- ADA experienced a 4% decline in the past 24 hours, despite a small recovery

- Active addresses trend remained stable amidst the decline

Cardano (ADA) has been on a downward trend recently, disrupting any potential recovery plans it had in place. This decline is expected to have significant consequences, especially as the number of active addresses has not shown significant movement during this period.

Cardano’s Price Movement

A closer look at Cardano’s (ADA) price trend on a daily chart revealed a notable drop recently. On August 2nd, ADA saw a sharp decrease of 7.38%, followed by a brief recovery.

This price drop affected ADA’s short-moving average, establishing itself as a strong resistance level at around $0.4.

The resistance at this moving average suggests that ADA will need significant buying pressure to break through this level and potentially start a trend reversal.

Source: TradingView

Despite a slight recovery in the last few hours, it’s worth noting that the Relative Strength Index (RSI) reading was close to 40, indicating bearish sentiment in ADA’s market.

Steady Active Addresses for Cardano

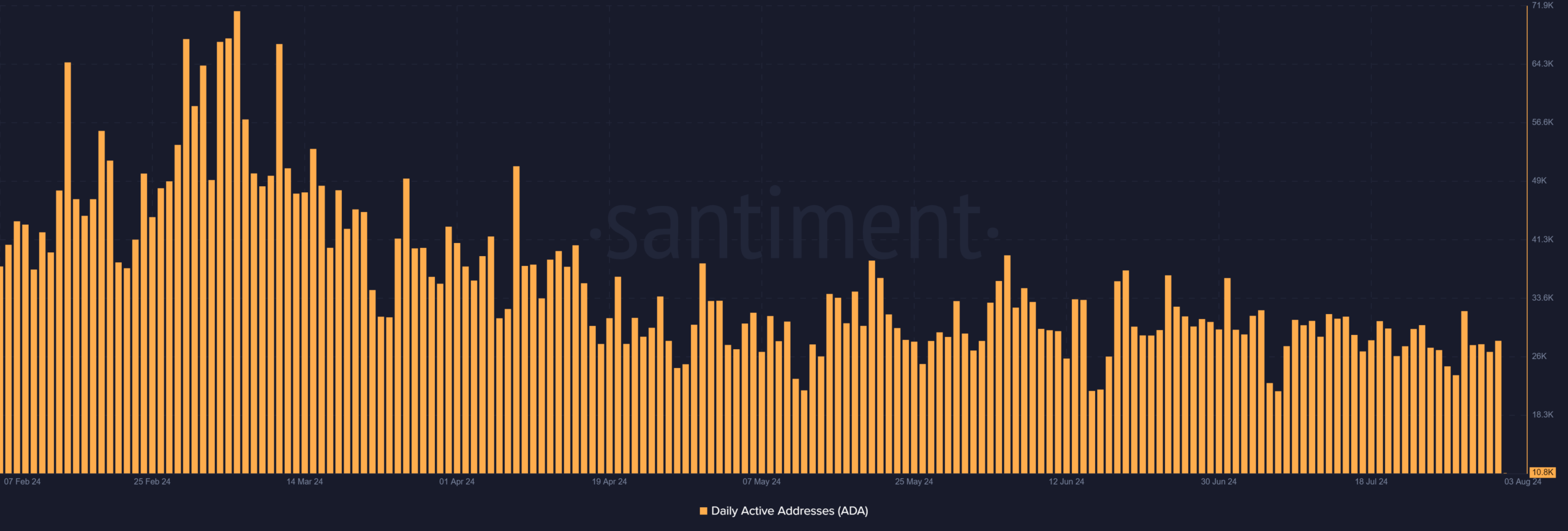

An analysis of Cardano’s daily active addresses on Santiment showed a consistent trend in user activity. The numbers have been fluctuating between 26,000 and 27,000.

This level of activity indicates a stable but not exceptional level of engagement among network users.

Source: Santiment

On August 2nd, there was a brief increase in activity, with active addresses rising to around 28,125. This minor spike could indicate a temporary surge in transactions or interactions on the network.

However, at the time of writing, there was a significant drop in active addresses to around 10,000.

Increase in Trading Volume

An interesting pattern emerged when analyzing Cardano’s volume.

Over the past few days, ADA’s trading volume has seen a significant rise. While the volume was around $280 million at the start of the month, it surged to over $400 million as the price declined on August 2nd.

This volume trend, along with a stable number of active addresses, suggests that ADA holders are in a holding pattern, neither panic selling nor aggressively buying at lower prices.

– Is your portfolio green? Check out the Cardano Profit Calculator

In summary, investors may be waiting for clearer signs of either recovery or further decline from the altcoin.