Authored by Trey Walsh, Executive Director of The Progressive Bitcoiner,

Having numerous reservations about the United States pursuing a Strategic Bitcoin reserve, I’ve observed major plans including legislation proposed by Senator Lummis and a draft Executive order from the Bitcoin Policy Institute. My reservations include issues related to timing, political ramifications, mechanisms/cost of obtaining Bitcoin, potential impacts on Bitcoin’s development, and effects on U.S. citizens’ use of Bitcoin as money.

Nic Carter wrote an excellent piece questioning the Strategic Bitcoin Reserve (SBR) and advocating against its pursuit. While there is support for the SBR from certain quarters, there has been little positive attention from progressives. I want to explore how a U.S. Strategic Bitcoin Reserve could benefit Americans, particularly in terms of social safety net spending.

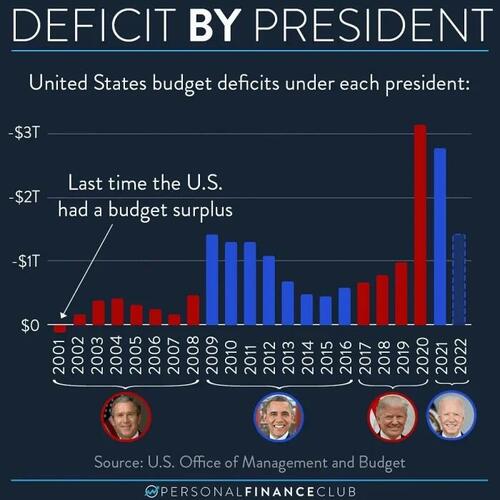

Looking at the current state of the U.S. economy, one key issue is how to pay for essential services amidst a debt and spending crisis. This sets the stage for considering strategic uses of a Strategic Bitcoin Reserve in social safety net spending, budget deficit management, and governance.

1. Hedge Against Inflation to Protect Public Programs

- Stability for Social Spending: A Bitcoin reserve could serve as a hedge against inflation and currency devaluation, ensuring stable funding for programs like Medicare, Medicaid, and Social Security.

- Future-Proofing Benefits: Bitcoin’s limited supply could protect against long-term fiat currency depreciation, preserving the value of entitlement programs.

2. Revenue Generation for Safety Nets

- Asset Appreciation: Leveraging a government-held Bitcoin reserve during financial need could generate additional revenue for social programs.

- Controlled Liquidation: Strict protocols for selling portions of the reserve during economic crises could support public welfare without undermining long-term value.

3. Alternative to Taxpayer Burden

- Reducing Taxpayer Reliance: A Bitcoin reserve could offer an alternative funding source for social safety nets, reducing the impact on middle- and lower-income households.

- Reducing deficit spending: Incorporating Bitcoin in reserves could lessen the need for deficit spending and money printing, addressing inflation concerns.

4. Emergency Financial Assistance

- Crisis Mitigation Fund: Bitcoin could act as an emergency reserve for funding unemployment benefits or cash transfers during financial crises.

- Global Remittance Efficiency: Bitcoin’s borderless nature could streamline international aid delivery, supporting vulnerable populations globally.

- Bridging the Wealth Gap: Pairing a Strategic Bitcoin Reserve with public ownership initiatives could empower individuals and communities economically.

- Direct Redistribution Mechanisms: Gains from Bitcoin reserves could fund Universal Basic Income programs or targeted assistance for low-income households.

While not directly linked to the SBR, Bitcoin acceptance could pave the way for innovative approaches to Bitcoin mining and community development.

6. Incentivizing Green Bitcoin Mining for Job Creation

- Jobs for At-Risk Communities: Green Bitcoin mining operations could create jobs in underserved regions, promoting economic revitalization and environmental sustainability.

- Revenue for Local Governments: Tax revenues from sustainable Bitcoin mining could strengthen local safety nets and community initiatives.

7. Economic Resilience to Fund Long-Term Programs

- Buffer Against Economic Crises: Bitcoin’s independence from fiat systems could provide a financial buffer during economic downturns, ensuring continuity of critical safety net programs.

- Strengthening the Social Contract: A Bitcoin reserve could reinforce the government’s commitment to protecting vulnerable populations, aligning with progressive values.

8. Enhancing Public Trust in Social Programs

- Transparent Funding Mechanism: Using a Bitcoin reserve for social programs could enhance transparency and public trust in resource allocation.

- Public Ownership: Allocating Bitcoin gains to citizens through rebates tied to social programs could establish a direct link between national reserves and public benefit.

Exploring the potential social benefits of Bitcoin in a changing world, beyond financial gains, highlights the transformative role it could play in improving lives at a structural level. This discussion reflects the ongoing exploration of Bitcoin’s impact on individuals and communities worldwide.

Loading…