Authored by Juan Galt via BitcoinMagazine.com,

In a significant development that could impact corporate adoption of Bitcoin, index provider MSCI is on the verge of making a crucial decision regarding the exclusion of companies with substantial Bitcoin reserves from its global benchmarks. The decision, expected on January 15, has the potential to trigger billions in forced selling and establish important precedents for Bitcoin’s status as a treasury asset on Wall Street.

MSCI Inc., a prominent New York-based publicly traded company listed on the NYSE with a market capitalization of $43.76 billion and a stock price of $565.68 as of January 2, plays a pivotal role in the investment landscape. The company manages over 246,000 equity indexes daily, with more than $18.3 trillion in assets under management benchmarked to them. These indexes serve as crucial tools for funds and portfolios, enabling investors to gain exposure to specific market segments.

Unlike the NASDAQ, which functions as both a stock exchange and a composite index tracking listed companies, MSCI focuses solely on index creation. Similarly, the S&P 500, managed by S&P Dow Jones Indices, is an index targeting the 500 largest U.S. companies by market cap. MSCI’s offerings, such as the MSCI World Index covering developed markets, provide comprehensive global and thematic coverage, influencing investment decisions worth trillions.

The genesis of the issue dates back to October 10, 2025, when MSCI proposed excluding companies with 50% or more of their assets in digital assets like Bitcoin or other cryptocurrencies from its Global Investable Market Indexes.

The rationale behind the proposal was that such companies operate more like funds than traditional businesses.

The proposal listed 39 companies, including Bitcoin holders like Strategy and Metaplanet. The announcement sparked an immediate market response, with Bitcoin witnessing a significant intraday drop of about $12,000 on the same day, signaling the beginning of a broader price correction.

Greater attention was drawn to the issue in late November 2025, when JPMorgan analysts outlined the risks in a report, projecting $2.8 billion in outflows from Strategy alone and up to $8.8 billion if other index providers followed suit.

This may have intensified selling pressure on affected stocks and contributed to Bitcoin’s continued decline amidst a wider market downturn.

If implemented, estimates suggest total forced selling could range from $10 billion to $15 billion over a year, according to Bitcoin for Corporations (BFC) analysis.

The consultation period, during which stakeholders could provide feedback, concluded on December 31, 2025. BFC, a coalition dedicated to accelerating corporate adoption of Bitcoin, took swift action. They launched a website outlining the flaws in the proposal, including a technical appendix detailing potential market impacts. BFC drafted a letter opposing the change, garnering over 1,500 signatures in two weeks and submitting it to MSCI on December 30. Eight of the 39 affected companies are part of the BFC.

Following initial outreach, BFC engaged in a discussion with MSCI’s head of research and leadership.

“We had a very constructive conversation,” stated George Mekhail, BFC’s executive director.

“I believe they were still in a mode of listening and learning. Much of this is related to a lack of understanding and education about Bitcoin itself, as well as these Bitcoin treasury companies and the nature of their operations.”

Mekhail observed that the proposal seemed to stem from genuine analytical concerns rather than ill intentions, sparked by Metaplanet’s recent issuance of preferred shares rather than Strategy’s larger holdings. A significant gap identified was MSCI’s failure to differentiate between Bitcoin and other cryptocurrencies, treating all digital assets equally. This alignment has temporarily united Bitcoin proponents and the broader crypto sector in opposition, underscoring an ongoing educational disparity between the Bitcoin industry and Wall Street institutions.

MSCI is scheduled to announce its decision on January 15, 2026. If approved, the exclusions will come into effect on February 1.

Mekhail outlined three potential outcomes:

-

implementation (worst-case scenario, leading to forced sales),

-

a delay for further evaluation (most likely, based on his assessment),

-

or complete withdrawal (best-case scenario).

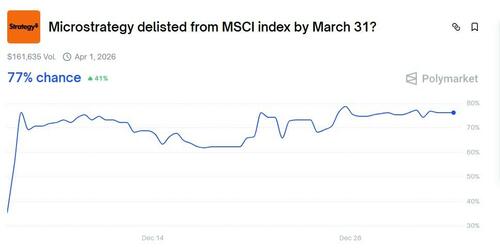

According to Polymarket predictions, there is a 77% chance of Strategy being delisted from MSCI by March 31.

The most significant financial repercussions would likely affect Strategy, which holds the majority of the impacted Bitcoin treasuries. Michael Saylor’s company has been actively involved in discussions with MSCI, issuing its own letter and working behind the scenes. Other entities opposing the proposal include Strive Asset Management and investor Bill Miller.

The backlash from the industry has been vigorous and visible, with no major groups publicly endorsing the proposal. This disparity underscores the organized and motivated Bitcoin community’s stance against dispersed critics, mirroring dynamics seen in recent political shifts like the 2024 U.S. election.

A withdrawal of the proposal would bolster corporate Bitcoin strategies, while its implementation could deter treasuries from adopting Bitcoin. In Mekhail’s words, “The most favorable outcome would be for them to take the concerns to heart and retract the proposal.”

The decision will serve as a litmus test for Wall Street’s acceptance of Bitcoin’s role in corporate balance sheets.

Loading recommendations…