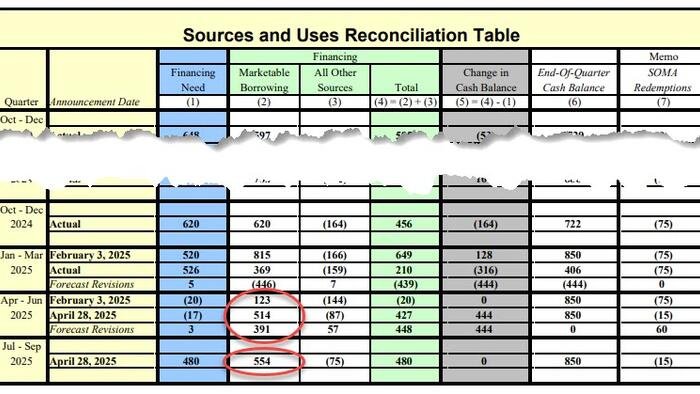

Today’s Treasury borrowing estimate release revealed that the Treasury is expected to announce $507bn in Q2 borrowing, a significant increase from the $123bn estimate in February. This surge in borrowing is primarily due to a lower starting cash balance resulting from the debt ceiling impasse. The Treasury has been forced to draw down on its TGA balance and use extraordinary measures to manage its funding needs.

However, the actual borrowing amount turned out to be slightly higher than expected, with $514bn being announced. This discrepancy can be attributed to the lower beginning-of-quarter cash balance and projected lower net cash flows. Despite this, the Treasury reported that the current quarter borrowing estimate is $53 billion lower than the February announcement, indicating a potential decline in funding needs.

Looking ahead to Q3, the Treasury anticipates borrowing $554 billion in privately-held net marketable debt. The timing of the debt ceiling deal will play a crucial role in determining whether the Treasury can restore its cash balance to the desired level.

Overall, the unexpected drop in debt issuance may have contributed to the decline in yields in the market. It appears that the ongoing debt ceiling standoff is having a significant impact on Treasury funding needs, with DOGE potentially playing a role in reducing the projected borrowing amounts.

Source: US Treasury

Support independent media by visiting the ZH Store and exploring the range of products available, including ZeroHedge hats and coffee.