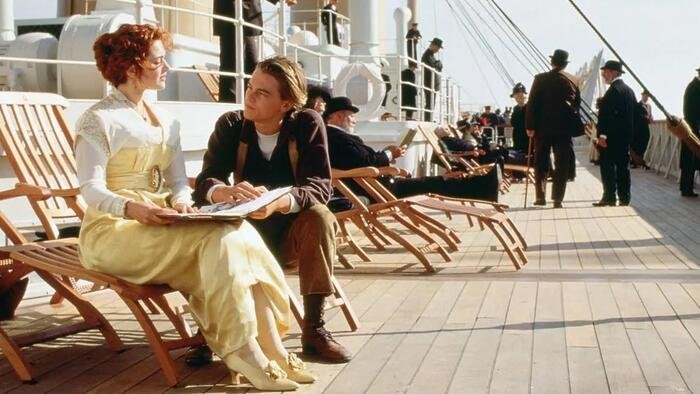

“Revisiting the Deckchairs on the Titanic”

By Michael Every of Rabobank

Yesterday’s Global Daily highlighted the ongoing systemic metacrisis. While many market indicators may not reflect it, one must remember how the deckchairs on the Titanic failed to warn passengers of the impending iceberg. Markets play a crucial role, but relying solely on them to gauge the gravity of current events could leave one in icy waters.

Recent headlines should serve as a sobering reminder: ‘Fear and loathing come for Bitcoin as big investors ponder selling’ (Australian Financial Review) and ‘It’s time to sound the alarm on growing fiscal and financial risk’ (Financial Times) as concerns over rising public debt and its financing loom large. However, there are areas where things appear more stable.

Turning to central banking, the RBA Governor’s comments on potential rate hikes if inflation rises came as a surprise to many. Similarly, Trump’s announcement of nominating the next Fed Chair in early 2026, with Hassett as a frontrunner, signals a shift in the Fed’s purpose and personnel. The full implications of these changes may not be fully grasped by the markets yet.

Geopolitically, talks between Russia and the US on a Ukraine peace plan have been described as ‘constructive’ but remain deadlocked on territorial issues. There are concerns that a costly deal could weaken Europe. Tensions are also escalating as Putin warns of potential conflict with Europe, while Ukrainian drones target Russian ships. The market’s assumption of a geopolitical median may not align with potential outcomes.

Elsewhere, Europe’s aspirations for peace have been challenged by Beijing’s divergent interests, prompting concerns of a rift between Europe and the US. India’s strategic defence partnership with Russia further complicates the global landscape.

In the midst of these developments, uncertainties loom over political transitions in Honduras and Venezuela, while potential conflicts between Israel and Hezbollah raise alarms. Economic disruptions caused by floods in Thailand and trade disputes between major players add further complexity to the global economic landscape.

In conclusion, while some deckchairs may be collapsing, we can still find temporary comfort in most of them. However, it is imperative to consider the broader picture and prepare for what lies ahead. The journey ahead may not be smooth sailing, but being aware of the risks is key.

Tyler Durden

Wed, 12/03/2025 – 13:25