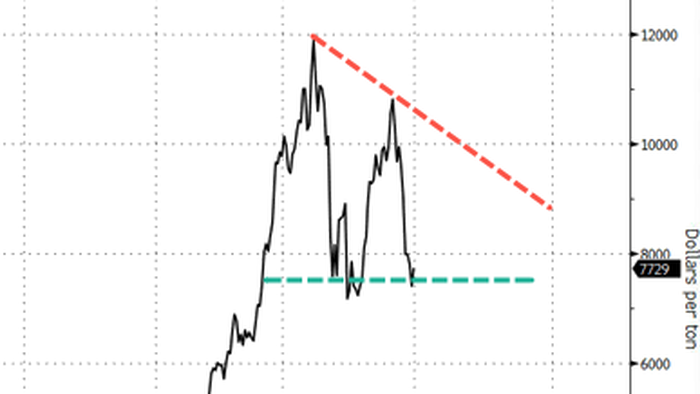

Traders in the commodity market are closely monitoring a triangle pattern developing in New York cocoa prices.

As reported by Bloomberg, Ivory Coast, the top cocoa producer, is expected to see an increase in cocoa production in the upcoming growing season. This news has pushed prices down to the lower support level of the triangle, hovering around the mid-$7,500 per ton mark. This is a significant drop from the near $12,000 level seen in mid-April when concerns over adverse weather conditions impacting global supplies in Ivory Coast and Ghana caused a spike in prices.

Early estimates suggest that Ivory Coast could produce 2 million tons of cocoa in the 2024-25 crop year starting October 1. This forecast is higher than the 1.8 million tons projected by the International Cocoa Organization for the current season ending in September. Historically, Ivory Coast’s cocoa output averaged 2.2 million tons in the five years leading up to 2023-24.

Reports indicate that 800,000 tons of the 2024-25 cocoa harvest have already been sold on the forward market, although forward sales have been halted by the industry regulator Le Conseil Cafe-Cacao. -Bloomberg

Despite the recent price decline driven by favorable weather conditions and improved crop projections in West Africa, renowned commodity trader Pierre Andurand remains optimistic about cocoa futures.

Andurand Capital Management continues to hold a strong belief in its “long cocoa thesis,” anticipating that tight supplies and robust demand will sustain price growth, as stated in a recent investor letter highlighted by Bloomberg.

Loading…