XRP is currently testing a crucial supply level after experiencing choppy price action in recent days, showing signs of strength as it gears up for a potential breakout. The price has surged by approximately 13% since Friday, bringing it close to the key psychological level of $0.65. A successful reclaim of this level would indicate the beginning of a new bullish cycle and renewed optimism in the market.

Related Reading

Analysts and investors are closely monitoring this price movement, hoping for XRP to surpass $0.65 in the coming days. With the broader crypto market aiming for higher prices, there is a growing belief that XRP will follow suit and continue its upward trajectory.

If the momentum persists and the level is breached, it could pave the way for a more significant rally, with expectations of reaching new highs.

However, a failure to break through could lead to further consolidation or even a retracement. The next few days will be crucial for XRP as it strives to solidify its bullish path.

XRP Testing A Crucial Resistance

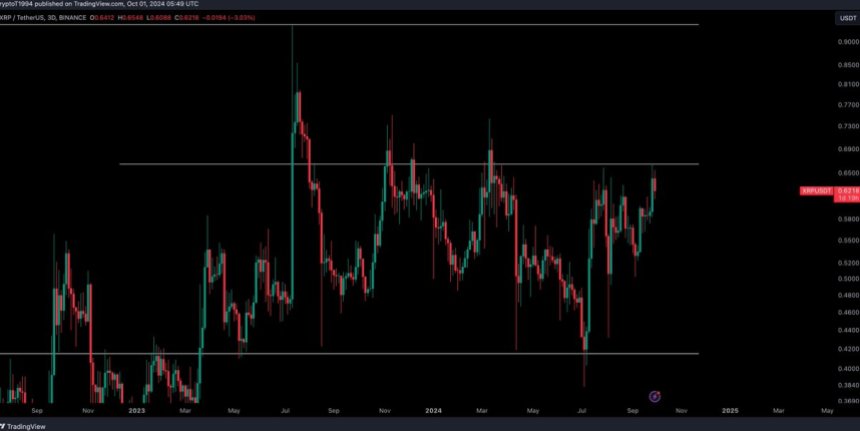

XRP is at a critical juncture as it approaches the key $0.65 mark, a level it has struggled to consistently close above since March, except for a brief breakout. Investors and analysts are closely observing the price action, speculating about potential outcomes as the market remains uncertain. The inability to surpass this resistance level has kept XRP in a consolidation phase for months, leaving traders eager for a clear direction.

Renowned crypto analyst Crypto Tony has provided insights on the situation, sharing a detailed technical analysis on X, emphasizing the significance of this price level. According to Tony, reclaiming $0.65 would indicate a return of bullish control, setting the stage for a potential rally.

According to his analysis, if XRP successfully breaks through this resistance, it could propel the price towards a new target of $0.92—a significant 40% surge from current levels.

Related Reading

The $0.65 level holds significant psychological and technical importance, and a breakout would likely shift market sentiment in favor of a sustained uptrend. However, until this level is decisively reclaimed, uncertainty prevails.

All eyes are on XRP to see if the bulls can drive the price to new highs in the weeks ahead.

Price Action: Key Levels To Watch

XRP is currently trading at $0.63 after experiencing months of volatile price action characterized by sharp increases and steep declines. The $0.65 level has served as a daily resistance since early 2023 and was previously a crucial demand level, offering support from April 2021 to May 2022. However, it has now become a challenging resistance zone for XRP.

To regain control and push higher, XRP needs to surpass $0.65 and confirm it as a support level. A successful breakout would demonstrate strength and potentially set the stage for a larger rally.

However, a failure to breach this level could lead to a correction towards the daily 200 moving average (MA) at $0.54, representing a 12% decline. This scenario could also result in further sideways consolidation for XRP, prolonging the uncertain price action in the coming months.

Related Reading

With the market trending upwards, XRP’s next moves will determine whether it can sustain the bullish momentum or undergo consolidation. For now, the $0.65 mark remains the critical level to monitor.

Featured image from Dall-E, chart from TradingView