Ethereum has recently experienced significant buying interest following a breakthrough of key resistance levels. Its market dominance is on the rise, particularly with Bitcoin bouncing back above $85,000. Several on-chain indicators are displaying positive signals, indicating a growing bullish momentum as Ethereum approaches a descending resistance line. However, a decrease in whale interest could potentially alter the forecast.

Ethereum’s Large Transaction Volume Declines

Recently, Ethereum has witnessed an increase in buying interest, with its price climbing nearly 6% in the past week. Coinglass data shows that approximately $82.8 million worth of trading positions in Ethereum were liquidated, resulting in buyers losing around $43.5 million and sellers around $39.2 million.

Last week, ETH reached its lowest point since March 2023. However, a pause in tariffs helped the price recover slightly. Despite this recovery, investor confidence remains subdued. Glassnode data indicates a significant decrease in the number of wallets holding at least $1 million worth of ETH this year, reaching the lowest level since January 2023. This decline suggests waning interest from affluent investors.

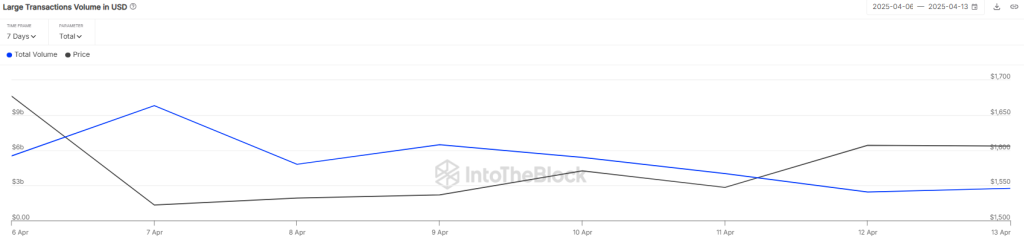

According to IntoTheBlock data, the volume of large Ethereum transactions has significantly decreased. Whale activity has dropped from a peak of $9.81 billion to just $2.75 billion, indicating a clear decline in interest from major investors. Recent transactions further support this trend—on April 14, a whale transferred 20,000 ETH (equivalent to about $32.4 million) to the Kraken exchange, likely in preparation for selling.

Additionally, an on-chain analyst revealed that an early investor from Ethereum’s 2015 ICO has been consistently selling. On April 13, this whale offloaded 632 ETH, valued at approximately $1 million.

Despite mixed market sentiment, Ethereum’s open interest (the total value of outstanding derivatives contracts) has decreased by 1.16%, currently standing at around $17.91 billion. This decline in open interest could impede Ethereum’s recovery and heighten the likelihood of a short-term retracement.

What’s Next for ETH Price?

Ether has rebounded from the crucial $1,500 level, with sellers finding it challenging to drive the price lower. Buyers are now focused on maintaining the price above a descending resistance line to reinforce the current bullish momentum. Currently, ETH is trading around $1,640, up more than 2% in the past 24 hours.

The moving averages are trending upwards, and the RSI is in positive territory—indicating that buyers currently hold the upper hand. If they can sustain the price above the descending resistance line, ETH could make a significant move towards the crucial $2,000 level in the hours ahead.

Conversely, if sellers aim to regain control, they will need to push the price below the EMA20 trend line. In such a scenario, Ether might decline towards $1,384—a pivotal support level. A break below this level could signify a short-term shift in momentum favoring the bears.