The staking ecosystem is experiencing rapid growth, attracting increased institutional interest and potential regulatory oversight. Everstake, a leading blockchain validator, secures over 80 cryptocurrencies and supports some of the industry’s top networks. In an exclusive interview, Sergey Vasylchuk, CEO of Everstake, delved into the platform’s origins, the challenges of staking, regulatory developments, and the significance of governance in blockchain ecosystems.

Balancing Growth, Security, and Risk Management

Everstake’s journey began as an experimental project while Vasylchuk was involved in building a cryptocurrency exchange. With a background in software development, payments, and banking, he was focused on enhancing the speed and practicality of blockchain technology for financial institutions. The limitations of early proof-of-work networks, such as slow transaction speeds, prompted him to explore proof-of-stake (PoS) solutions.

“When I first encountered EOS, I was amazed by the transaction speed of under two seconds. This realization that we were approaching the speed required by financial systems led us to delve deeper into optimizing blockchain performance and developing techniques to enhance network efficiency,” Vasylchuk explained. These innovations propelled Everstake to become a validator for numerous blockchains, evolving into a comprehensive infrastructure provider for over 80 blockchain projects today.

Aside from staking, Everstake serves as a crucial infrastructure layer for blockchains, bridges, and decentralized applications. “We are not just validators. We support blockchain ecosystems, ensure security, and aid in the scalability of new networks,” emphasized Vasylchuk.

As staking gains mainstream traction in the crypto space, validators are confronted with increasing operational and security challenges. Managing thousands of keys and servers necessitates stringent risk management processes to avert costly errors. Vasylchuk highlighted that Everstake maintains an uptime of nearly 99.9%, underscoring its commitment to reliability.

“The primary challenge lies in onboarding new testnets rather than running existing blockchains. New networks often come with design flaws and bugs, requiring meticulous technical evaluation to select the right emerging blockchain to support,” he stated.

To bolster institutional confidence, Everstake recently achieved SOC 2 Type 1 certification, a widely recognized security standard. While retail stakers rely on the company’s longstanding reputation, institutional investors demand additional validation. “For many institutions, certification is a prerequisite for engagement. Without it, they are unable to collaborate with us,” explained Vasylchuk.

Ethereum Staking Growth and Market Outlook

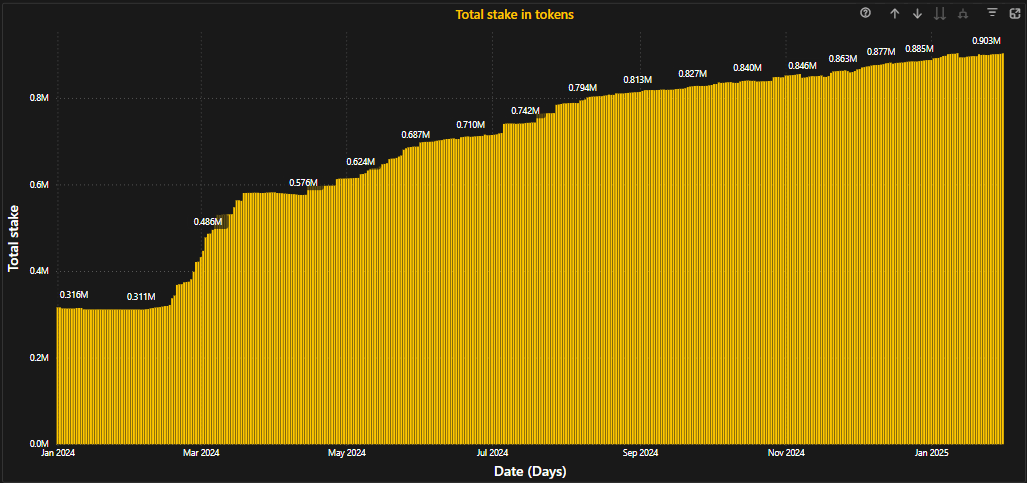

Over the past year, Ethereum has witnessed a steady 4% increase in staked ETH, indicating enduring confidence in PoS networks. Vasylchuk anticipates this growth to persist, drawing parallels with Solana, where over 65% of tokens are staked.

