By Peter Tchir of Academy Securities

You Ain’t Seen Nothing Yet

It’s interesting how this Canadian band’s song is stuck in my head, reflecting where we currently stand. President Trump and Treasury Secretary Bessent are vocal about the challenges ahead, emphasizing that “we ain’t seen nothing yet.” They are preparing the nation for potential hardships in pursuit of their vision. President Trump aims to revive U.S. manufacturing and bolster the middle-class lifestyle – an ambitious yet commendable goal.

Our investment themes like National Security Equals National Production and Refine Baby Refine align with these goals, emphasizing the importance of U.S. economic transformation.

We believe that the introduction of tariffs is a necessary step, despite concerns about inflation. Companies will need time to adjust to supply chain disruptions, impacting the economy and earnings.

The need for diplomatic negotiations with countries like Russia and Ukraine is crucial, reflecting our 2025 theme – Messy but Manageable. The focus is shifting towards the implementation of policies rather than just their objectives.

As the global landscape evolves, the market risks of deglobalization become more apparent. The disruption of trade balances could have significant implications on corporate revenues and earnings, given the reliance on international markets.

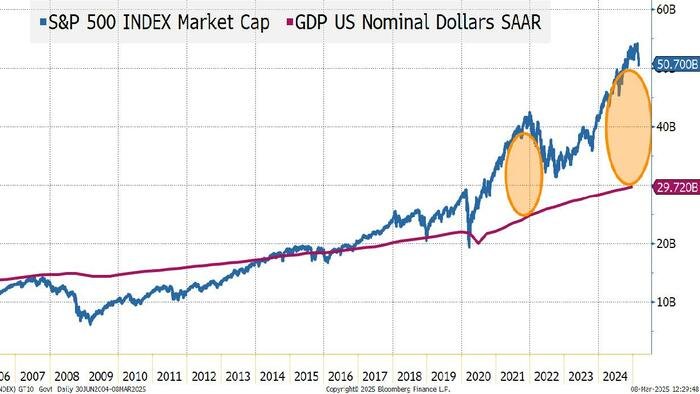

The divergence in P/E ratios between the S&P 500 and STOXX 600 reflects the impact of globalization on market valuations. The current environment signifies a potential shift in global economic dynamics.

Bottom Line: The global economy is undergoing a significant realignment driven by U.S. policies. Investors should anticipate continued market volatility and adjust their portfolios accordingly.

On risk assets: Focus on under-owned and shorted assets while avoiding overbought positions. The evolving economic landscape may lead to fluctuations in credit spreads.

On rates: Expectations of lower yields may be challenged by capital flow dynamics. The impact of deglobalization on P/E ratios and market valuations remains a key consideration.

Overall, the current market environment suggests that we are just scratching the surface of potential changes. Stay vigilant and adapt to the evolving landscape.