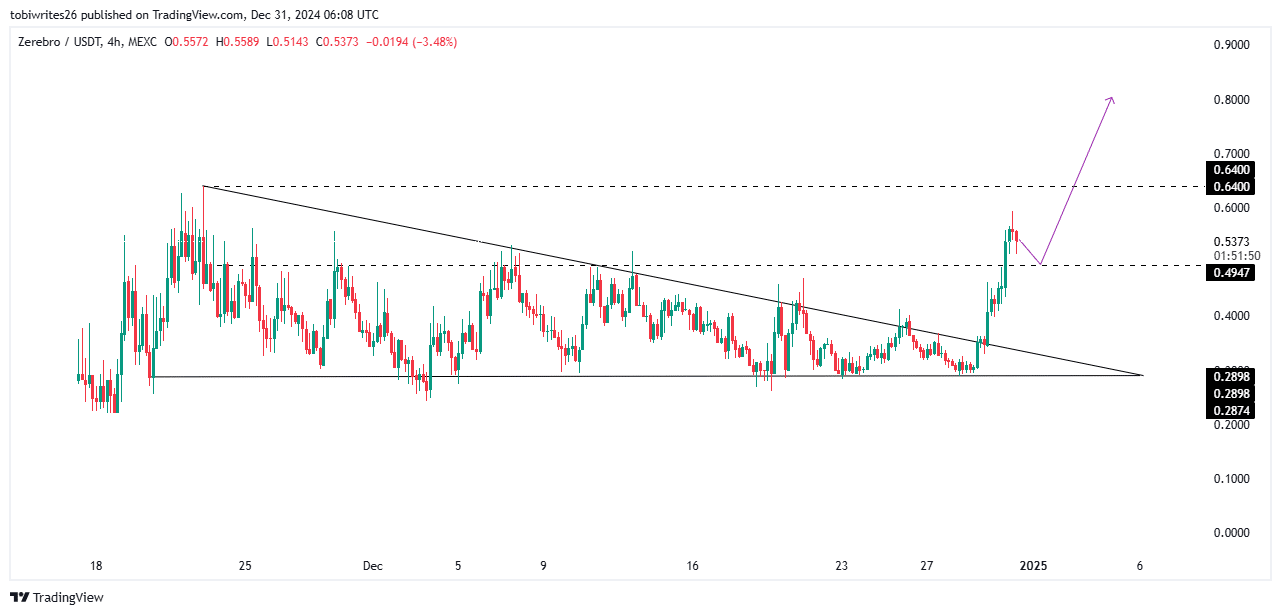

- After breaking out of a consolidation channel, ZEREBRO’s rally has been impressive, with a strong support level indicating the potential for further gains, possibly reaching $0.80 or more.

- The market capitalization of ZEREBRO currently stands at $541.6 million, with a notable 67.92% increase over the past month and an additional 35.90% surge in the last 24 hours.

Despite recent gains, there is speculation about whether ZEREBRO is approaching its peak. However, analysis from AMBCrypto suggests that the asset remains bullish with potential for further upside.

Is ZEREBRO Poised for More Growth?

ZEREBRO has seen a significant rally following its breakout from a prolonged consolidation phase that began in November, driving its price higher.

The breakout typically indicates a potential peak around $0.64, but ZEREBRO is currently consolidating at $0.55. Analysis suggests two possible scenarios: hitting $0.64 or aiming higher towards the $0.80–$1 range.

In the latter case, depicted in the chart below, ZEREBRO would need to retrace to a support level at $0.497 before potentially surging to $1, which could push its market capitalization above $1 billion.

