- Ripple Labs grabbed attention with a significant partnership announcement

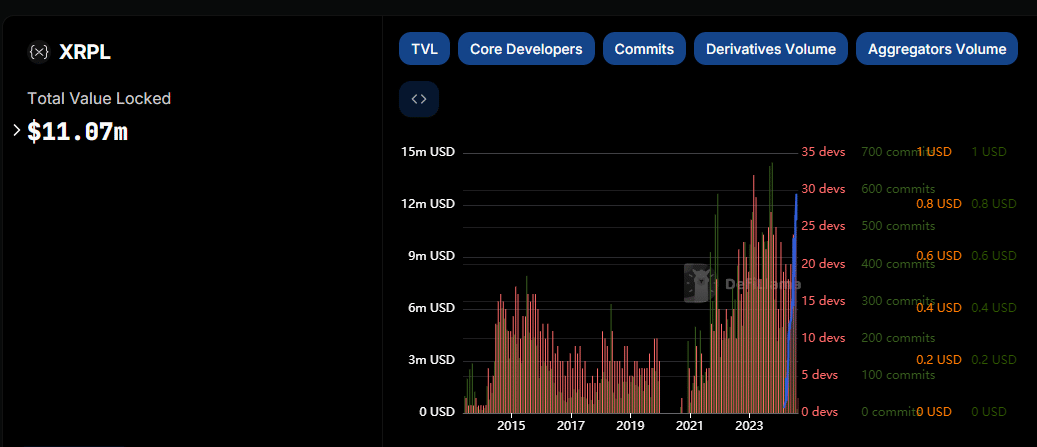

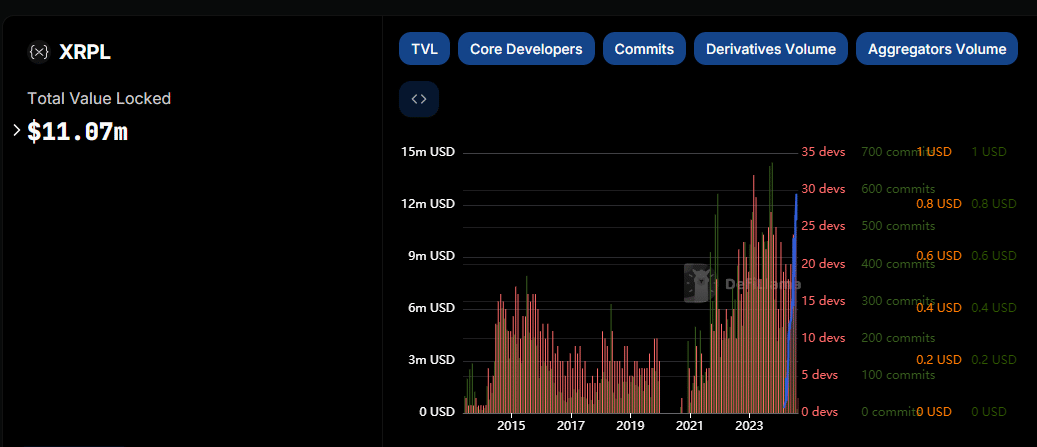

- XRP ranks lowest in total value locked among the top 10 popular cryptocurrencies

It has been a positive period for XRP and Ripple. The altcoin is showing signs of recovery on the price charts after a recent decline, and the blockchain company made headlines with a collaboration with the DIFC Innovation Hub in the UAE. Additionally, Ripple announced a $1 billion XRP fund to support developers working on XRPL projects. XRP has also been approved for use by licensed firms in the DIFC. Moreover, the XRP ledger testnet is scheduled to reset for 15 minutes on August 19 at 3 AM EST to enhance stability. Ripple is also gearing up to launch its RLUSD stablecoin for instant cross-border payments, with XRP serving as the bridge currency for liquidity.

Despite some positive developments, certain on-chain metrics for the blockchain remain negative.

