- Recent data indicates a surge in various address metrics, notably active addresses, which is a positive indicator for AVAX.

- The increase in active addresses and USD balances held by large accounts may be influenced by whale activity.

Avalanche’s [AVAX] price has dropped by 14.05% in the last 24 hours, extending its weekly losses to 29.12%. Despite this bearish trend, a shift in market sentiment could be on the horizon.

Whale activity seems to be intensifying, potentially setting AVAX up for a new market phase.

Increasing addresses indicate growing market interest

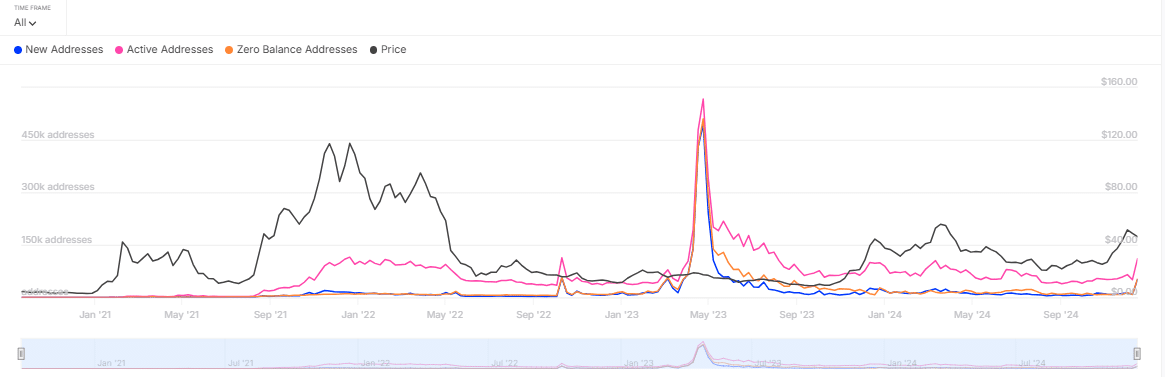

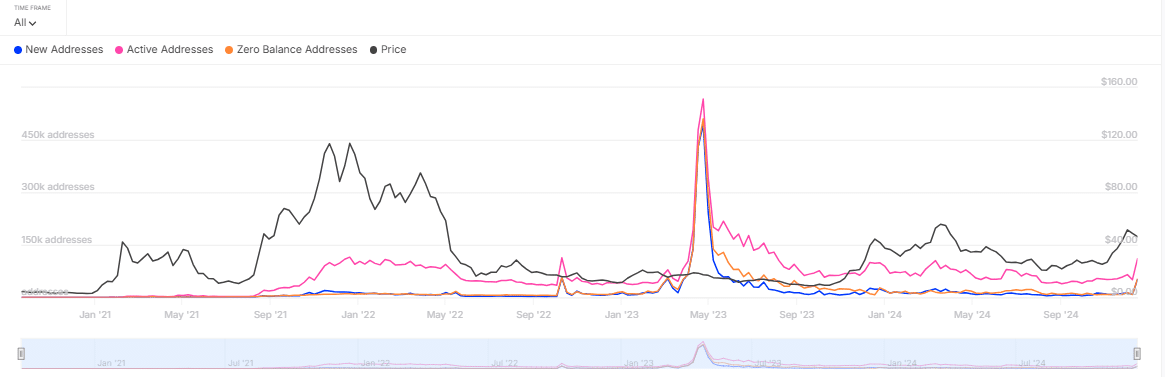

Market interest in AVAX is on the rise, with both Active Addresses (AA) and New Addresses (NA) experiencing simultaneous surges.

In the past week, AA has increased by 44.50%, suggesting more transactions by existing participants. Meanwhile, NA has seen a significant rise of 142.90%, indicating a growing adoption of AVAX, possibly driven by new market entrants.

Source: IntoTheBlock

The combination of increased market participation and a surge in new addresses is a bullish sign, suggesting a potential upward trend in the market.

According to AMBCrypto, whales accumulating millions of dollars worth of AVAX could be driving this growth, contributing to the increased activity.

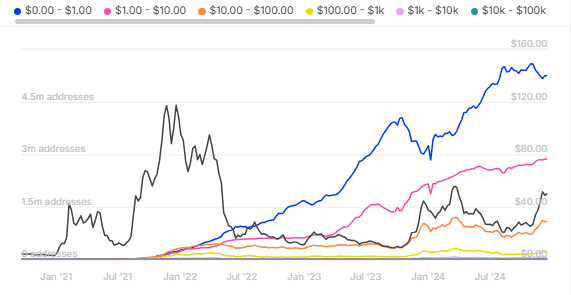

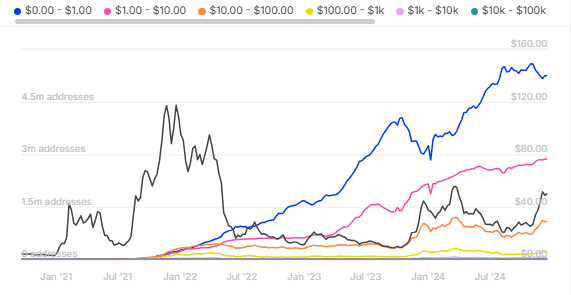

Accumulation of AVAX by large holders

There has been a significant increase in AVAX acquisition across various address categories, particularly among those holding between $1 million and $10 million worth of AVAX in the past week.

