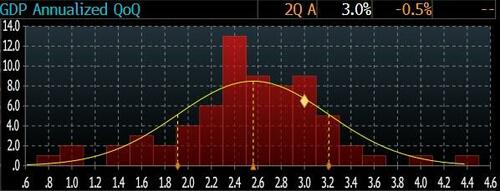

Goodbye to the fears of a recession caused by imports in the first quarter. Just one quarter after pessimistic economists predicted doom for the US economy due to a surge in imports, the Bureau of Economic Analysis released the first estimate for Q2 GDP at a surprising 3.0%, a complete turnaround from the -0.5% decline in Q1…

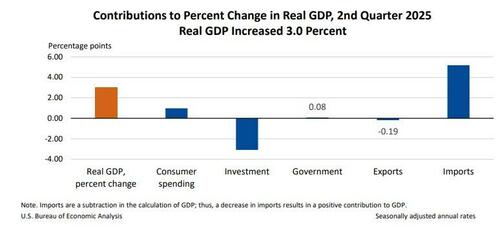

… with an increase in real GDP attributed to a decrease in imports and a rise in consumer spending, partially offset by declines in investment and exports.

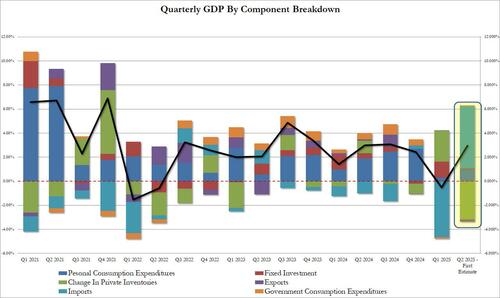

Compared to Q1, the increase in real GDP in Q2 was due to a decrease in imports and an increase in consumer spending, although there was a downturn in investment.

- Personal Consumption contributed 0.98% to GDP, up from 0.31% in Q1.

- Fixed Investment dropped to 0.08%, a significant decrease from 1.31% in Q1.

- Private inventories saw a big drop, with trade or net exports adding the most to GDP at 4.99%.

- Government added 0.08% to GDP.

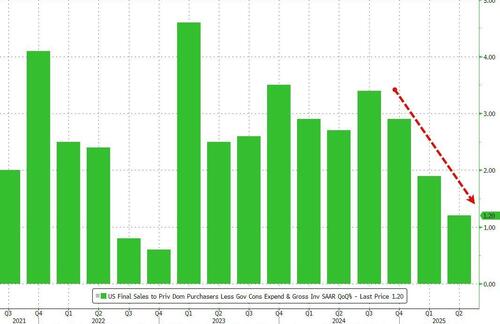

While Personal Consumption and Fixed Investment were slightly weaker than expected, the increase in real final sales to private domestic purchasers was lower in Q2 compared to Q1.

On the inflation side, the GDP price index and core PCE numbers showed a mixed result, which will influence the Fed’s decision later today.

Overall, the Q2 GDP report was stronger than expected but should be viewed as an average between Q1 and Q2, indicating the US economy is growing around 1.3-1.4%. This data suggests no immediate need for rate cuts.

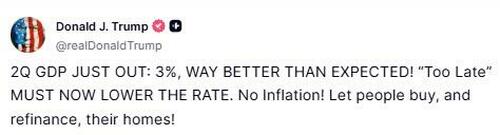

Expect some strong reactions from Trump on social media following the Fed’s decision later today.

Loading recommendations…