- Kaspa’s price dropped significantly in the last 30 days

- Several indicators suggested a trend reversal towards $0.12

The past month has been tough for Kaspa [KAS] as its value took a major hit, potentially causing concern among investors.

Despite the downward trend, some on-chain metrics and technical signals hinted at a possible bullish turnaround. This prompted AMBCrypto to delve deeper into the potential for a bullish resurgence.

Kaspa’s Recent Challenges

Investors in KAS faced difficulties as the token’s price plummeted by over 25% in the last month, with an additional 8% drop in the past week. As of now, Kaspa is trading at $0.11 with a market cap exceeding $2.7 billion.

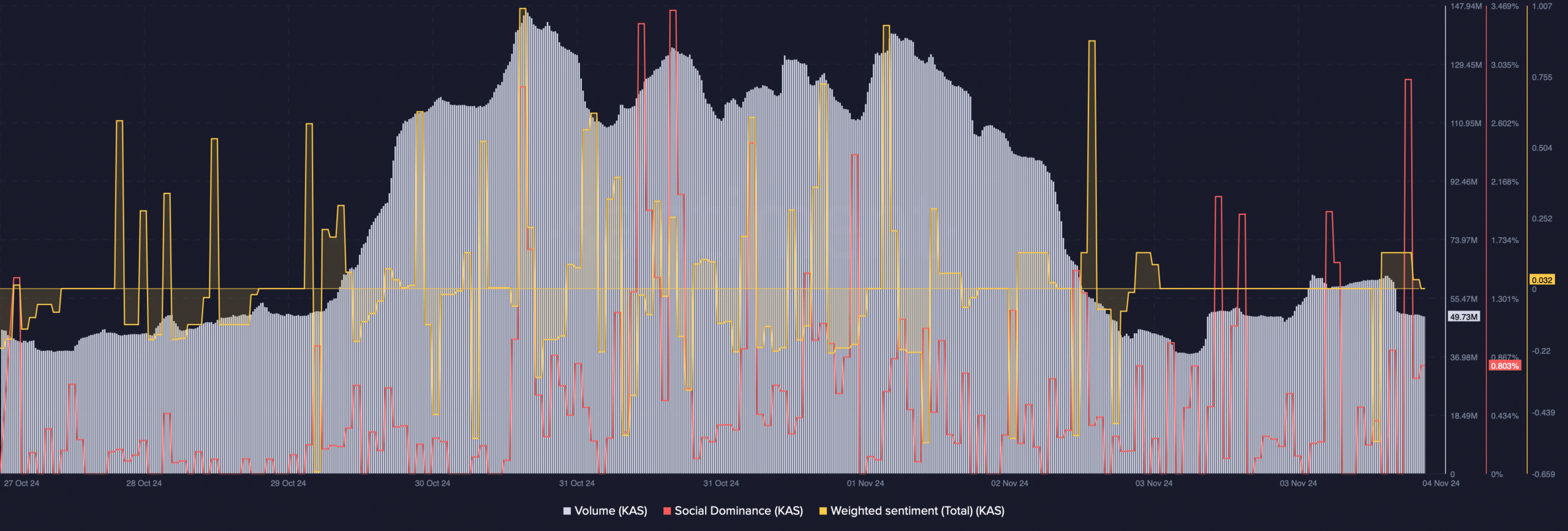

Following this sharp decline, certain on-chain metrics indicated a potential shift towards a bullish trend. Analysis of Santiment’s data by AMBCrypto revealed an increase in KAS’s social dominance, reflecting its popularity in the crypto community.

After the significant drop, KAS’s sentiment turned positive, suggesting a growing bullish sentiment around the token.

Source: Santiment

Following a sharp rise, Kaspa’s trading volume began to decline, a typical indicator of a trend reversal.

