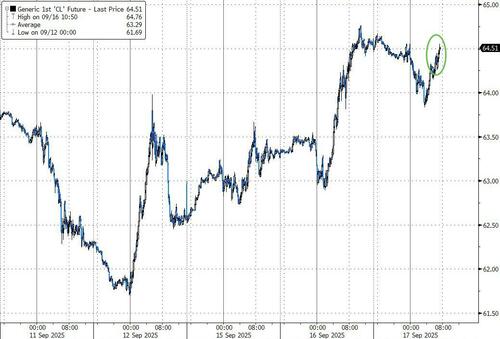

Oil prices dipped lower overnight following a three-day rally as market participants evaluate the impact of Ukrainian attacks on Russian energy infrastructure and await the Federal Reserve’s interest rate decision later today.

WTI crude was hovering around $64.50 per barrel after climbing 3.2% over the past three sessions. Ukraine’s strike on the Saratov refinery is the latest in a series of attacks on Russian energy facilities, leading to a reduction in the OPEC+ member’s production levels, according to Goldman Sachs.

The American Petroleum Institute (API) reported a significant draw in crude inventories overnight, which could drive buying activity if confirmed by the official Energy Information Administration (EIA) data.

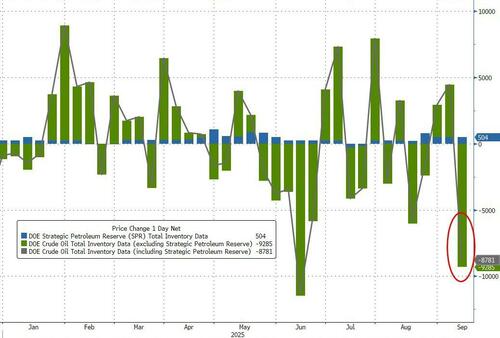

API

DOE

The US saw a massive decrease of over 9 million barrels in crude stocks last week, surpassing expectations and marking the largest draw since June. Gasoline inventories also saw a decline, while distillates stocks increased for the third consecutive week…

Source: Bloomberg

Even with the addition of 504k barrels to the Strategic Petroleum Reserve, total US commercial crude stocks experienced their second largest weekly decline in 15 months…

Source: Bloomberg

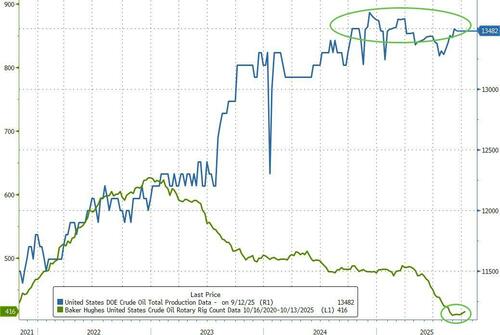

US crude production remains near record highs despite the halt in the decline of the rig count…

Source: Bloomberg

Despite recent gains, oil prices remain within a $5 range that has persisted for the past month and a half, influenced by geopolitical tensions and bearish market fundamentals.

The accelerated increase in OPEC+ supply has led to concerns about a potential oversupply later in the year, while the surge in oil tanker earnings indicates higher output levels.

WTI crude has recovered from its overnight decline and is trading slightly higher today…

The focus in the oil markets remains on the Ukrainian attacks on Russian energy infrastructure, as well as the broader risk of escalation following a recent drone incident in Poland, noted Emily Ashford, head of energy research at Standard Chartered Plc.

“We believe that a 25 basis-point Fed rate cut is already priced in, but a surprise 50 basis-point cut could further boost market sentiment,” Ashford commented in anticipation of the upcoming Fed decision.

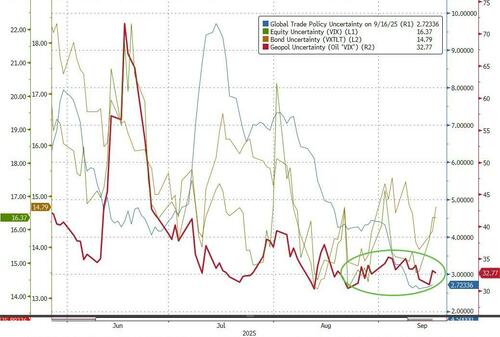

Implied volatility in the oil market has remained subdued, reaching its lowest level in over three weeks on Monday, as prices continue to trade within a narrow range established since early August.

Loading recommendations…