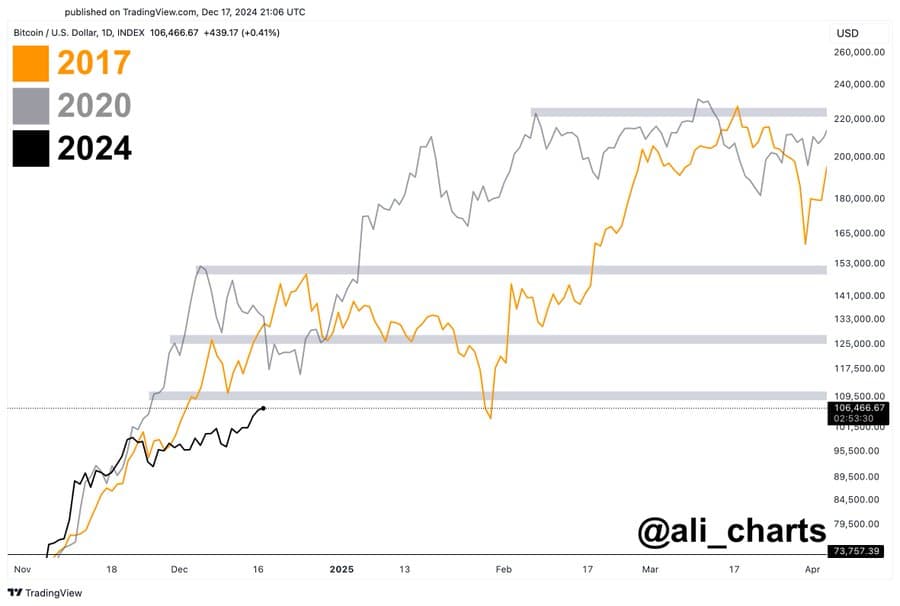

- BTC seems to be following the patterns of the previous bullish cycles of 2017 and 2020, potentially paving the way for a significant price surge.

- Long-term holders are expected to play a crucial role in this phase, adding to the upward price momentum.

Bitcoin (BTC) has held above the psychological level of $100,000 for several days, despite broader market declines following its all-time high of over $108,000.

Over the past week, BTC has struggled to maintain its monthly profitability, with a modest gain of 0.64%. In the last 24 hours, it has seen a 2.05% increase.

According to AMBCrypto, these fluctuations could be part of a larger rally as BTC moves towards establishing new record highs.

BTC to $220,000: A cautious journey ahead

BTC is mirroring the historical patterns of its 2017 and 2020 bullish cycles, indicating a potential market peak at $220,000, as per crypto analyst Ali Chart.

As BTC follows this trajectory, it is expected to face three key resistance levels where selling pressure may emerge before resuming its upward trend.

The ongoing market decline appears to align with this broader structure, moving towards these critical zones.

Source: X

Ali Chart has outlined the potential price milestones:

“If Bitcoin (BTC) behaves like in 2017 and 2020, there will be a brief correction after reaching $110,000, a steep correction after hitting $125,000, a big correction at $150,000, and the end of the bull market at $220,000!”

AMBCrypto analysis suggests that these corrections are likely to be influenced by long-term holders who are currently contributing to the downward movement of BTC.

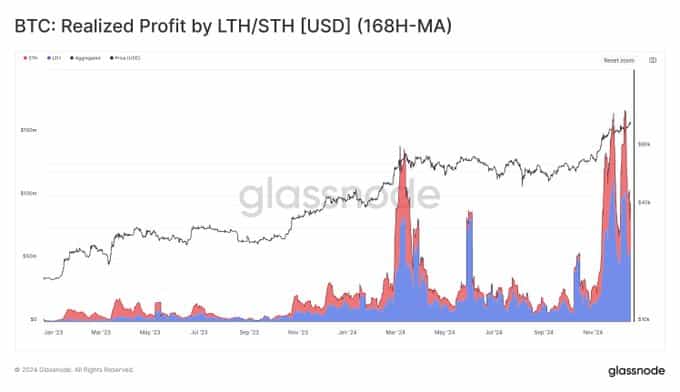

Long-term holders drive distribution in the market

According to Glassnode, market distribution patterns have significantly shifted after BTC reached a new high above $90,000 in mid-November.

During this period, long-term holders initiated a substantial sell-off, taking profits and driving market activity. This sell-off accounted for a significant portion of the trading volume.

Source: X

Further analysis reveals that activity is largely driven by BTC holders who have held their positions for 6 to 12 months, many of whom accumulated during the last market cycle.

If history repeats itself, BTC could soon enter an exhaustion phase where profit-taking slows and buying activity resumes, leading to a renewed rally in BTC prices.

Source: X

AMBCrypto notes that profit-taking and exhaustion patterns may persist as BTC reaches new price milestones, triggering corrective moves before further rallies.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These phases are expected to trigger corrective moves before further rallies. Potential price corrections could occur at key levels, including $110,000, $125,000, and $150,000.

sentence: Could you please rewrite the sentence?