Addresses in this range have grown by 24.08% during this period, indicating a gradual entry of whales into the market.

Similar growth patterns were observed in other categories: addresses holding between $100,000 and $1 million in AVAX saw a 20.13% increase, while those with balances between $10,000 and $100,000 recorded a 23.56% spike.

Source: IntoTheBlock

The collective accumulation by large traders indicates a positive outlook. When market sentiment aligns among these key players, it typically signals a healthy buying trend, potentially driving the coin’s price higher from its current levels.

Gradual decline in AVAX supply

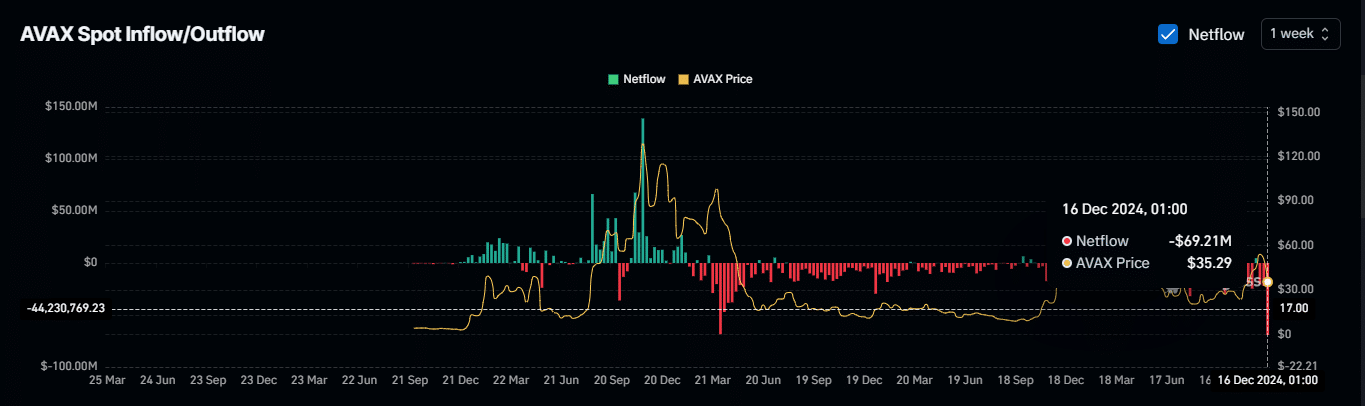

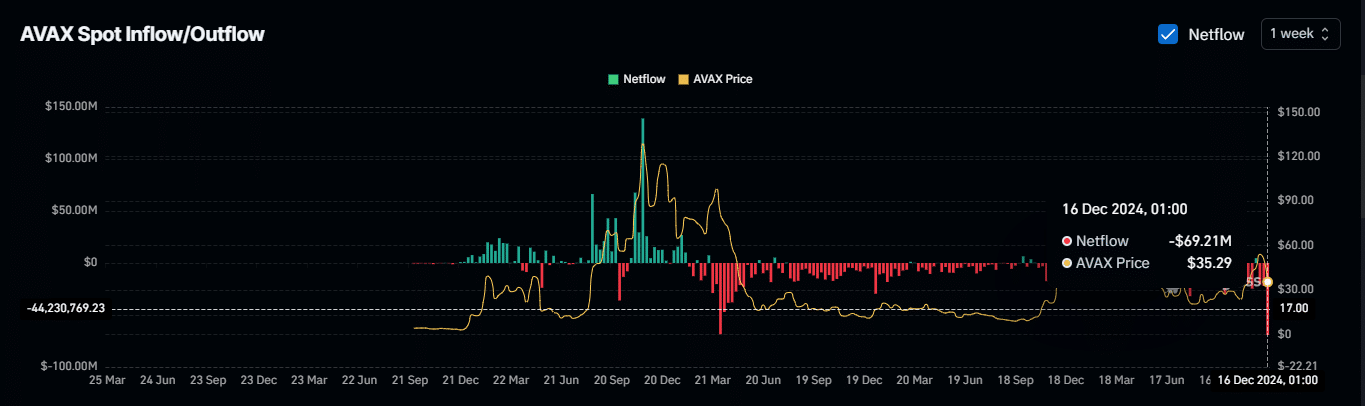

The available supply of the coin in the market is steadily decreasing, with exchange net outflows seeing a significant drop.

In the past 24 hours alone, $9.61 million worth of AVAX was withdrawn from exchanges, bringing the weekly net outflow to $69.21 million—the highest level since April 4, 2022.

Source: Coinglass

Simultaneously, the Open Interest Weighted Funding Rate has returned to a positive stance, indicating that sophisticated traders are positioning themselves for a potential rally.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

If market sentiment shifts decisively towards bullish momentum, AVAX could witness a significant price surge, recovering from its recent decline.

sentence: The cat was too tired to play.

Rewritten sentence: The cat was too exhausted to engage in play.