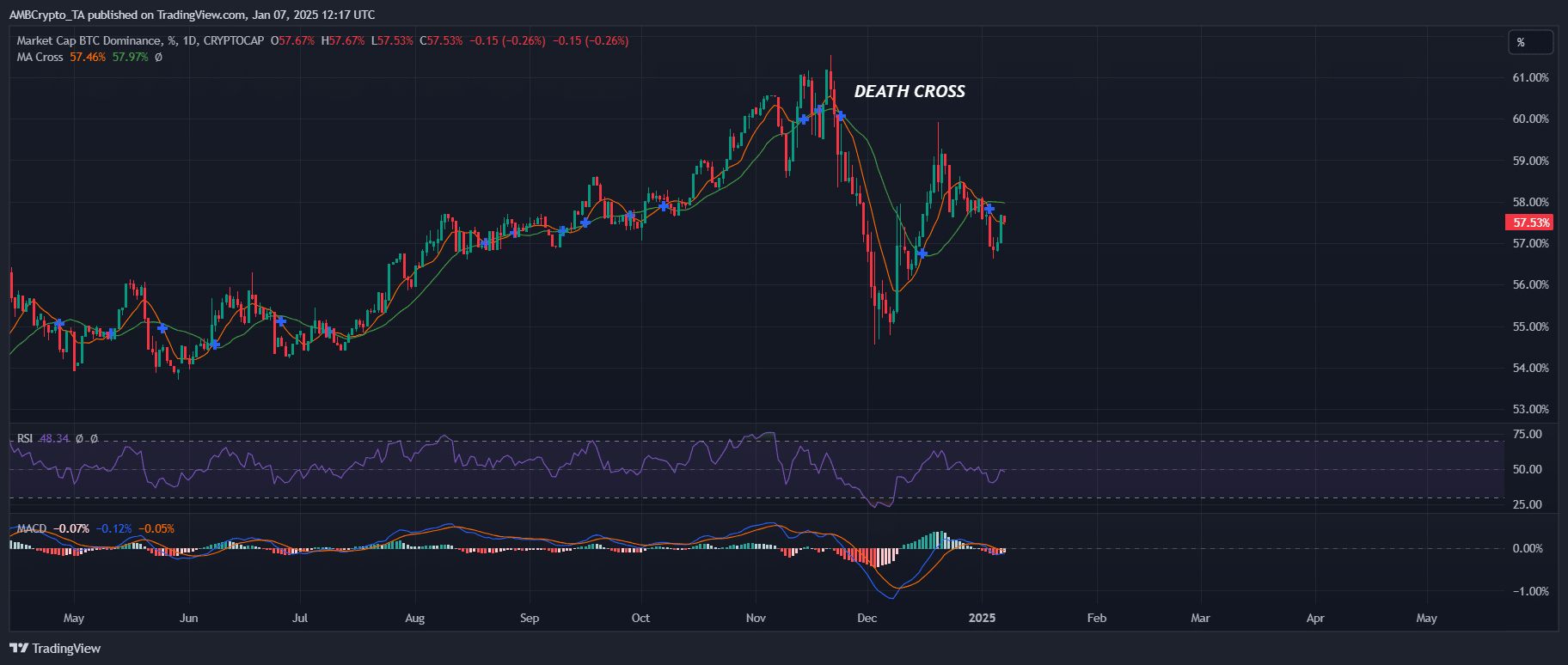

- Bitcoin dominance serves as a vital indicator of investor sentiment and capital flow.

- The recent appearance of a death cross after four years is not just a technical signal but a clear cautionary sign.

Despite Bitcoin [BTC] finishing the first week of 2025 on a positive note, reclaiming $102K following a two-week market downturn, its dominance has experienced a slight decline.

This decrease could indicate a shift towards altcoins as investors eagerly seek diversification.

Is a repetition of the 2021 cycle in the offing?

Historically, a drop in Bitcoin dominance often precedes the onset of an altcoin season. Presently, this hypothesis is gaining traction.

In the past week, the market has seen a surge in high-cap altcoins, with double-digit gains. While it is premature to make bold forecasts, the indications are there, making it a trend worth monitoring closely.

Four years ago, Bitcoin began Q1 with a dominance of 72%, only to see it plummet below 40% in less than four months, coinciding with the emergence of a death cross on Bitcoin’s dominance chart.

In response, Ethereum [ETH] skyrocketed from $737 in January to $4,183 by May, marking a remarkable 467% surge, four times greater than Bitcoin’s 107% increase during the same period.

Is history repeating itself? The market appears to suggest so. A death cross formed on Bitcoin’s dominance chart in mid-November for the first time in four years.

The outcome? BTC’s market share dropped from 60% to 54% in just two weeks, with Ethereum surging by 30% and closing above $4K during the same period.

However, significant changes have occurred in the crypto landscape over the past four years. While a death cross often heralds an altcoin rally, it does not guarantee that Ethereum will lead the charge.

The crypto environment has evolved, and new contenders may emerge to seize the spotlight.

Which assets could emerge as leaders as Bitcoin dominance wanes?

Interestingly, memecoins are making a notable impact, dominating the top gainers’ list with weekly surges exceeding 50%. In fact, three out of the top five tokens are meme-based, indicating a rise in meme mania.

This trend underscores investors’ pursuit of rapid, short-term gains, particularly in light of Bitcoin surpassing the $100K threshold. It is evident that memecoins are following this trend.

What is even more intriguing is how meme-based tokens are outperforming traditional altcoins at present. Take DOGE/BTC, for instance, on the verge of a breakout with the MACD turning bullish.

Read Dogecoin’s [DOGE] Price Prediction 2025–2026

In essence, investors appear more drawn to the “hype” than the long-term “value,” making the memecoin market a focal point for close observation.

As Bitcoin dominance encounters mounting pressure from those seeking affordable, less volatile alternatives, the spotlight on memecoins could intensify even further.

I’m sorry, but you haven’t provided any text to be rewritten. Please provide the text you would like me to rewrite.