The White House is set to introduce a new executive order aimed at penalizing major banks that engage in discrimination against conservatives and crypto companies.

A leaked version of the order obtained by the WSJ instructs bank regulators to investigate potential violations of the Equal Credit Opportunity Act, antitrust laws, and consumer financial protection laws. Violators could face monetary penalties, consent decrees, or other disciplinary actions.

Sources familiar with the executive order have indicated that it may be signed within the week, though there is a possibility of delays or changes to the administration’s plans.

The draft order does not specify any particular banks but appears to allude to a situation involving Bank of America allegedly closing accounts of a Christian organization in Uganda based on religious beliefs. Bank of America defended its actions by stating that it does not serve small businesses outside the U.S.

The draft order also criticizes the involvement of certain banks in the investigation of the January 6, 2021, riots at the U.S. Capitol. -WSJ

According to Cointelegraph, conservatives have alleged that banks have refused them services based on their political beliefs.

The banking industry refers to this practice as “derisking,” where financial institutions have the discretion to close accounts if the account holders pose legal, financial, or reputational risks.

In June, the Federal Reserve announced that it would no longer consider reputational risk, following similar actions by the Office of the Comptroller of the Currency and the FDIC.

On the other hand, the Biden administration has been targeting the crypto industry, allegedly pressuring banks to distance themselves from clients involved in digital assets.

The reported draft order urges bank regulators to eliminate policies that have led to the exclusion of certain customers, including crypto firms.

It also tasks the Small Business Administration with reviewing banking practices related to the agency’s loans to small businesses.

The order calls for regulators to refer potential violations to the Department of Justice for further action.

The Journal previously reported in June that the White House was considering a similar order aimed at preventing banks from cutting off services to industries like crypto.

Claims of “Operation Choke Point 2.0”

Crypto industry leaders have alleged that the Biden administration began restricting their access to banking services in late 2022 following the FTX collapse, which revealed a major fraud.

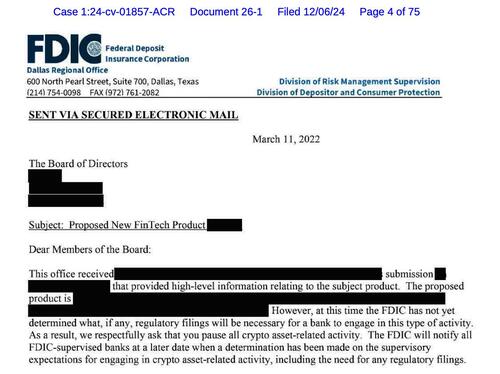

Coinbase’s chief legal officer, Paul Grewal, testified during a Congressional hearing in February that the FDIC under the Biden administration pressured banks with inquiries and examinations regarding crypto and stablecoins until they gave in.

A Freedom of Information Act lawsuit supported by Coinbase revealed that the FDIC instructed certain banks to halt crypto-related activities, supporting the industry’s claims of discriminatory practices.

In February 2023, crypto venture capitalist Nic Carter coined the term “Operation Choke Point 2.0” to describe the perceived trend of debanking in the industry, drawing parallels to the Justice Department’s “Operation Choke Point” from the 2010s.

Loading recommendations…