Written by Charles Hugh Smith via OfTwoMinds blog,

The interconnected dominoes across the economy are starting to fall.

We are all familiar with the disappointment that comes when euphoria meets reality, leading to disillusionment. But hold on–it’s about to get worse.

The new solution to all your problems, the one you believed in so strongly, turns out to be deeply flawed–a scam, in fact. That really stings. Not only did they capture your heart, but they also took your money.

And now, let’s talk about the AI Boom/Bubble. The excitement is sky-high, but the disconnect from reality is glaring and can be broken down into measurable components:

1. AI revenues are significantly lower than the massive investments being made (capital expenditure). The excitement hinges on the belief that revenues will catch up, but doubts are starting to emerge about the true financial potential of this Prince Charming.

This analysis has raised some concerns, and the real question is: What if it underestimates revenues by 50%? That would mean we’re only at 3% of the necessary revenues to justify the investments, not 2%. Maybe this is why Prince Charming prefers dimly lit restaurants–he’s had some, ahem, cosmetic work done and is cautious about bright lights.

$2 trillion in new revenue needed to support AI’s growth trend (Bain & Company)

2. AI tools are inherently unreliable and often produce superficial “busy work” that may seem valuable but actually has a negative impact as it’s incomplete, misleading, or incoherent. Distinguishing between quality work and AI-generated fluff actually takes more time because AI excels at creating a superficial facade. In essence, AI creates time-wasting tasks rather than enhancing productivity.

AI-Generated ‘Workslop’ Is Destroying Productivity (Harvard Business Review)

People Overtrust AI-Generated Medical Advice despite Low Accuracy.

Considering that AI-generated work closely resembles authentic research and that AI tools tend to prefer AI-generated content (i.e. low-quality work), we are faced with a harmful mix of unreliable outcomes.

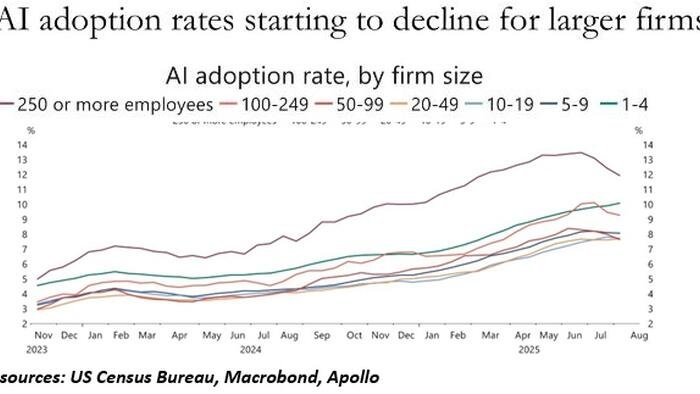

3. The rate at which major companies are adopting AI is plateauing. This graph indicates that the peak of excitement has been reached by those with the most resources to discern its real-world effectiveness.

The prevailing argument is that Prince Charming is not to blame for disappointing his enamored partner; she has unrealistic expectations. In other words, it’s the companies’ fault that AI is not delivering. Is this the great promise of AI–to shift blame from the con-artist to the victim?

4. AI data centers are competing with other users for electricity, water, and resources. Advocates claim that AI data centers consume only a fraction of the grid’s total energy, but fail to acknowledge that prices are determined at the margins and the insatiable demand for electricity and water by those with deep pockets will drive up costs at a rate far exceeding the additional consumption of AI data centers.

This reality is evident in reports of households seeing their utility bills skyrocket from $250 to $800 per month. While other factors play a role–such as the need for grid upgrades and higher insurance costs due to extreme weather events–overlooking the voracious appetite of AI data centers for resources is akin to excusing Prince Charming for stealing your wallet.

How Can We Meet AI’s Insatiable Demand for Compute Power? (Bain & Company)

Feel free to verify the claim that 60% of Santa Clara’s electricity is consumed by AI data centers: I did. It’s accurate.

This is not to say that AI has no value. The concern here is that the excessive capital and resources poured into AI without careful consideration will lead to an economic crash. While it may seem like there’s unlimited capital to invest, in reality, capital is finite, and investments with minimal returns divert resources from more productive opportunities.

The same applies to water and electricity/energy. These resources are not limitless, and when someone with endless resources enters the market, prices will rise, leaving consumers with less disposable income for other goods and services.

Companies allocating scarce capital to AI will need to evaluate the actual costs and returns on investment, prompting them to scale back. This pullback will reverse the exponential growth of AI spending, deflating the AI Bubble that has inflated the stock market into a euphoric bubble surpassing the extreme optimism of the dot-com era that burst 25 years ago.

Will AI trigger an economic crash? Unprecedented misallocation of resources, disappointing revenues, escalating utility costs eroding consumer purchasing power, and the inevitable reversal of investment enthusiasm leading to stock market crashes are not conducive to positive economic development.

Once the stock market frenzy subsides, the wealth effect reverses, causing people to feel (and be) poorer, resulting in reduced borrowing and spending. Those maxed out on credit will be forced to choose between paying bills or keeping the lights on.

One falling domino is manageable, but this scenario is different: the cascading dominoes touch every aspect of the economy. What was once shielded will now be impacted–harshly.

* * *

Explore my latest book Ultra-Processed Life and my updated Books and Films. Support my work for $3/month on patreon.com. Subscribe to my free Substack

Loading recommendations…