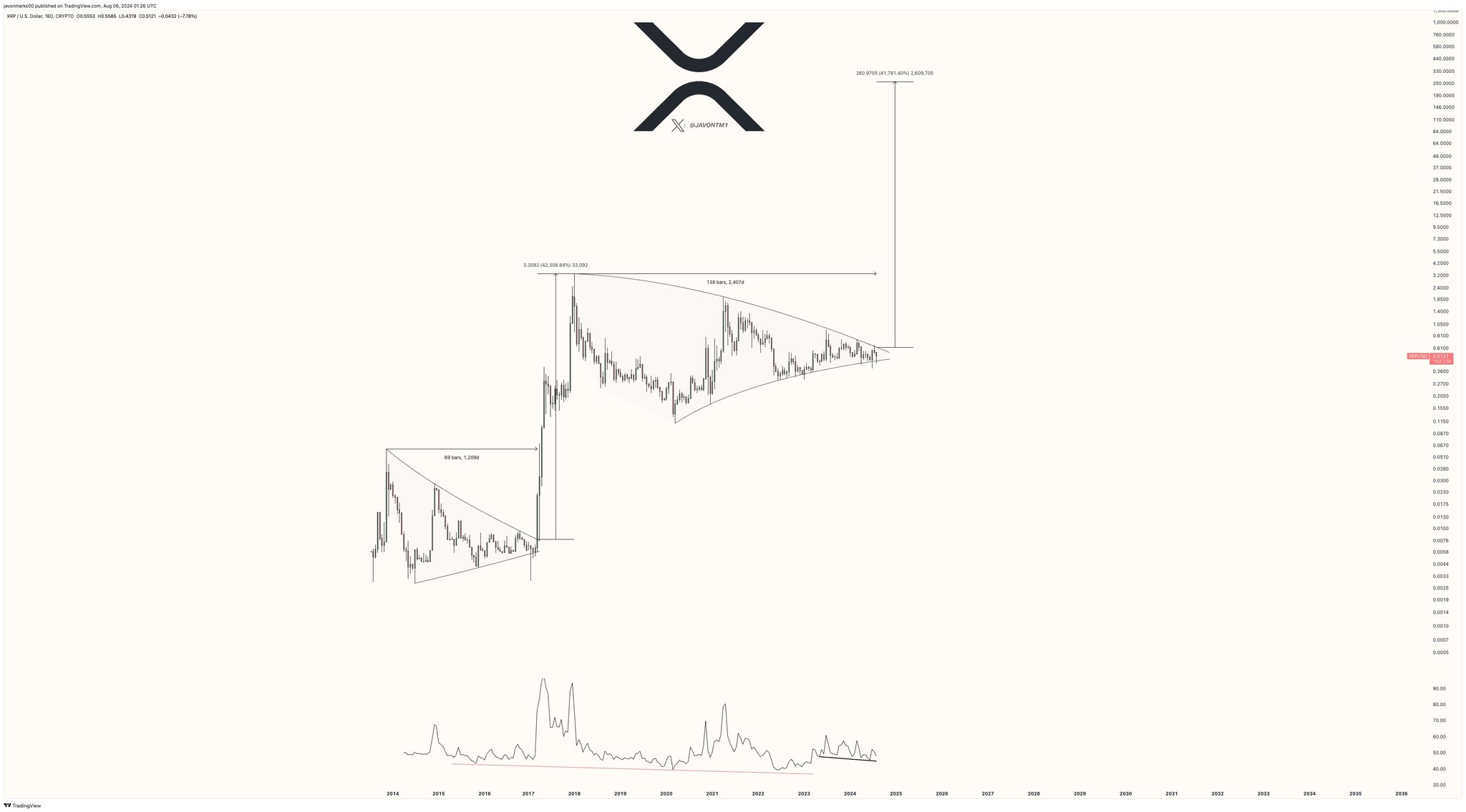

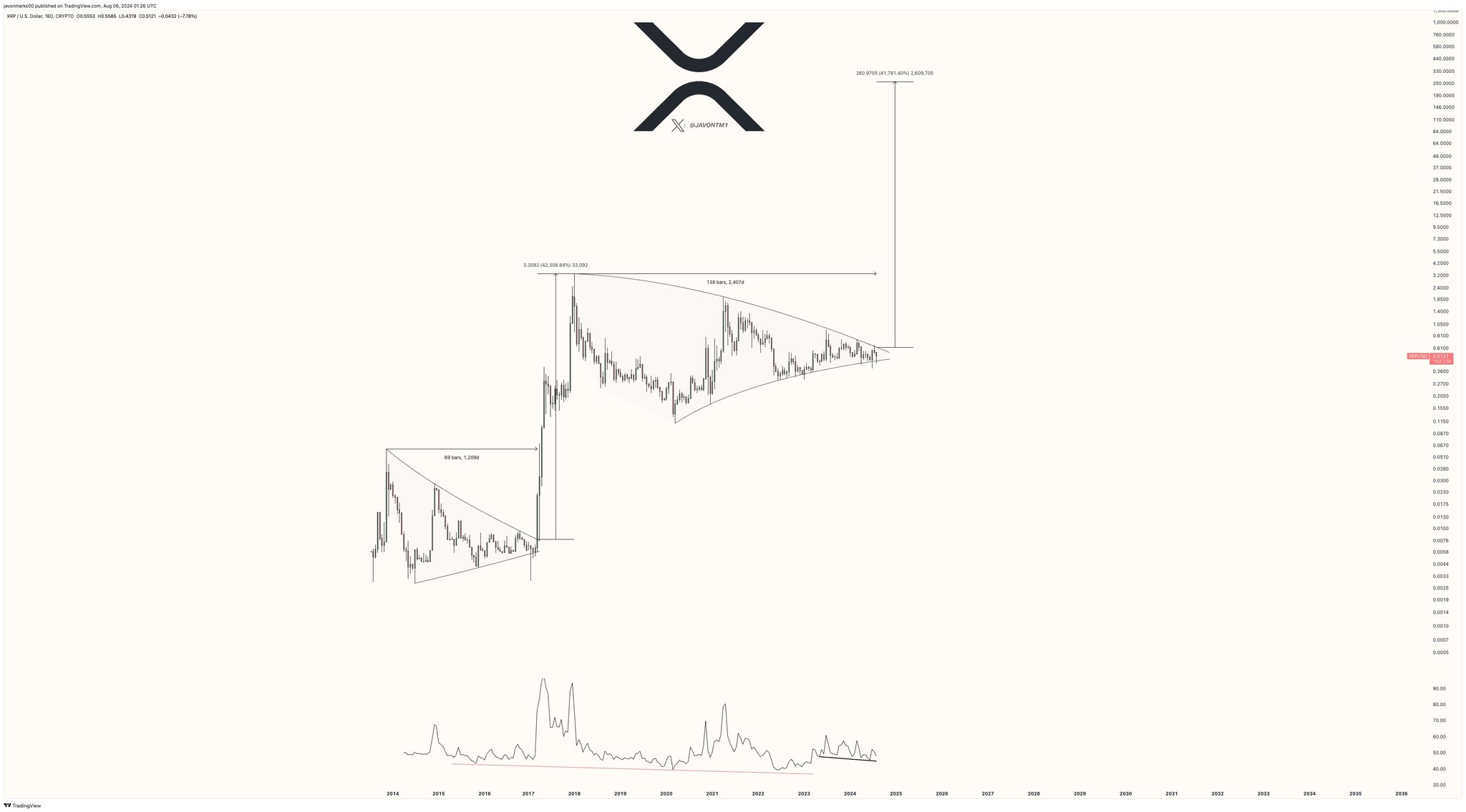

Exploring XRP’s 7-year Stagnation

While many cryptocurrencies are achieving new all-time highs due to widespread adoption, XRP has been stuck in a consolidation phase for seven years.

The extended period of stagnation indicates that XRP may not break out to new highs anytime soon. The descending triangle pattern on the charts suggests a potential further decline rather than a significant rise.

Source: TradingView

Analyzing the Metrics

A deep dive into XRP’s long-term on-chain data, covering price, social activity, network metrics, total supply, and number of holders, indicates that the consolidation phase may continue.

For instance, a graph displaying a sharp decline in wallet activity suggests minimal interest from investors and traders, reflecting XRP’s ongoing stagnation.

Source: Santiment

Comparatively Low Figures

It is noteworthy that Ripple’s total value locked stands at only $11.07M.

In contrast, Ethereum, Tron, Solana, and Binance Smart Chain boast figures of $47B, $7.3B, $4.8B, and $4.1B respectively, significantly overshadowing Ripple’s value.

Source: DeFiLlama

This disparity indicates Ripple’s challenges, despite a $3M increase in TVL since February, which is relatively insignificant given Ripple’s stature.

Metrics such as developer activity and trading volumes suggest that XRP’s 7-year consolidation phase may persist.