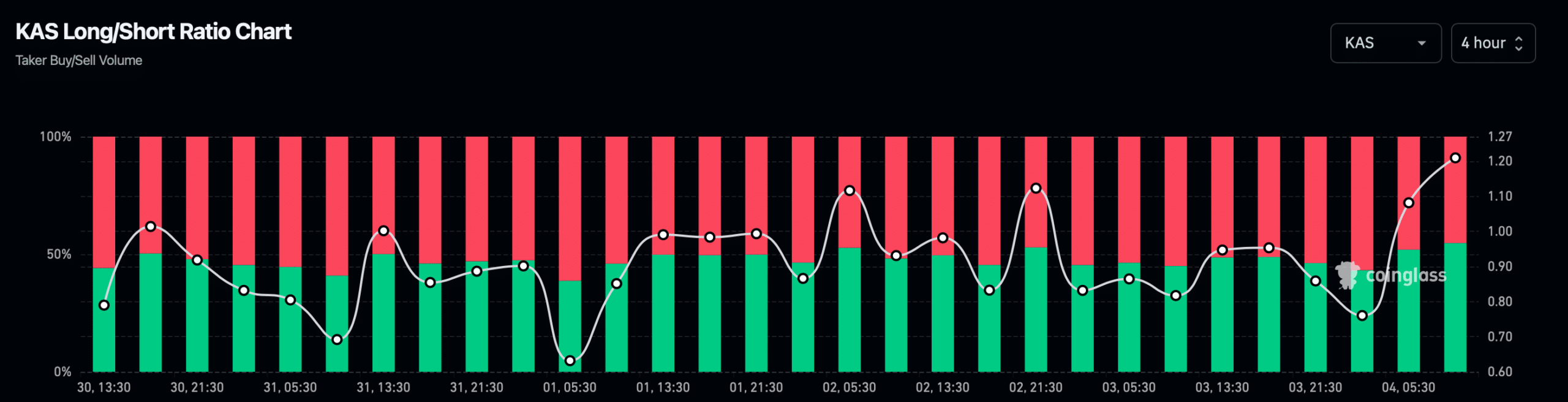

AMBCrypto’s analysis of Coinglass’ data also unveiled several other positive metrics. For instance, KAS’s Open Interest decreased, signaling a likelihood of price change.

Moreover, KAS’s long/short ratio showed an upward trend, indicating more long positions than short positions in the market – a bullish sign.

Source: Coinglass

Future Prospects for KAS

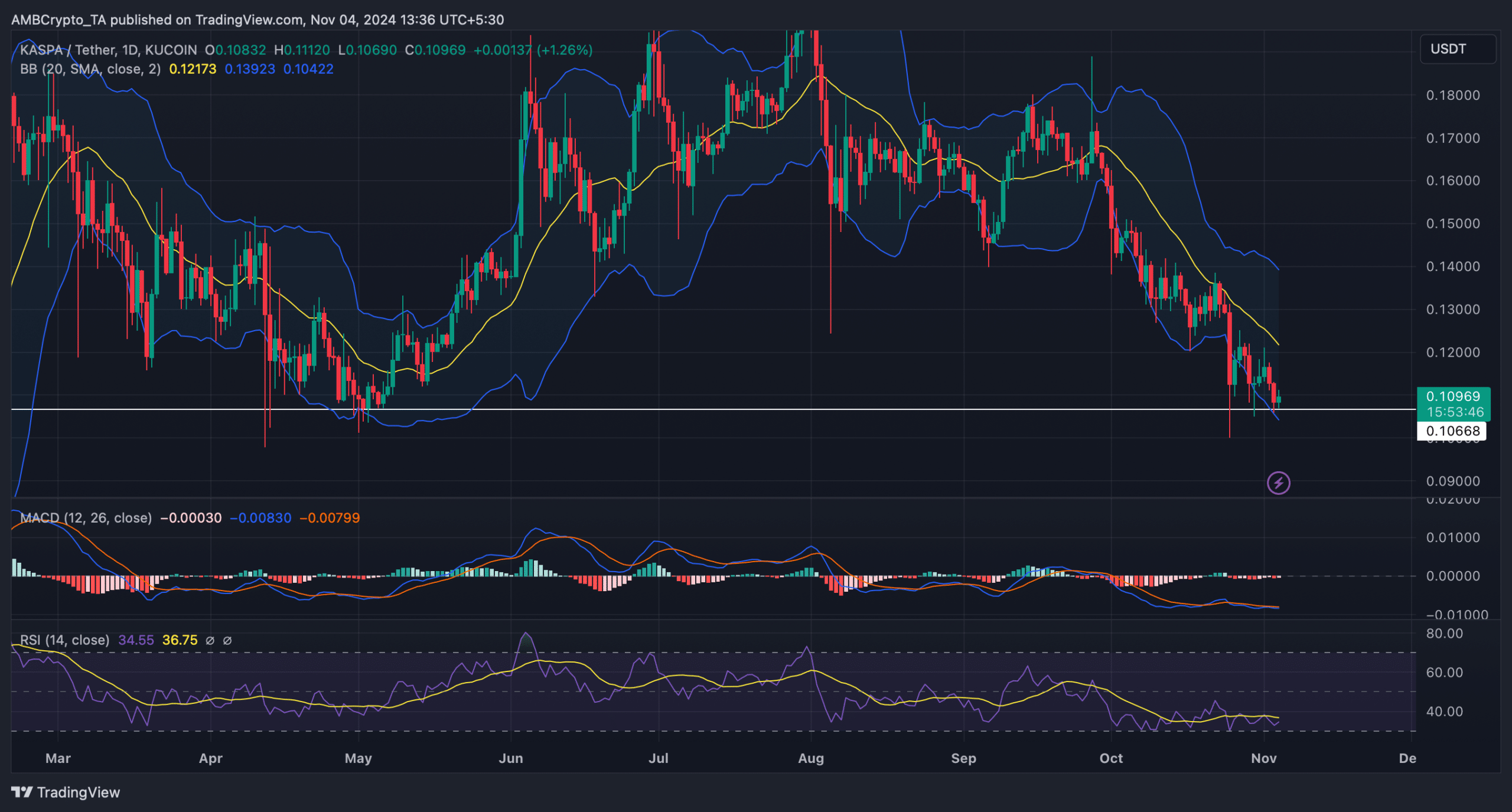

AMBCrypto examined KAS’s daily chart to determine if technical indicators also supported a trend reversal. It was observed that Kaspa’s price reached the lower Bollinger Bands limit, testing a crucial support level. Such scenarios often precede price increases.