Source: TradingView

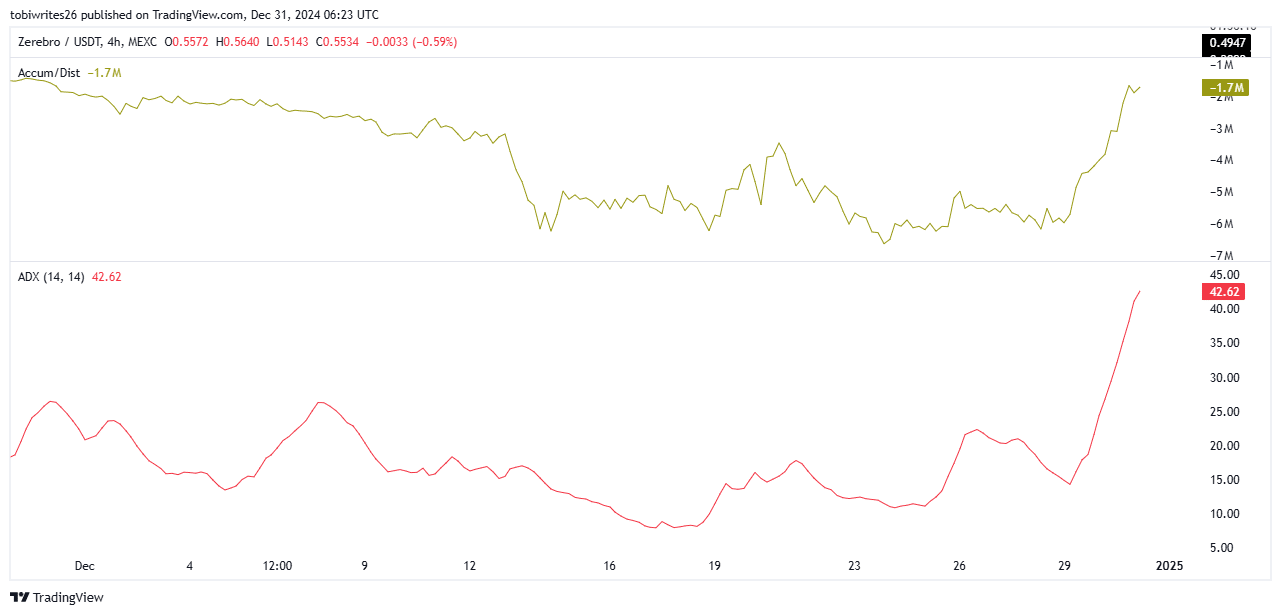

To determine the sustainability of the bullish trend, AMBCrypto has analyzed key technical indicators, confirming the continued presence of bullish momentum.

Increasing Accumulation Could Drive ZEREBRO Higher

Currently, ZEREBRO’s Accumulation/Distribution (A/D) indicator indicates an accumulation phase, supported by an upward trend line.

The A/D indicator combines price and volume data to assess market direction. An upward trend alongside price movement signals high demand for the asset.

Source: TradingView

Additionally, the Average Directional Index (ADX) was evaluated to confirm the directional bias. A high ADX reading of 42.62 for ZEREBRO suggests strong bullish momentum and the potential for further price appreciation.

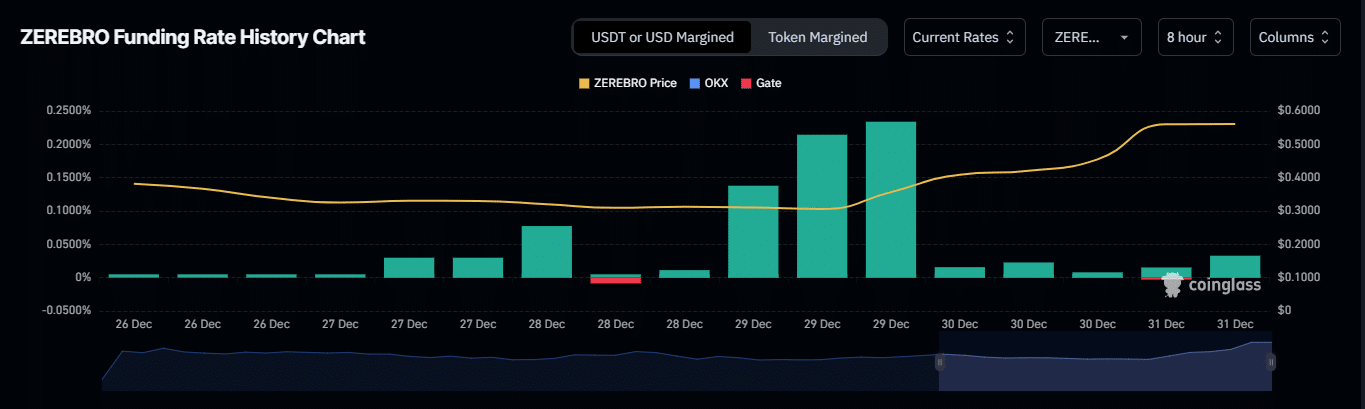

On-chain metrics also support this trend, showing increased activity among derivative traders in the market.

Derivative Traders Bullish on ZEREBRO

Derivatives market data indicates a rise in long contracts for ZEREBRO, with the Funding Rate at 0.0320% reflecting growing bullish sentiment among traders.

A rising funding rate typically signifies a bullish market sentiment, with long traders willing to pay a premium to maintain their positions.

Source: Coinglass

Overall, the positive sentiment among derivative traders and technical indicators point towards further upside potential for ZEREBRO, with the possibility of a new all-time high in the near future.