Reasons to Trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP has re-entered a pivotal trading range against Bitcoin (BTC), stirring up excitement as technical signals suggest a potential breakout. This move is reinforcing its bullish position, highlighting three major price targets that could confirm a larger macro rally.

XRP Sets Sights On Key Targets Against Bitcoin

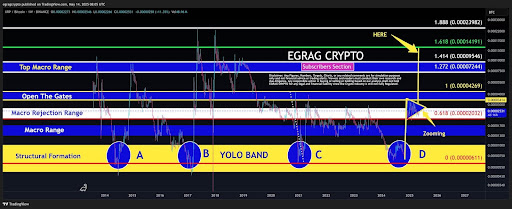

After months of consolidation, the XRP/BTC trading pair is now back inside a critical triangle formation, which market expert Egrag Crypto has identified as a key price range to watch for potential breakout or breakdown moves. The analyst shared a short-term XRP/BTC chart on X (formerly Twitter), explaining how important this price range is for the trading pair to hit new bullish targets and reach even larger goals.

Related Reading

This triangle structure, dating back years, acts as a roadmap for XRP/BTC’s potential breakout, but only if it successfully flips certain levels into support. The first major target highlighted by Egrag Crypto is $0.000003033, which represents the upper boundary of the triangle. A decisive breakout above this level would signal a structural shift, confirming a possible bullish breakout from the narrowing wedge.

The analyst’s second key target is $0.00003430, the local high from XRP/BTC’s last rally. This price level is crucial for momentum validation, as flipping this into support with strong volume would build strong confidence in the next upward move and show confirmation that it can hold above it.

The third and most critical target the XRP/BTC pair is expected to reach is $0.00004300, which aligns with the Fibonacci 1.0 level and XRP/BTC’s previous cycle high. A move beyond this level suggests the beginning of a macro rally, unlocking access to higher Fibonacci extension levels, including:

- 1.272 Fib ($0.00007244)

- 1.414 Fib ($0.00009546)

- 1.618 Fib ($0.00014191)

- 1.888 Fib ($0.00030000)

The Altcoin Must Hold Support Or Risk Macro Breakdown

While Egrag Crypto’s breakout targets paint an optimistic picture, the XRP/BTC LTC analysis comes with a stark warning of a potential crash. The analyst has raised alarm bells, warning not to lose the 0.618 Fibonacci level at $0.00002032.

Related Reading

This support range acts as the last kind of defense for XRP/BTC’s bullish market structure. The analyst goes as far as to say, “Lose an arm, but don’t lose this range,” emphasizing the importance of maintaining this level. He further predicts that if the pair drops below this support level, it could see a decline to as low as $0.00000611.

At the time of the analysis, XRP/BTC was trading at approximately $0.00002516, showing early signs of recovery after dipping below the triangle range. If bulls can defend this level and hold on to their upward momentum, the path toward flipping resistance levels into support becomes potentially clearer.

Egrag Crypto has also outlined potential price projections for the XRP based on the bullish scenario where the XRP/BTC pair reaches several upper Fibonacci levels and Bitcoin rallies to key milestones.

Featured image from Getty Images, chart from Tradingview.com