Following the decline, the token’s Relative Strength Index (RSI) showed a slight uptick. Additionally, the MACD technical indicator hinted at a possible bullish crossover.

Source: TradingView

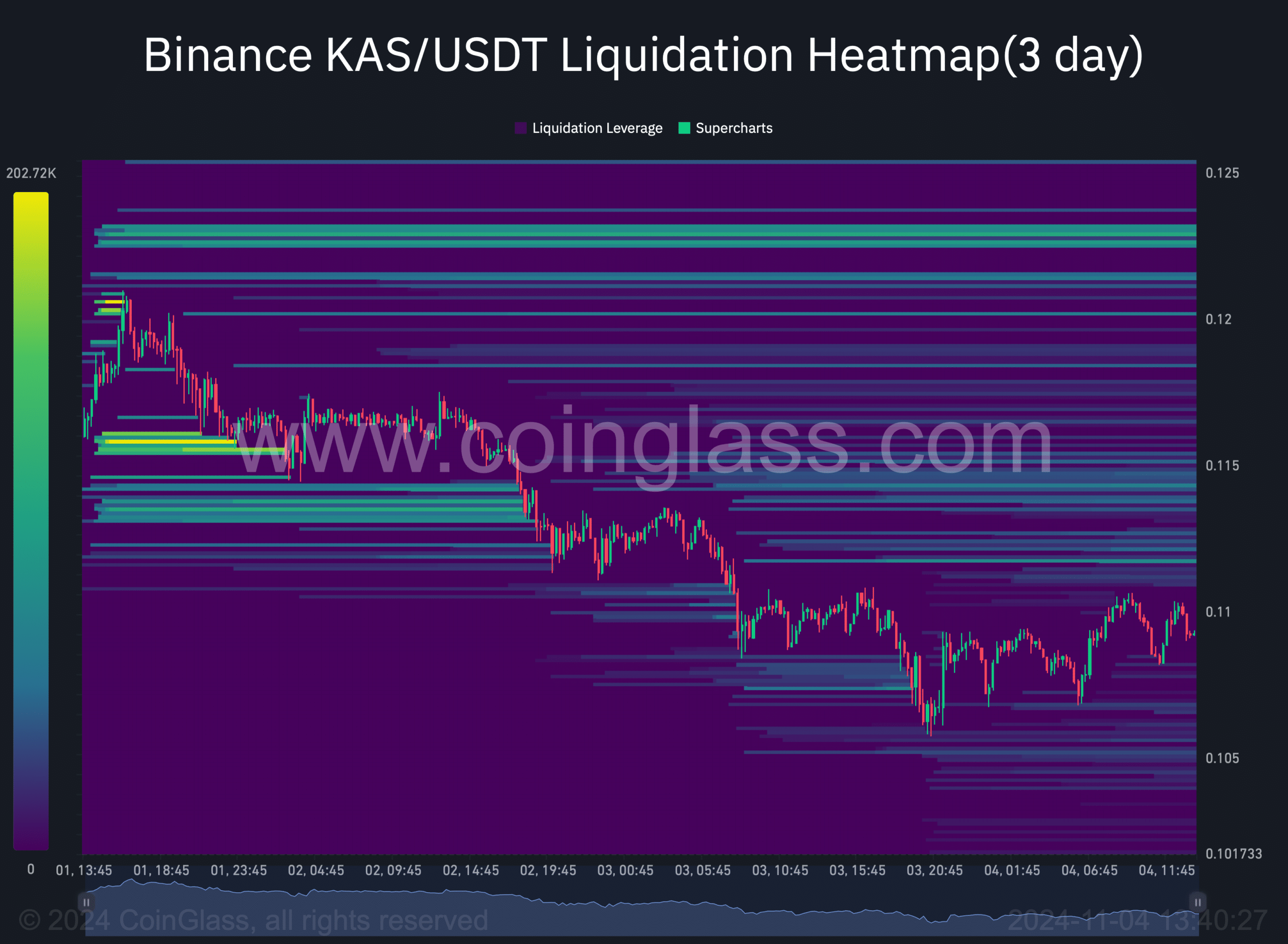

If a bullish trend reversal occurs, reaching $0.122 as the first target wouldn’t be surprising, as Kaspa’s liquidations are expected to rise significantly at that level.

Read Kaspa’s [KAS] Price Prediction 2024–2025

Typically, an increase in liquidations leads to short-term price corrections. Surpassing that resistance could propel KAS towards its peak in August.

Source: Coinglass

sentence: The cat jumped onto the table and knocked over a vase.

The vase was knocked over by the cat when it jumped onto the table.

![After a 25% price drop, can Kaspa [KAS] crypto rebound to $0.12?](https://doorpickers.com/wp-content/uploads/2024/11/Will-KASs-breakdown-end-1000x600.webp)