“Although Ethereum’s staking currently stands at 27%, there is considerable room for expansion. Observing networks like Solana, we anticipate a substantial rise in Ethereum’s staking percentage,” he observed.

While Ethereum and Solana exhibit promising staking prospects, Vasylchuk recognizes the potential in newer staking ecosystems but underscores the critical role of robust governance models for long-term success. “Staking transcends mere reward accrual; it encompasses governance. By staking, you delegate your voting power. Unfortunately, many users prioritize APR over selecting responsible validators,” he cautioned.

The Role of Validators in Blockchain Governance

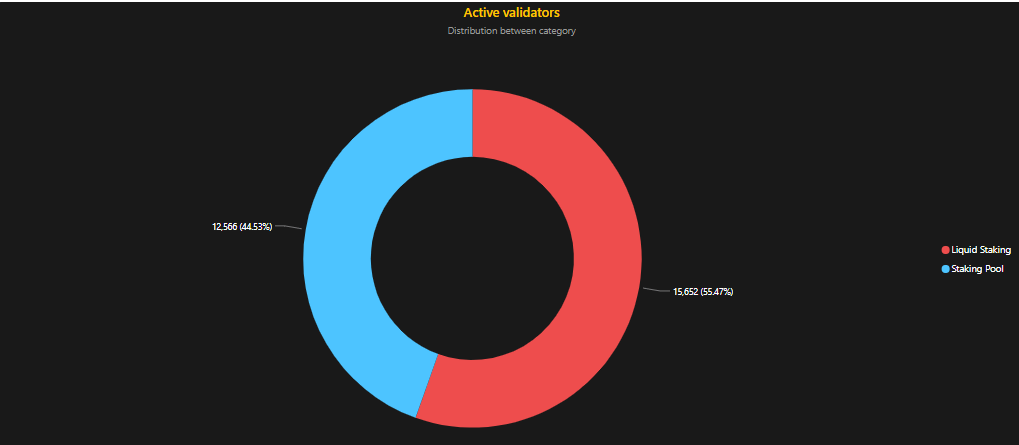

As a prominent validator across multiple networks, Everstake plays a pivotal role in governance decisions. Dismissing concerns of centralization risk posed by large validators, Vasylchuk clarified, “Despite being one of the largest, our stake in Solana merely amounts to 1.4%, and in Sui, it stands at 1.3%. This is far from centralization.”

He pointed to centralized exchanges as a more significant threat to blockchain governance, emphasizing, “Exchanges control staked funds but curtail user participation in governance, weakening decentralization and granting them disproportionate influence over networks.”

Regulatory Uncertainty and Institutional Adoption

With governments increasingly focusing on cryptocurrency regulation, staking is attracting heightened scrutiny. Vasylchuk believes regulators still lack a comprehensive understanding of staking, often misconstruing it as a purely financial tool rather than a governance mechanism.

“When we elucidate staking as a voting process, regulators tend to get confused. While they aim to regulate it, the modus operandi remains unclear,” he remarked. Nonetheless, he remains optimistic that clearer regulations under the new U.S. administration could pave the way for institutions to fully embrace staking.

“Should institutions attain regulatory clarity, we could witness the emergence of staking ETFs or publicly traded staking companies, unlocking substantial new investment avenues,” Vasylchuk predicted.

2025 and Beyond: A Bullish Outlook

Despite regulatory ambiguities, Vasylchuk envisions a robust year for staking in 2025, propelled by a bullish market, institutional entry, and enhanced regulatory clarity. However, he asserts that the true potential of staking will be realized once traditional financial institutions can access it through regulated investment vehicles.

“A staking ETF would revolutionize the landscape. It is not a question of ‘if,’ but ‘when.’ With proper risk management and regulation, staking could burgeon into a multi-trillion-dollar market,” he concluded.

As Everstake continues to broaden its involvement in blockchain governance and security, Vasylchuk remains steadfast in bridging the chasm between crypto and traditional finance. His dual mandate of optimizing blockchain infrastructure while enlightening regulators positions Everstake as a pivotal player in the future of decentralized finance.