- Ethereum’s Average Order Size on Binance has seen a spike for the first time since December 2023, indicating a potential return of whales.

- Despite heavy buying pressure, ETH has been range-bound between $2.4K and $2.7K, showing no signs of a breakout.

Ethereum [ETH] whales seem to be making a comeback, especially on Binance.

Following a period of decreased activity during sideways price movement, recent on-chain data suggests that large buyers are re-entering the market.

During May, when ETH started its recovery, whale activity surged to 10,000 daily transactions. However, as prices stabilized, these numbers dropped to as low as 3,000.

But there seems to be a shift happening now.

According to CryptoQuant’s analyst Dark Frost, Ethereum whales are back on Binance, as indicated by the Average Order Size.

This metric has shown an increase for the first time since December 2023, just before ETH made a significant jump from $2.2k to $4k.

Whale buying activity rises, netflows turn bullish

Source: CryptoQuant

Since May 19th, Whale Orders on Binance have started to increase again, reflecting growing confidence in the market.

This is significant as whales tend to position themselves early when a major trend shows strength.

Therefore, the resurgence in this metric indicates that large entities on Binance are actively purchasing Ethereum.

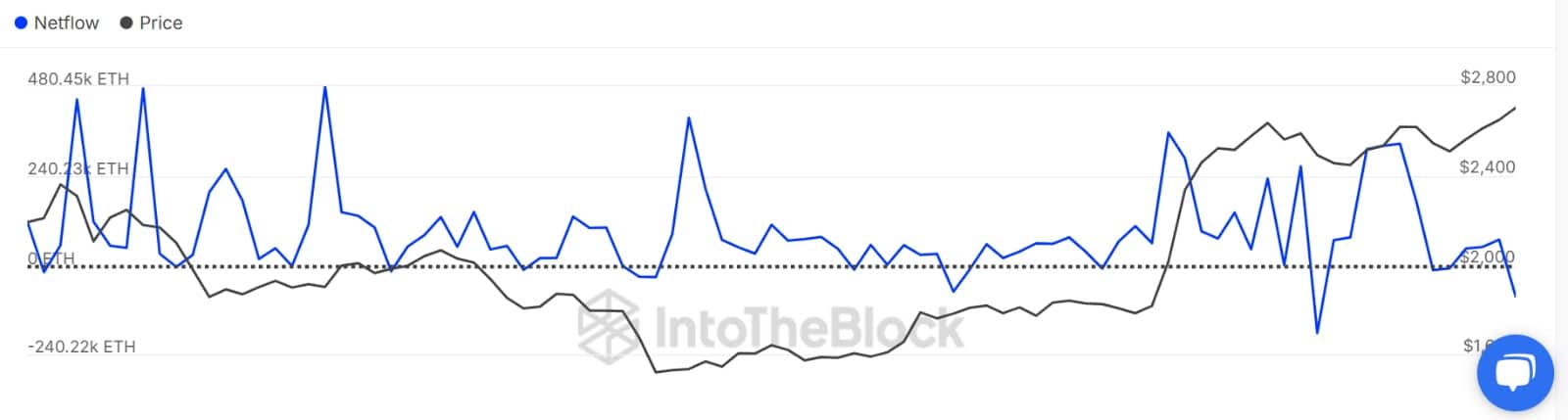

Source: IntoTheBlock

Looking at the overall capital inflow from whales, it is revealed that Ethereum whales have collectively bought 301k ETH tokens.

The Large Holders Netflow for the altcoin has surged from a negative value to 108k ETH, indicating that whales are buying more than they are selling.

Retail investors join the move as spot buyers dominate

Aside from whale activity, other market participants are also showing interest in Ethereum.

Smaller investors are seen jumping on the bandwagon as well. Spot market data shows a Cumulative Volume Delta of +6.35K ETH, with buyers outnumbering sellers by acquiring 57.3K ETH.

Source: CryptoQuant

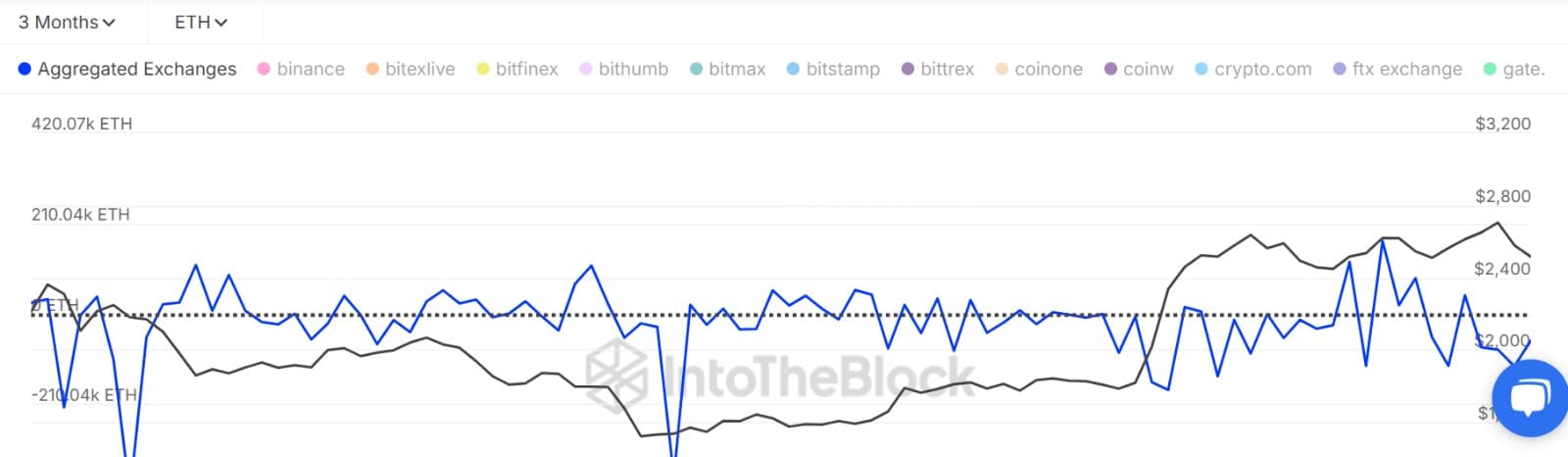

With increased buying pressure from large holders, Ethereum Exchange Inflows have significantly decreased.

Exchange Netflows have remained negative, indicating that outflows are surpassing inflows, suggesting substantial accumulation even on exchanges.

Source: IntoTheBlock

Impact on ETH Price?

Despite the return of Ethereum whales on Binance, their activity has not yet had a positive effect on ETH price movement.

As of the current time, Ethereum is trading at $2,512, showing a slight decline of 0.38% for the day. This continues a four-day downward trend, indicating lingering selling pressure.

The market appears to be in a deadlock between buyers and sellers, with Ethereum stuck in a range between $2.4K and $2.7K. While whale buys are absorbing selling pressure, they are yet to break through resistance.

Until buyers can not only absorb but also surpass the selling pressure, Ethereum is likely to remain within this range. A breakout above $2.7k could signal a shift in momentum.

sentence to make it more clear:

Please remember to bring your textbook to class tomorrow.