Wondering where to begin?

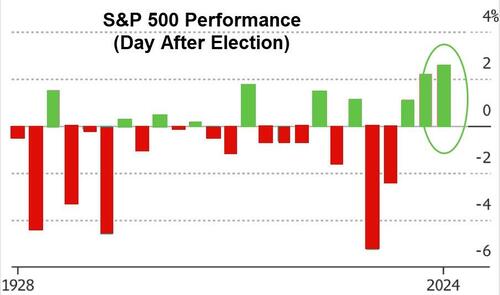

The S&P 500 saw a remarkable 2.7% surge today, marking the largest post-election-day gain in history…

The ‘Trump Trade’ emerged as a major winner in the stock market…

Source: Bloomberg

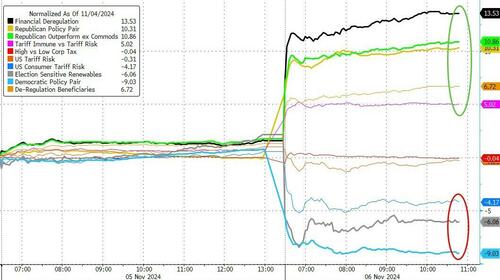

Several Election Themes experienced significant shifts, with ‘Deregulation Gainers’ triumphing while ‘Renewables’ and ‘Tariff Risks’ faced setbacks…

Source: Bloomberg

Overall, major indices surged significantly, led by a substantial short-squeeze in Small Caps (nearly 6% increase). Any initial profit-taking at the market open was swiftly countered by BTFD algorithms…

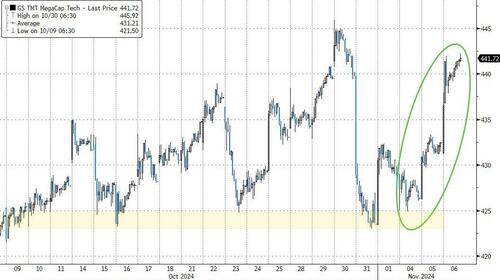

Big Tech giants experienced a significant surge, nearing their all-time highs…

Source: Bloomberg

Tesla shares skyrocketed by 15% to reach their highest level since July 2023

Following a period of uncertainty, DJT also saw significant gains in the wake of recent developments…

Furthermore, most shorted stocks experienced a notable uptick…

Source: Bloomberg

With some of the uncertainties resolved (FOMC meeting tomorrow), the VIX experienced a sharp decline today…

Source: Bloomberg

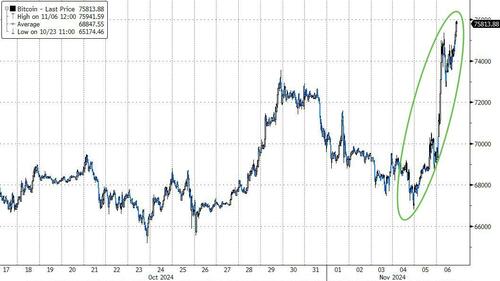

Crypto assets, particularly Bitcoin, surged to a new all-time high of $76,000…

Source: Bloomberg

Could the next target be $100,000 or more?

Source: Bloomberg

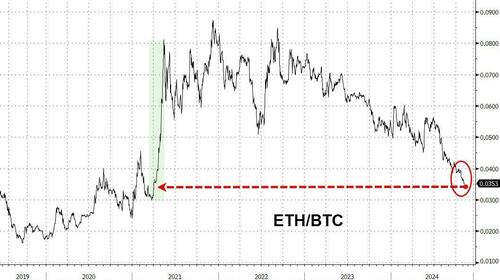

Ethereum also witnessed a significant surge above $2,700, although it remains a relative laggard compared to Bitcoin and has erased some of its DeFi boom gains…

Source: Bloomberg

Treasury yields surged following Trump’s victory, with the long end notably lagging behind (30-year +17bps, 2-year +9bps), driving up prices across the board this week…

Source: Bloomberg

UST Yields have now reached their highest levels since early July…

Source: Bloomberg

Inflation Breakevens surged higher following Trump’s win, with 2-year BEs hitting their highest levels since April…

Source: Bloomberg

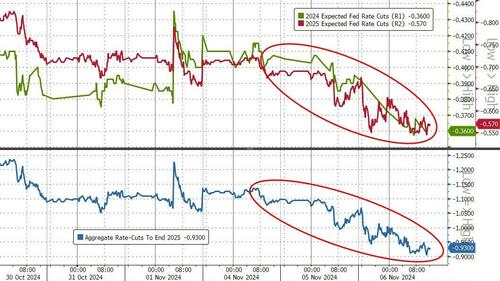

Expectations for rate cuts plummeted, with 2025 now pricing in just 57bps of cuts!!! The cumulative rate cut projection from now until the end of 2025 is less than 100bps (less than 4x25bp cuts)…

Source: Bloomberg

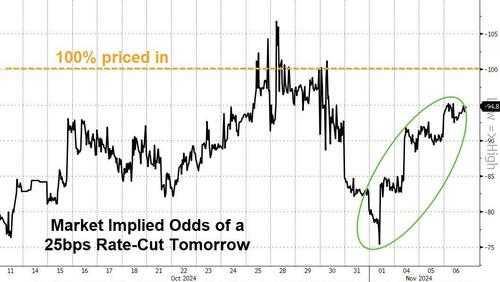

The upcoming 25bps rate cut seems like a certainty (implied 95% odds by the market)… but beyond that, it’s anyone’s guess…

Source: Bloomberg

The dollar surged to 12-month highs, marking its most significant daily gain since Feb 2023…

Source: Bloomberg

The strength of the dollar proved too much for gold to withstand, leading to a significant drop. This marked Gold’s worst performance since June and prompted a test of the 50DMA…

Source: Bloomberg

Despite concerns about increased supply, crude oil prices closed higher today (attributed to economic growth), with WTI surpassing $72 once again…

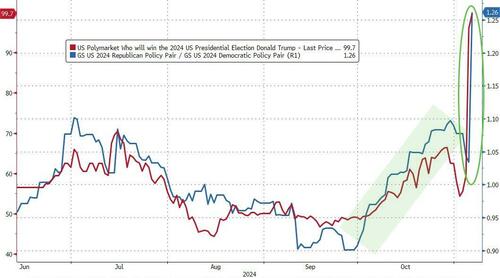

Following Biden’s exit and Harris’ endorsement, Goldman’s Republican policy pair (GSP24REP) initially underperformed by ~-7% until October 1st but has shown signs of recovery post-VP debate. As per Goldman’s trading desk, further upside is expected in their Republican Policy Pair (GSP24REP) leading up to the inauguration day…

Source: Bloomberg

Trade smartly.

Loading…