53rd Anniversary of the “Nixon Shock”: A Look Back at the End of the Gold Standard

On August 15, 2024, we commemorate the 53rd anniversary of the “Nixon Shock,” a pivotal moment in US economic history. This was the day when President Richard Nixon made the controversial decision to eliminate the gold standard for the US dollar, a move that was intended to stabilize the currency.

However, the repercussions of this decision have been far-reaching, sparking ongoing debates among economists about its long-term effects. Neil Jacobs, from Bitcoin savings platform Swan Bitcoin, recently highlighted the significance of Nixon’s actions and advocated for the use of Bitcoin as an alternative form of currency.

According to Jacobs, the dollar has lost 98.5% of its gold value since Nixon’s decision, emphasizing the need for a more stable monetary system. He succinctly stated, “This is why we ₿itcoin.”

Source: Niel Jacobs

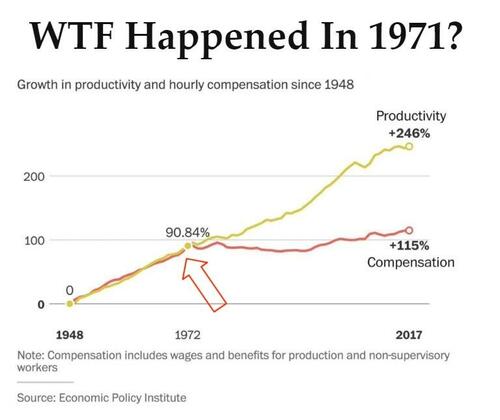

The website “WTF Happened in 1971” sheds light on the aftermath of the Nixon shock, citing a disconnect between wages and productivity following the abandonment of the gold standard. Prior to 1971, productivity gains translated into higher wages for workers. However, post-Nixon era, these gains predominantly benefited shareholders, leading to stagnant wage growth and a decline in living standards.

Wages vs productivity. Source: WTF Happened in 1971?

Despite Nixon’s assurances that severing ties with the gold standard would combat inflation and stabilize the dollar, the reality has been starkly different. The cost of goods, such as a 1971 Ford Mustang Fastback, has exponentially risen, underscoring the challenges faced by consumers in today’s economy.

Prices for U.S. manufactured Ford Mustang automobile models, 1971. Source: CK Pony Parts.

Amidst these challenges, there is a growing debate about the future of currency and the potential role of blockchain technology. While some economists argue that abandoning the gold standard was beneficial, others advocate for alternative forms of money, such as Bitcoin.

As we reflect on the 53rd anniversary of the “Nixon Shock,” it remains to be seen how the evolution of financial systems, including the rise of cryptocurrencies, will shape our economic landscape in the years to come.

Loading…

following sentence:

“The students were excited about the upcoming field trip to the museum.”

The students were eagerly anticipating the upcoming field trip to the museum.