John Burns Research & Consulting (JBREC) recently released its midyear housing market report, providing updated grades on market conditions for both the resale and new-home markets. The overall sentiment among agents and homebuilders is turning negative.

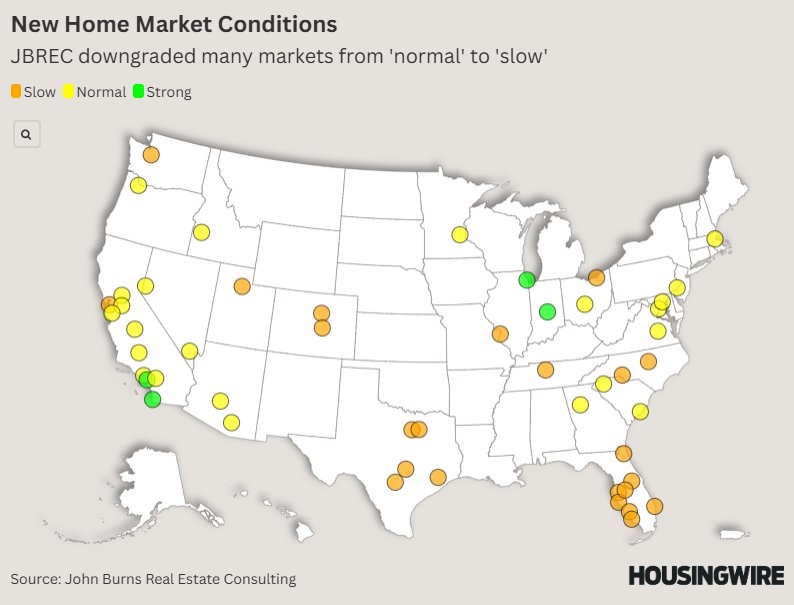

JBREC evaluates cities in the new-home market on a scale from very slow to very strong, and unfortunately, many areas across the country are moving in the wrong direction.

According to Chris Porter, JBREC’s senior vice president of research, the company has downgraded several markets this spring, with more cities shifting from normal to slow grades, which is unusual for the spring selling season.

Notably, Texas and Florida, which have historically seen good conditions for builders, are now all designated as “slow.” Rising property taxes and homeowners insurance expenses are cited as major factors driving homeowners to sell in these areas.

Other once-thriving markets like Colorado, North Carolina, and Nashville are also now graded as “slow.”

On a brighter note, Chicago and Indianapolis are graded as “strong.” In California, most areas are either “strong” or “normal,” with cities like San Diego and Orange County falling into the “strong” category.

JBREC also assessed the resale market by polling real estate agents on their views of market conditions. Unfortunately, the results show a challenging landscape, with markets in Florida and Texas being graded as “very slow” or “slow.”

California and the Southwest are also facing struggles, with only a few cities receiving a “normal” designation, while the majority are labeled as “slow.”