Oil prices remained stable following a three-day decline as investors evaluated the impact of Western sanctions against major Russian oil producers and conflicting reports on US inventory changes.

President Trump is expected to enforce strict new sanctions on Moscow in an effort to pressure Vladimir Putin into negotiations to end the conflict in Ukraine, as stated by US ambassador to NATO, Matthew Whitaker.

Indian state-owned refiners are deliberating whether to continue purchasing discounted Russian oil after the sanctions were implemented, with some processors opting to temporarily halt purchases. Indian Oil Corp. has confirmed its commitment to buying Russian crude as long as it complies with international sanctions.

Analysts at Standard Chartered, including Emily Ashford, noted that the market is assessing the potential long-term impact of the additional sanctions, which will depend on the actual reduction in oil supply.

API data showed significant inventory draws across various categories, stabilizing overnight prices. The official DOE inventory report confirmed these draws, emphasizing a decrease in inventories for crude and related products.

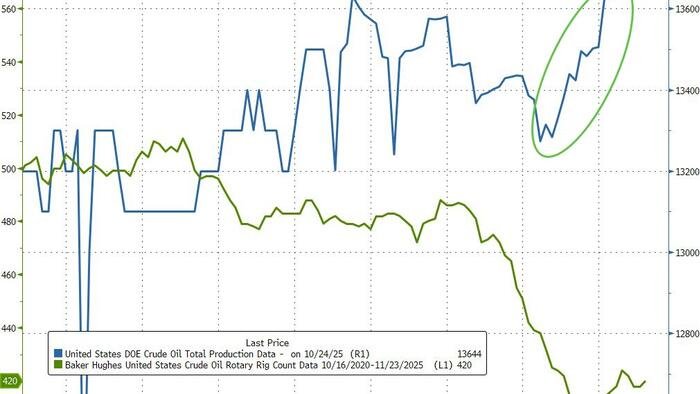

US crude production reached a new record high last week, contributing to a modest rally in WTI prices. Despite this, oil prices are on track for a third consecutive monthly decline due to expectations of a global surplus and increased production by OPEC+.

Key OPEC+ nations are scheduled to meet this weekend to discuss another potential supply increase. Additionally, market participants are closely monitoring developments in the US-China trade negotiations, with a meeting between President Trump and Chinese leader Xi Jinping scheduled for Thursday.

The images and data visualizations in the original article have been retained for reference.