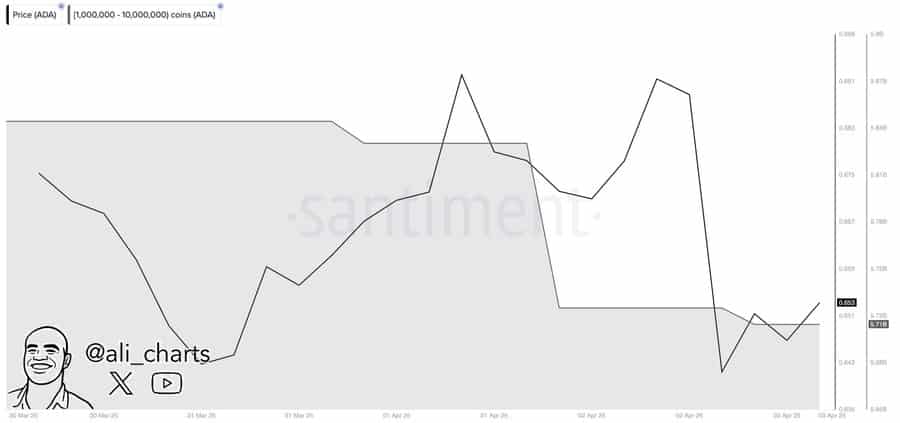

- Whales have recently been selling off a significant amount of ADA, leading to a price drop.

- Other technical indicators in the derivatives market have also contributed to the downward trend.

The sentiment surrounding Cardano [ADA] has turned bearish as investors have been selling their holdings over the past month. This trend may continue as recent market data indicates a continued selling pressure.

Whales continue to sell ADA

Whales, who hold a significant portion of ADA, have been selling off their holdings over the past 48 hours, amounting to a total of 120 million ADA sold.

Such massive sell-offs often indicate a lack of confidence in the market, potentially leading to further price declines for ADA.

Source: Santiment

In the derivatives market, selling pressure has been evident, with a decline in Open Interest in the Futures and options market over the past 24 hours.

The decrease in Open Interest suggests contract closures, influenced by factors like lack of confidence and long liquidation.

Source: Coinglass

The trading volume has been dominated by sellers, with the long-to-short ratio indicating high selling pressure in the market.

If DeFi investors continue to withdraw their ADA from protocols, the asset’s value is likely to continue declining.

Bullish sentiment emerges

Despite the bearish trend, spot market traders have been accumulating ADA over the past week, indicating a potential bullish outlook.

Traders have been buying ADA and moving their assets into private wallets, showing a long-term commitment to the market.

Source: Coinglass

However, the impact of bullish traders may be limited unless other market sentiments also turn bullish.

following sentence: The cat jumped over the fence and landed gracefully on the other side.

Revised: Gracefully, the cat leaped over the fence and landed on the other side.