Authored by Kyle Anzalone via The Libertarian Institute,

As conflicts in Ukraine and the Middle East persist, Vertical Research Partners predicts that major weapon manufacturers will see unprecedented cash flow in the upcoming years.

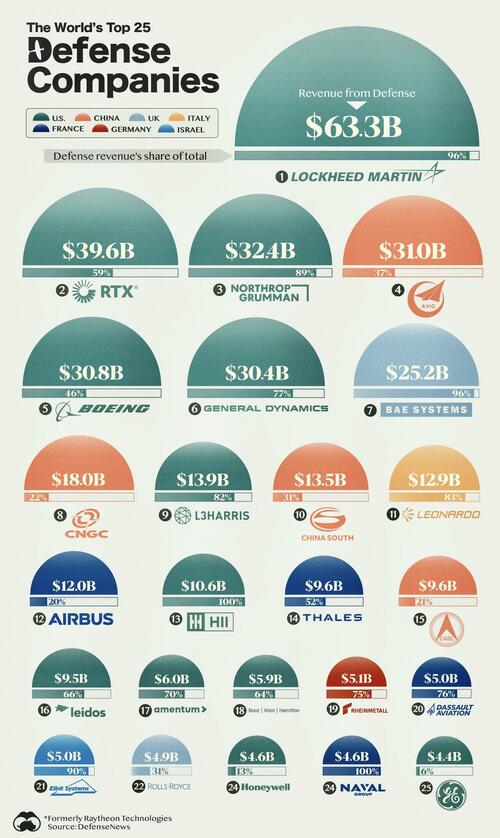

The analysis, commissioned by the Financial Times, reveals that “The top 15 defense contractors are projected to have free cash flow of $52 billion in 2026,” with the “Five leading US defense contractors expected to generate cash flow of $26 billion.”

The projected cash flow for 2026 is set to be twice the figures from 2021. This surge in cash flow is part of a consistent upward trend for weapons manufacturers, who are already benefiting from increased global military spending and conflicts.

These companies have implemented controversial policies domestically:

Prior to the recent influx of new orders, companies had already allocated significant funds towards share buybacks, with some taking on additional leverage to do so. Last year saw the highest levels of buybacks by aerospace and defense companies in the US and Europe in the past five years, according to data from the Bank of America, although these levels remain below those of other sectors.

…The substantial buybacks using taxpayers’ money by US contractors have stirred criticism among some lawmakers who have doubted whether companies are sufficiently investing in new facilities and production. Executives have maintained that they are increasing capital spending while also returning money to investors.

The United States is spearheading the global arms race, with a military budget equivalent to the combined budgets of the next ten countries. Furthermore, under President Joe Biden’s administration, the US has supplied billions in weaponry to Ukraine, Israel, and Taiwan.

This policy has resulted in significant conflicts in Ukraine, Gaza, and Lebanon. Additionally, tensions in the South China Sea are escalating as Israel and Iran edge closer to a potential direct confrontation.

The US government has the ability to reduce tensions in various global hotspots. By leveraging Washington’s military assistance to Tel Aviv and Kiev, the US could encourage Israel and Ukraine to engage in negotiations.

In the South China Sea, potential conflicts between China and Taiwan or the Philippines have been exacerbated by Washington’s commitment to defend Manila and Taipei against Beijing.

The US has also supplied the Philippines and Taiwan with hundreds of millions in armaments, further heightening tensions with China.

Loading…