Written by Gail Tverberg via Our Finite World, it is important to acknowledge that the economies currently at the top may not remain there indefinitely. The graph in Figure 1 illustrates a concerning downward trend in GDP growth rates for Advanced Economies since the 1960s. This trend is exacerbated by the fact that this data includes a period of growing debt, which artificially stimulated economic growth.

The primary factor contributing to this decline appears to be the diminishing growth of oil supply. In the 1940s to 1970s, rapid oil supply growth allowed the US to lead globally in both military and financial aspects. However, as oil consumption growth slowed after the 1970s, so did GDP growth. The correlation between oil consumption growth and GDP growth is evident in Figure 3, even as Advanced Economies transitioned to service-oriented economies.

Furthermore, the shift towards service economies and outsourcing manufacturing to lower-wage countries post-1980s contributed to the weakening link between oil consumption and GDP growth. Prior to 1981, increasing interest rates were used to regulate economic growth, as shown in Figure 4. However, these strategies may not be sufficient to counteract the underlying issues driving the downward trend in GDP growth. The Federal Reserve of St. Louis chart shows the trend in interest rates for 10-year US Treasury Notes and 3-month US Treasury Bills over time, as annotated by Gail Tverberg.

In the period from 1981 to 2020, interest rates generally fell, with short-term rates typically lower than long-term rates. This led to various stimulative effects on the economy:

(a) Lower interest rates made monthly mortgage payments more affordable, increasing demand for new homes.

(b) Lower rates allowed for refinancing of existing mortgages, reducing monthly payments.

(c) Increased demand for new homes stimulated the construction industry.

(d) Lower rates affected purchases of items bought with loans, such as cars, boats, and second homes.

(e) Bonds held by financial institutions increased in value as interest rates fell.

(f) Mark-to-market accounting allowed financial organizations to immediately reflect the benefit of higher bond values.

(g) Falling interest rates led to rising asset prices, such as stocks and real estate.

(h) Lower interest rates encouraged speculation in the stock and housing markets, widening the wealth gap between rich and poor.

Since 2020, interest rates have started to rise in Advanced Economies. It is challenging to envision a positive outcome from a transition to higher interest rates. As depicted in news reports, the Federal Reserve has increased interest rates 11 times between March 2022 and January 2024 to combat inflation by making borrowing more expensive. However, the escalation of long-term interest rates began earlier, coinciding with significant borrowing by the US to sustain economic programs during the Covid restrictions in 2020.

This influx of funds into the economy provided income to individuals and businesses while reducing the production of goods and services due to restrictions on non-essential activities. The resulting imbalance of wealth and limited supply of goods fueled inflation, exacerbated by high US borrowing and global fuel shortages. The ongoing necessity for the US and other Advanced Economies to borrow to sustain their economies and support endeavors like the Ukraine War poses a complex challenge with no clear solution in sight.

The repercussions of elevated asset prices and interest rates extend to sectors like agriculture and real estate, where rising costs deter new entrants and lead to reduced food production and increased rents, affecting wealth distribution and consumer spending. If long-term interest rates persist at higher levels, the benefits of declining rates will diminish, causing economic downturns, asset devaluation, and financial instability for institutions reliant on long-term bonds.

The dependence on debt and leveraging in Advanced Economies renders them susceptible to financial crises if interest rates rise or remain elevated, threatening the stability of economies supported by debt bubbles and unfunded obligations. This predicament mirrors the struggle in the biological world, where competing species vie for limited resources in an ecosystem governed by the Maximum Power Principle, determining winners and losers based on their ability to maximize energy utilization for economic growth.

In essence, the current economic landscape reflects a global ecosystem where strategic decisions and resource allocation determine the sustainability and functionality of the world economy, underscoring the imperative to dissipate energy efficiently to maximize goods and services for societal benefit. In order to maintain a high world GDP, which measures the output of work performed by the global economy, it is important to maximize energy flow within systems. The Maximum Power Principle states that systems that maximize their energy flow are more likely to survive in competition. This principle can be applied to the competition between Advanced Economies and less advanced economies, with the former potentially losing ground in industrial output and bidding for resources like oil.

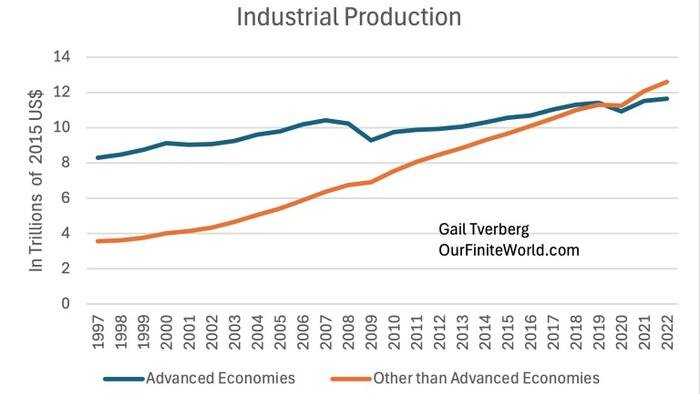

The Advanced Economies have been falling behind in industrial output and bidding for oil supplies, as seen in Figures 5 and 6. Additionally, in conflicts like the one in Ukraine, limited manufacturing capability has hindered the ability of NATO allies to pull ahead of Russia. This highlights the vulnerability of Advanced Economies in competition over scarce resources.

The world economy is constantly evolving and adapting to challenges, such as the Covid-19 pandemic leading to changes in oil consumption and work habits. As the world economy undergoes reorganization, it is important for leaders to make strategic decisions to avoid severe financial problems or conflicts over resources. It is crucial to navigate these challenges wisely to prevent detrimental outcomes in the future. following sentence in a different way:

Original: The cat quickly ran across the street.

Rewritten: The cat darted across the street in a hurry.