After a bearish June, the Stellar (XLM) price seems to be stabilizing and attempting to reclaim key support levels. As of June 26, 2025, the XLM price is trading around $0.238, down by 28% from mid-May within a descending channel.

Despite the price decline and decreasing XLM market cap, the Total Value Locked (TVL) has been steadily increasing. This inverse relationship indicates growing investor confidence in Stellar. The derivatives data also show positive signs, with XLM’s funding rate turning positive and the weighted sentiment signaling a bullish trend.

Scopuly, a Stellar-based DeFi wallet, recently predicted a breakout for XLM with a target of $0.46. This suggests that significant movements may be on the horizon for XLM price.

On-Chain Metrics Signals A Pump Coming In XLM Price

The rise in TVL for Stellar over time reflects increasing demand and changing market dynamics. The TVL for Stellar has surged from $7.2 million in 2024 to $86.7 million, showcasing an 11x increase in just 4 months.

Although XLM’s price and market cap have been declining in H1 2025, the growth in TVL suggests a potential rise in the XLM price.

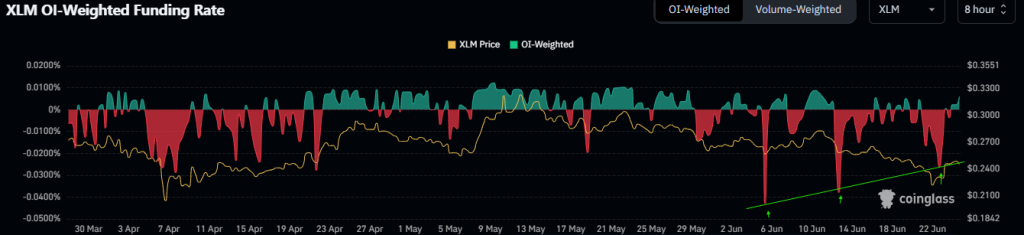

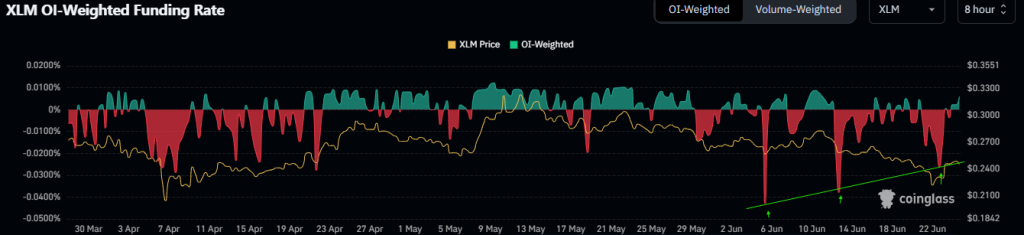

Furthermore, the positive funding rates for XLM indicate a bullish sentiment. CoinGlass’s OI-Weighted Funding Rate data shows that more traders expect XLM’s price to increase, which is a positive sign for potential price growth.

When funding rates shift from negative to positive and remain positive, it usually signals an uptrend in the XLM price.

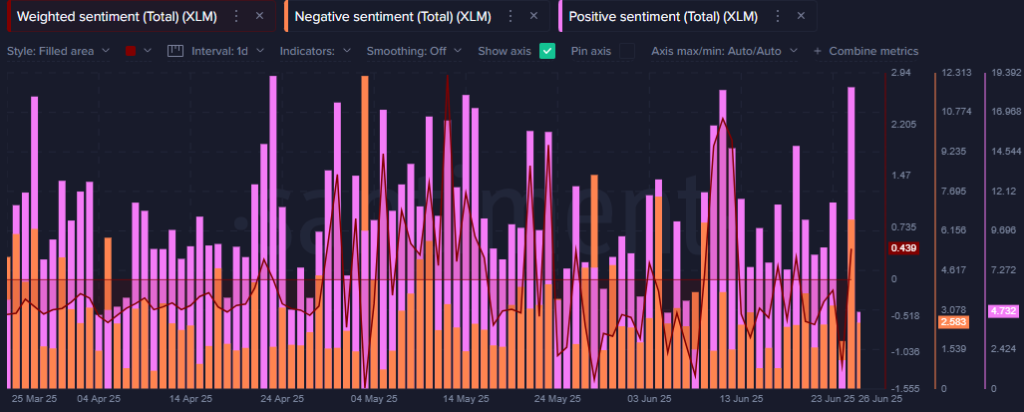

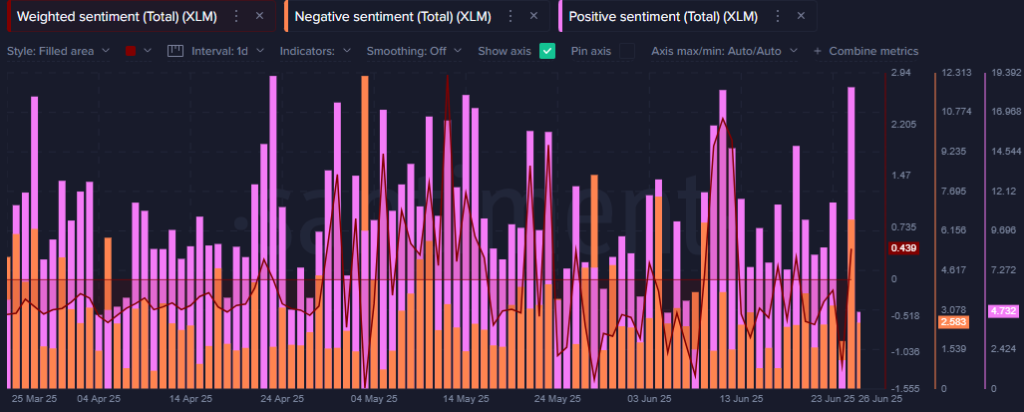

This positive sentiment is further confirmed by Santiments’ weighted sentiment, which has turned bullish around the $0.225 support level. This shift indicates a decrease in negative emotions and an increase in positive sentiment, potentially leading to a price rally.

Moreover, Dune analytics data shows a rise in active addresses for XLM, suggesting growing user engagement with the project.

Can XLM Price Break Bearish Structure?

Although XLM has been in a falling channel, recent on-chain data and its ability to maintain support levels suggest a potential price rally. Currently trading near the upper border of the channel, a breakout could lead XLM to retest the $0.40 mark in the short term.

If the upper border is breached, a bullish trend is likely to follow, but a loss of support could see the price decline to $0.15.