adulthood was a beginning. For the next, a challenge. For the latest, a concept—constantly marketed but rarely achieved. What once symbolized a milestone has now become a simulated experience behind a paywall.

The post-World War II economic boom was never sustainable. In hindsight, this was evident. It relied on circumstances that were always temporary: abundant energy from newly discovered oil fields, monopolies in a pre-globalized world, dollar dominance that spread inflation worldwide, and a demographic structure with more working individuals than retirees. It was a fleeting opportunity, not a golden era. And when that window closed, the illusion had to be upheld—through debt, narratives, and increasing sacrifices from future generations.

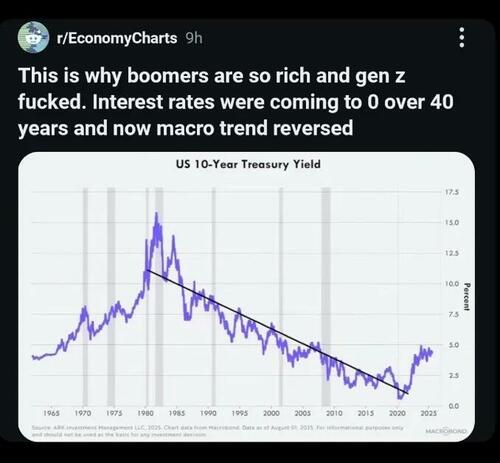

The numbers no longer add up. Boomers purchased homes for two or three times their annual income during a period of declining interest rates that lasted four decades—turning their mortgages into wealth-generating assets as rates plummeted from 15% to near zero. Today’s homebuyers face prices five to six times their income—or even more in major cities—while rates can only rise from historic lows. The Federal Reserve data confirms this unprecedented decline, with rates dropping from over 18% in the early 1980s to around 2.6% in 2021.

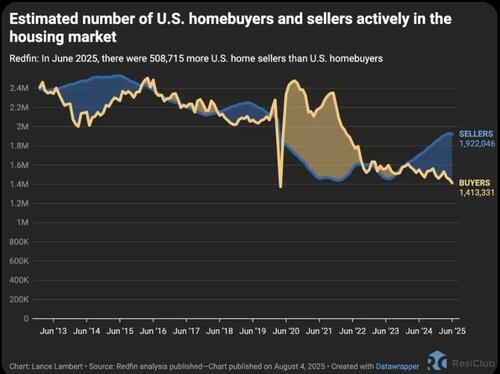

The housing market itself reveals the truth: recent data indicates over 500,000 more sellers than buyers—not because homes are affordable, but because an entire generation has been systematically priced out.

The institutions that once promised stability—education, government, media, finance—evolved into mechanisms of extraction. Speaking the same old language, they now serve a different purpose: to maintain compliance within a system that no longer offers an escape route.

This was not just an economic shift. It was existential. The fundamental pillars of meaning—family, ownership, stability—were quietly demoted to lifestyle choices, then systematically made unattainable. People without homes are easier to uproot. People without families are easier to isolate. People without roots are easier to control.

The Boomers didn’t orchestrate the scheme, but they reaped its rewards. They acquired land, pensions, and a functional society. Many still believe they earned it, failing to see how extensively their reality was engineered from the outset. Their offspring tried to replicate a model that no longer existed. Their grandchildren grew up in the aftermath, perplexed by why their skills and efforts do not yield results.

This was not a coincidence. As detailed in The Technocratic Blueprint, we are witnessing the culmination of a century-long plan—a sophisticated scheme where the bill is finally coming due. The architecture for this extraction has deep historical roots, tracing back to systematic shifts in American governance and citizen classification. What ensued was a prolonged, methodical extraction of the populace—disguised as progress, opportunity, and evolution. The postwar boom did not contradict this system—it facilitated it.

Now, the illusion has dissipated. What was once promised is now unattainable. The institutions that perpetuated the illusion are depleted. They extract, but no longer inspire. They preach equality while enforcing dependence. They market empowerment while stripping away autonomy.

Yet, they persist in claiming that the dream is alive.

But here’s where the extraction becomes truly intricate. As the traditional American Dream faded, a new form of engagement emerged: digital membership in a global dollar consortium. As KF recently outlined in his analysis of the GENIUS Act, stablecoins—disguised as innovative digital accounts—have proliferated, serving 400 million users globally while yielding substantial profits for issuers.

The trade-off is stark. Boomers had tangible assets with some privacy in transactions. The next generation receives digital “assets”—stablecoin wallets, app-based banking, algorithmic financial services—in return for complete surveillance. What appears to be financial inclusion is, in reality, the framework for comprehensive economic monitoring.

This signifies the systematic substitution of real value with stated value across all sectors. America has evolved into a “club promoter” for the global dollar system, offering lenient entry requirements that have attracted billions into U.S. treasury-backed stablecoins. Users gain access to “dollar-denominated wealth” through stablecoins that yield no interest, while issuers profit from treasury yields. It is the same extraction model that has been methodically instilled through culture and media for decades, now expanded globally and digitized.

Experts in these systems, such as Aaron Day, caution that this entails a “backdoor CBDC”—applying existing financial surveillance laws to what was once private currency.

The surveillance trade-off is particularly insidious. Initially, these systems offer less monitoring than traditional banks—minimal paperwork, limited identity verification. However, once everyone is ensnared in the digital infrastructure, America can impose stricter controls than ever before. Every transaction becomes traceable, every account can be frozen, every economic actor becomes manageable.

We are witnessing the substitution of physical ownership with digital access—and labeling it progress. While Boomers amassed equity in homes, the next generation accumulates balances in accounts subject to monitoring, alteration, or deletion with a few keystrokes.

But the charts do not deceive. That single chart—the stark decline from 52% to 13%—reveals what no institution will acknowledge: the old system is defunct. It was not lost. It was liquidated—and we were the collateral.

What emerges in its place remains uncertain. The GENIUS Act’s full-reserve model could lead to unprecedented control—or the first genuine challenge to fractional-reserve banking in a century. As Catherine Austin Fitts has highlighted, the Act lacks safeguards against programmable money, potentially spawning private CBDCs with even less oversight than government-issued digital currency. As she explains, ‘the issuing is not centralized, it’s dispersed. But if you look at the control mechanism of a social credit system and we know the federal government is doing remarkable things to pull together all the data they need to do a social credit system controlled by private corporations, tech companies, essentially.’ The outcome is not predetermined—it is being determined now.

The silver lining is that once the illusion shatters, you cease playing the rigged game. You stop vying for morsels and commence constructing something genuine. Not a nostalgic imitation of a bygone era—but a novel framework, rooted in truth, agency, and genuine sovereignty. The chart that marks the demise of the old ideal becomes the blueprint for a brighter future—if we are brave enough to decipher its true message.

Loading recommendations…