- The daily market structure of Toncoin remained bearish.

- A recent bounce with high volume gave hope to TON bulls.

Most Toncoin [TON] holders were struggling, with 96% of them underwater. Despite this, there was a 25% price bounce in the last four days.

However, the downtrend on the daily chart remained strong.

The $3.85 resistance level was a key point for a potential bearish reversal.

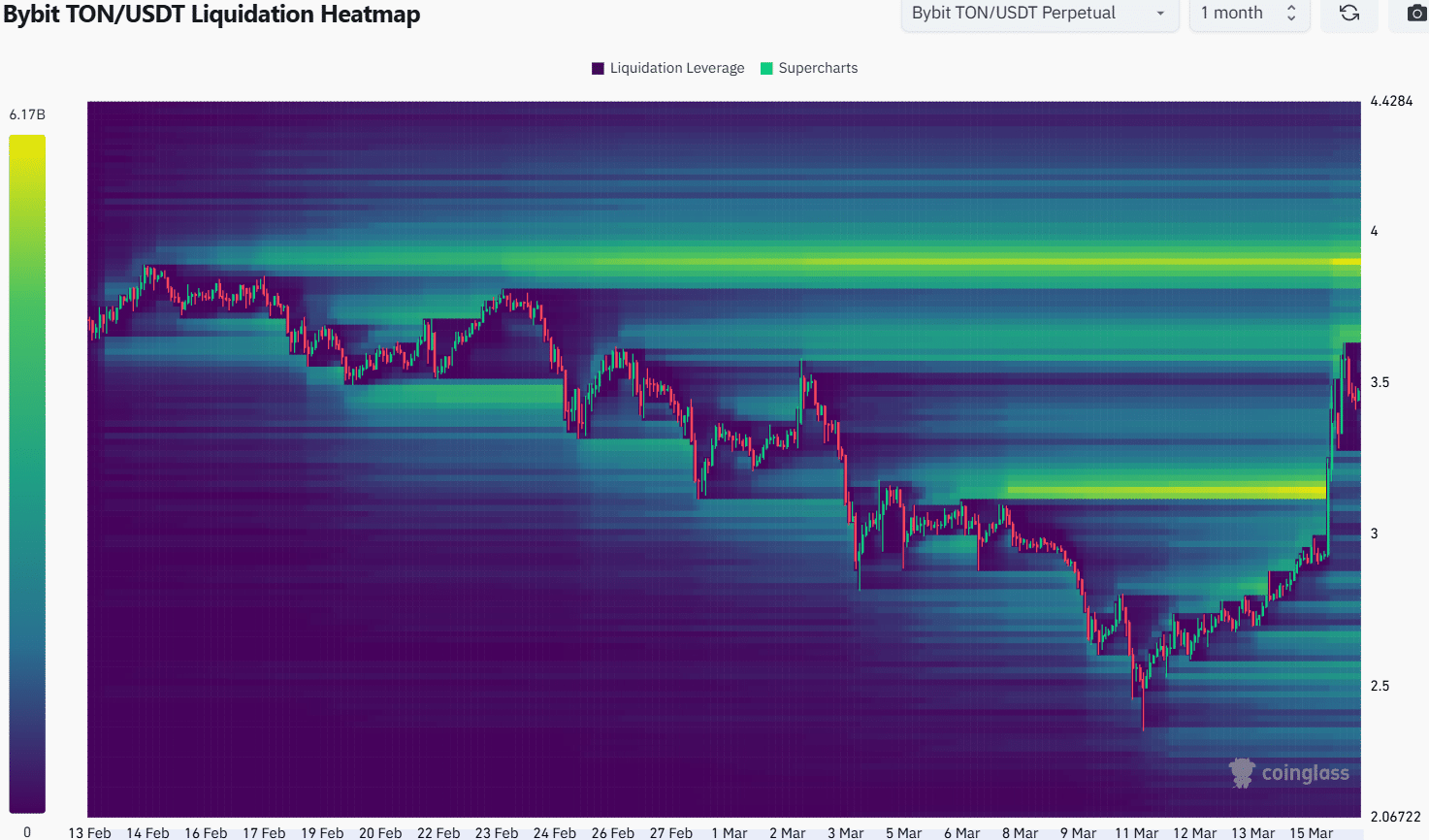

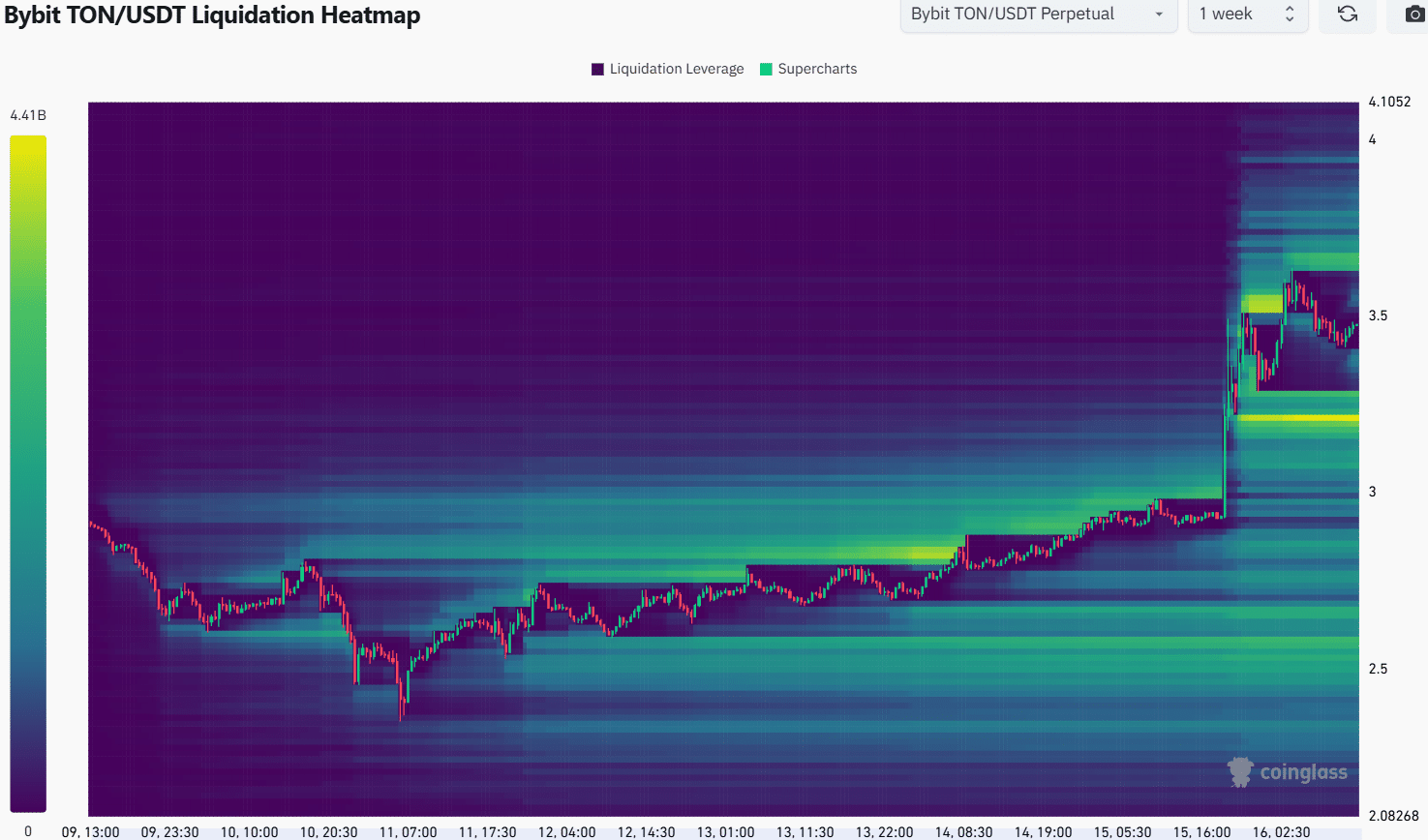

AMBCrypto analyzed liquidation heatmaps to gauge TON’s price movement.

Toncoin Expected to Reach $3.6 Before Reversal

Source: TON/USDT on TradingView

The recent high at $3.95 from February could be a target for TON in the near future. The MACD showed a bullish crossover despite remaining below zero.

Although recent gains were promising, the overall trend in this timeframe remained bearish.

The high trading volume in recent days pushed the OBV above December’s lows, hinting at a potential bullish move.

Fibonacci retracement levels based on the rally from February to June 2024 showed a bounce above 78.6%, indicating short-term positivity but facing resistance ahead.

Breaking the $3.95 mark would be crucial for a shift in market structure towards bullishness.

Even if achieved, the $4.5 zone could pose as a strong resistance. Overall, a quick recovery for TON seemed unlikely.

The 1-month liquidation heatmap pointed out liquidity levels at $3.66 and $3.9, potential zones for a bearish reversal.

Zooming into the 1-week heatmap, $3.2 and $3.67 were critical levels to monitor. TON was likely to climb to $3.6 before dropping to $3.2 to seek liquidity.

Traders could anticipate a reversal at lower timeframes after this move, especially on Mondays.

A break above $3.7 would negate the retracement idea towards $3.2.

Disclaimer: The information provided is the author’s opinion and does not constitute financial advice.

following sentence:

I will be attending the meeting tomorrow.

I plan to attend the meeting scheduled for tomorrow.