eToro is gearing up for a significant shift: Yoni Assia, the CEO of the platform, revealed in an interview with Fortune that they are planning to launch their own blockchain to support millions of monthly transactions and expedite the introduction of new digital assets like tokenized stocks on Ethereum.

What is eToro’s proprietary blockchain and why is it needed?

Assia explained that the current blockchain infrastructure is insufficient to handle the massive volume of transactions processed by eToro each month. The CEO noted, “We cannot manage millions of monthly transactions on existing networks.” Therefore, eToro is contemplating the implementation of a sidechain: a “light chain” linked to a main blockchain, capable of executing faster and more cost-effective operations while upholding the security of the primary system.

The company is currently in advanced discussions with 4 or 5 platforms to select technology partners, although no specific names have been disclosed. While a launch is not imminent, the direction is clear: through its proprietary blockchain, eToro aims to enhance the entire ecosystem, from trading to digital assets, and to facilitate interoperability between wallets.

What changes for users with the tokenization of stocks?

Assia announced the tokenization of the most popular stocks and ETFs in the United States, directly on Ethereum. This process involves converting traditional stocks into digital ERC20 assets (the token standard on Ethereum), enabling trading, transfers, and automated management of trades 24/5, overcoming the current limitations of stock market hours.

Upon launch, there will be 100 tokenized stocks and ETFs, including major US names. Initially, European users will have access through a dedicated waiting list, with plans for expansion in the future.

The tokenized shares will be transferable between eToro digital wallets, paving the way for decentralized finance even with regulated securities. This is a significant advantage, especially considering that other competitors like Robinhood are making similar moves amidst regulatory uncertainties.

How does eToro fit into the race for the tokenization of Wall Street?

Following the announcement, Bloomberg confirmed that eToro’s initiative mirrors that of Robinhood, which also pledged tokenized assets for European clients. However, unlike Robinhood, eToro has opted for a standard technology (Ethereum, ERC20) and gradual access approaches (waitlist, starting with Europe) to mitigate controversies and regulatory risks.

While Robinhood faced issues after an airdrop of “OpenAI tokens” turned out to be a derivative contract rather than actual equity, eToro prioritizes transparency, compliance, and a methodical approach, ensuring that each tokenized asset corresponds to real underlying stocks or ETFs.

The inter-wallet transferability brings traditional finance closer to the principles of DeFi (decentralized finance), where users retain control, albeit on regulated platforms.

What is the market response: Is ETOR losing ground?

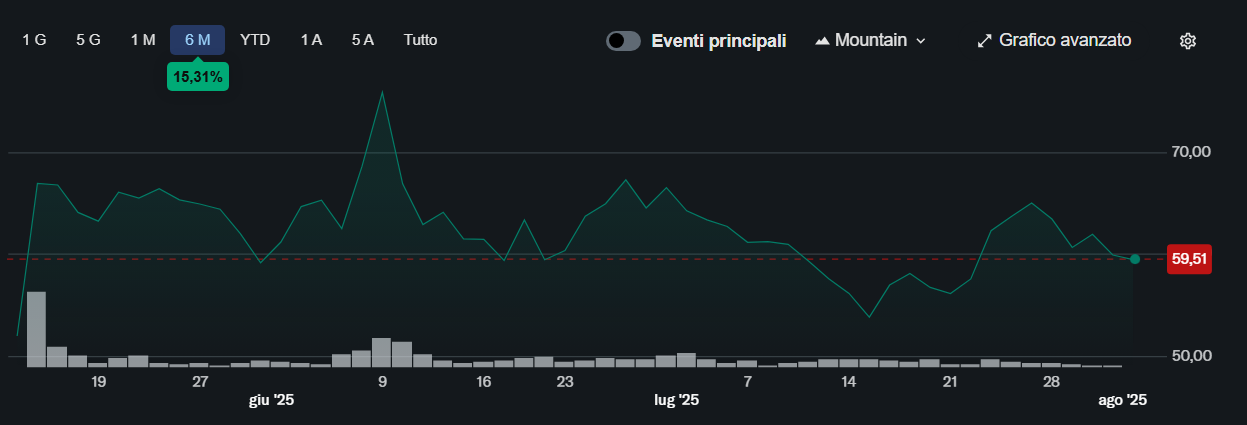

Despite the news, the price of ETOR (eToro’s stock listed on Nasdaq) witnessed a decline: -4% on June 18, closing at 60 dollars per share, compared to the peak of 79 dollars on June 10, marking a total loss of 24%. The market appears to be awaiting tangible evidence of the efficacy of the blockchain model and the true potential of widespread tokenization.

Chart of the price trend of the ETOR stock since its listing on the stock exchange. Source: Yahoo Finance

TradingView reflects a downward trend in the past week, with investors closely monitoring the actual adoption of tokenized shares and future partnerships in the blockchain sector.

“`html

ETOR quotes by TradingView

1M” ], “fontSize”: “10”, “headerFontSize”: “medium”, “autosize”: false, “width”: 800, “height”: 500, “noTimeScale”: false, “hideDateRanges”: false, “hideMarketStatus”: false, “hideSymbolLogo”: false

“`

What are the risks and advantages for eToro clients?

Individuals joining the waiting list for tokenized stocks can enjoy swift trading, extended trading hours, and increased flexibility in managing their digital assets. Nonetheless, risks related to regulations, token volatility, and the security of the utilized blockchain infrastructures persist.

Assia assures maximum caution and collaboration with regulators to prevent “Robinhood cases”. The gradual approach, initially limited to Europe and internal eToro wallets, indicates prudence along with a clear intent to usher in a new era of traditional trading, with tokenized assets now available round-the-clock.

What happens now: impacts and future prospects for trading and blockchain

Assia’s announcement signifies a shift: the convergence of traditional and DeFi is entering the implementation phase, with the ultimate outcome contingent on:

- The ability of the forthcoming eToro blockchain to effectively support “millions of transactions”

- User feedback on tokenized stocks and 24/7 accessibility

- Response from regulators and competition in the USA and Europe

As competitors delve into this realm and markets become increasingly responsive to technological innovations, the landscape of tokenized trading could undergo significant changes in the upcoming weeks. Stay tuned to the eToro community and forthcoming official announcements to stay abreast of developments in blockchain and financial tokenization.